The app for independent voices

Global Warming: The LA Times has satellite photos of the aftermath of the LA fires. Yes, this—global warming—is going to be very expensive. And distributing the costs and keeping insurers in the building as right-wing politicians try to make political hay about the rootless cosmopolites located in Bermuda—that is going to be very fraught:

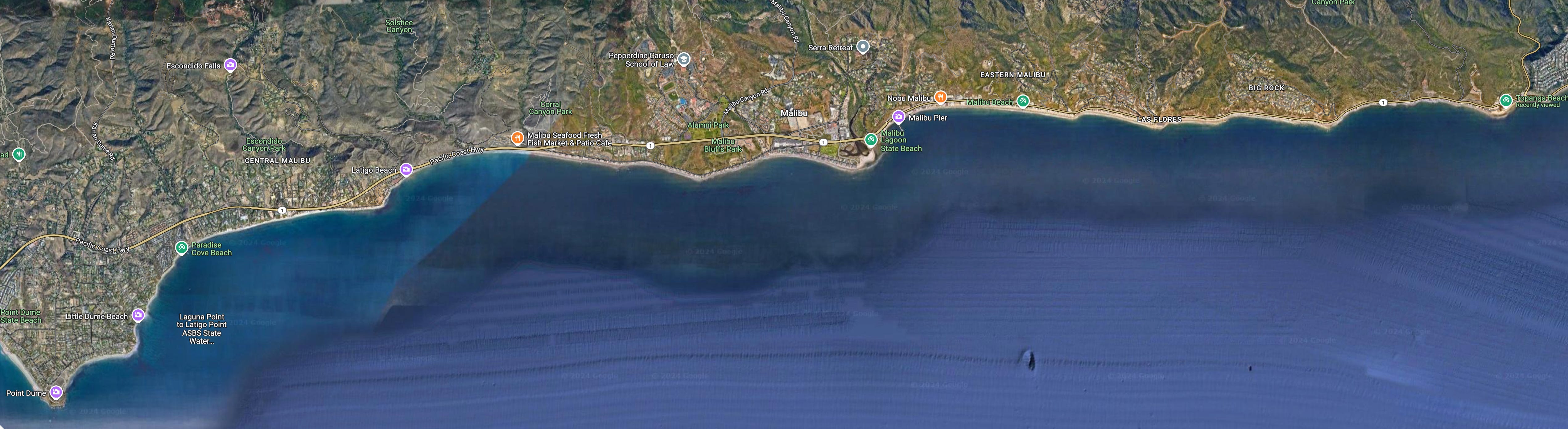

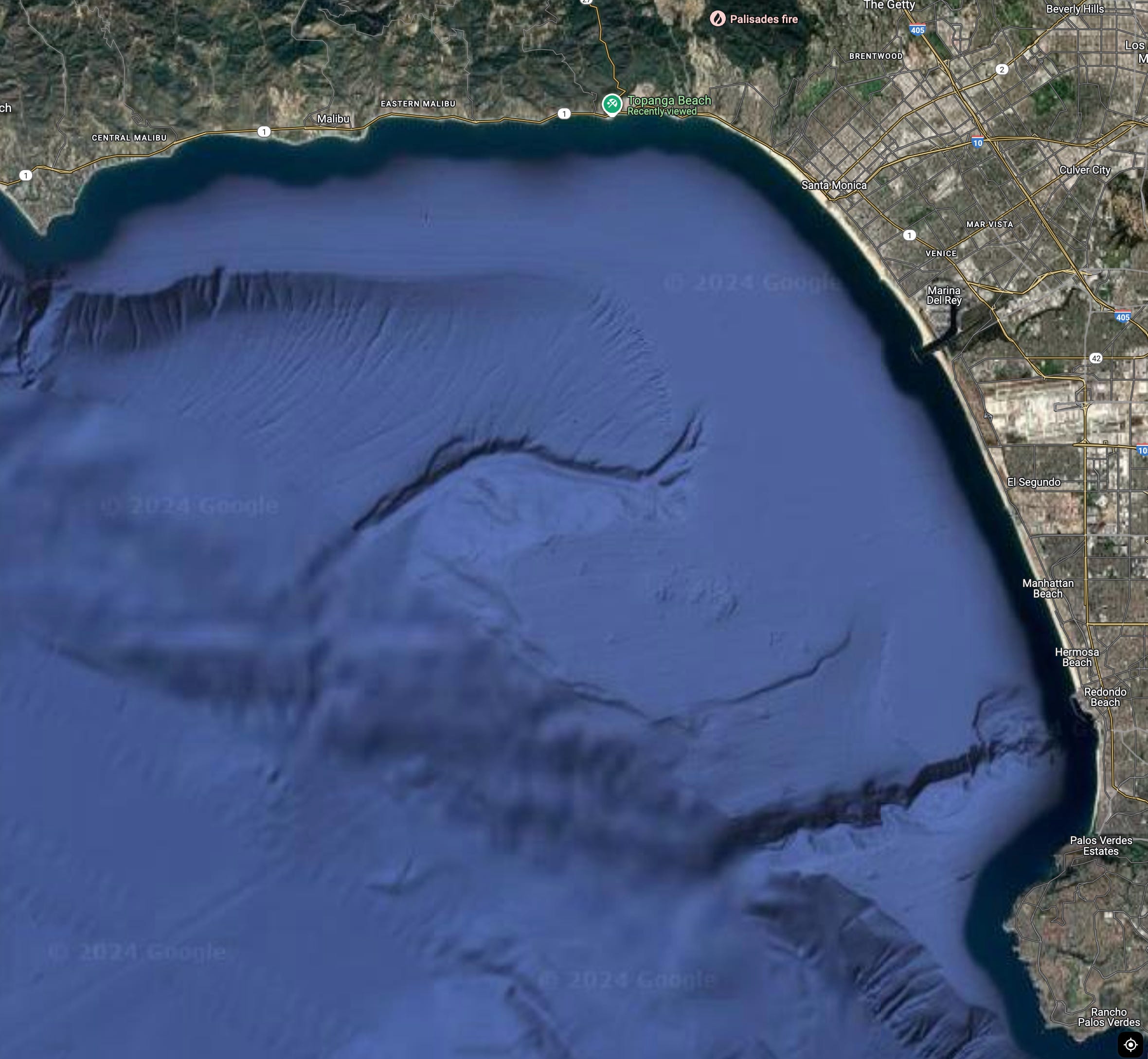

Terry Castleman: “Shocking before-and-after satellite images show destruction of Malibu and Altadena neighborhoods”: ‘The image below shows a famous strip of Malibu homes latimes.com/california/… sandwiched between Pacific Coast Highway and the ocean just west of Topanga Beach.

And the kid—the family insurance expert—is in the picture:

“The first step for affected homeowners is to focus on personal safety, as well as the safety of family and any pets, according to Michael DeLong, a research and advocacy associate at the Consumer Federation of America, a consumer advocacy group. After that, homeowners should contact their insurer as soon as possible. When it’s safe to return home, take photos and videos and start a journal to document the damage. Policyholders should also document every interaction with their insurance company and track their expenses. DeLong suggests keeping receipts for temporary housing, food costs and any initial repairs. If a homeowner does decide to take on immediate repairs, they should vet any adjustors or contractors before hiring and make sure they are licensed. “Unfortunately, post-disaster scams are pretty commonconsumerfed.org/press_r…DeLong said. If a homeowner believes their insurance company is mishandling their claim, DeLong said they should contact the California Department of Insurance. The agency's website consumerfed.org/press_r… where homeowners can file complaints. Looking forward, DeLong suggests homeowners take measures to mitigate future wildfire risks. Steps like installing a roof with noncombustible coverings or clearing away flammable vegetation near a home can limit the damage. "That may cost money in the short run, but it will save you money in the long run. In fact, it could actually save your home and even your life," DeLong said. “The problem is that doing all these measures takes time and money and effort. And for people living paycheck to paycheck, that’s really hard to do"… <usatoday.com/story/mone…>

And:

