I appreciate your perspective. I'll offer some additional counterpoints.

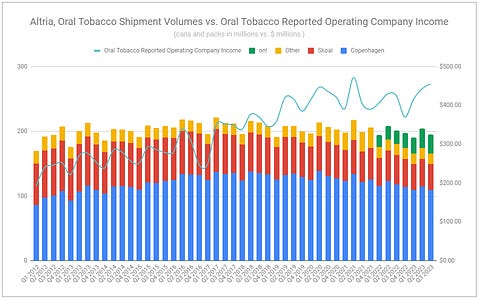

While UST's legacy volumes have continued to fall - largely due to MONPs taking total share, I think it's worth acknowledging that total volumes have actually remained rather stable over the last decade. But focusing on volumes misses that on! has grown mainly on the back of high promo spend, which is now scaling back as they take price. It can be argued that the Oral Tobacco segment has been under-earning the last few years vs. what it would have had it not pursued acquiring Burger Söhne (80% for $372m in 2019 and $250m for remaining 20% in 2021). So value of legacy intangibles decreases - but value has simply shifted to Helix (MONP sub), which positions the company well for the future. Composit oral volumes vs. segment EBIT (image below, from my latest piece) is not exactly alarming. Let's say a writedown of legacy intangibles occurs. In full context, should investors be surprised or concerned?

I remain skeptical toward total impact of pending regulatory actions. Not to say they won't have impact, but quite a few other geographies act as reasonable examples of lesser impacts than what many expected. As for " Already smoking income is starting to come in lower despite boosting prices as total volume decay accelerates and compounds." I am not sure that looking at a single quarter and extrapolating as the 'new normal' makes sense. Adjusted Smokeable EBIT was down y/y in Q1 2021 and Q3 2021. Reported Smokeable EBIT was down y/y in Q1 2014, Q3 2016, Q1 2018, Q2 2018, Q3 2018, Q1 2019, Q3 2021, Q2 2022, Q1 2023, Q3 2023. I think a stronger argument can be made on a concern of unit costs over the recent four years rather than volumes.

I do think that HTP, which is largely untested in the U.S., is a looming threat in the future. But IQOS rollout will be slower starting in May of next year, as the only version that has PMTA authorization is the previous blade version. It will be an additional year+ until ILUMA can move in the U.S., which will still take time. I suppose that I'm less concerned with this specific point. I'm long both names (and others), and any shift to IQOS HTUs represents movement to a product with substantially higher contribution margin.