Michael DeLong, research and advocacy associate at the Consumer Federation of America, told Common Dreams Wednesday that while climate-driven extreme weather has "made many areas riskier to insure," insurance companies are also canceling policies because "they're trying to take advantage of the situation of rising risks and rising costs to weaken consumer protections." "They've been waging a campaign against Proposition 103 <consumerwatchdog.org/pr… a ballot initiative that got passed in the late 1980s that, among other things, puts in place a lot of consumer protections about insurance," he added. "This has been a big deal for consumers and it's helped keep rates down. But insurance companies really hate these consumer protections and have been trying to weaken them."… California Insurance Commissioner Ricardo Lara… DeLong said Lara is "allowing the net cost of reinsurance to be passed on to consumers…. Until a few weeks ago, California's regulations didn't allow the cost of reinsurance to be passed on to consumers, and now they do," DeLong explained. "So that's probably going to drive up costs for consumers. The commissioner and the department say it's going to make the insurance industry more stable—we're kind of skeptical of that." "Another reform that he's done is allowing the use of catastrophe models in insurance," DeLong added, referring to a risk management tool that helps insurers assess potential financial impacts of disasters. "Every other state allows insurance companies to use them; California did not until recently. Catastrophe models can be helpful and useful; the problem is that many catastrophe models aren't that good; they're based on inaccurate or incomplete information and they don't have any transparency."… As coverage becomes more difficult to obtain, hundreds of thousands of California homeowners have turned to the state's FAIR Plan an insurer of last resort…. "If the FAIR Plan is the only thing you can do, take that," DeLong said. "In the meantime, you can reach out to the Department of Insurance and let them know that you want them to protect consumers and reject excessive rate increases. You can also try mitigation measures consumerwatchdog.org/pr…o reduce risk, like clearing brush around your home, improving your roof so it's a Class A roof, which means it's very difficult to catch on fire, you can take measures to prevent embers from starting fires on your property," he added. "The problem is that all of that costs money, and not everyone may be able to afford that… California has recently started some proposals to provide grants to consumers to undertake these measures, and these should be expanded even more…. There is some good news," DeLong said. "The California Department of Insurance is working on a public catastrophe model, one that would have opportunities for input from consumers, that would be based on data that's fair and open…. However, that's going to take at least a couple of years to get off the ground," he added… <commondreams.org/news/c…>