The app for independent voices

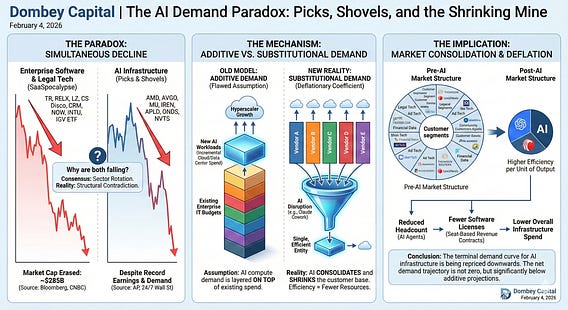

The AI Demand Paradox: Why Picks and Shovels Are Declining Alongside the Industries They Were Built to Replace

This week offered a real-time case study in how AI disruption transmits through the market in ways that consensus models have not adequately captured.

This week, Anthropic released a legal plugin for its Claude Cowork platform, an agentic AI tool capable of automating contract review, NDA triage, compliance workflows, and legal brief preparation. The market response was swift and severe. By Tuesday, $285 billion in market capitalization had been erased across software, financial services, and asset management. Thomson Reuters fell 16%. RELX, parent company of LexisNexis, dropped 14%. LegalZoom declined 20%. CS Disco lost 12%. A Goldman Sachs basket of U.S. software stocks recorded its largest single-day decline since April's tariff-driven selloff. Jefferies' equity trading desk has termed the broader move the "SaaSpocalypse".

This was not an isolated reaction. The selloff accelerated a repricing that has been underway for weeks. The iShares Expanded Tech-Software Sector ETF is now approximately 28% below its recent highs. Salesforce has declined 26% year to date. ServiceNow is down 28%. Intuit has shed over 34%. Software stocks have slid approximately 20% year to date while the broader market has largely flattened. The market is making a clear directional statement: AI represents an existential repricing event for enterprise software.

None of this is particularly controversial at this point. The more interesting observation is what happened simultaneously on the other side of the AI trade.

The Contradiction

On the same day that SaaS and legal tech stocks were collapsing under AI disruption fears, AI infrastructure stocks were also declining materially. AMD fell 17% today despite reporting fourth-quarter revenue of $10.27 billion, above the $9.67 billion consensus, with data center revenue up 39% year over year to $5.4 billion. Broadcom lost 6%. Micron declined 12%. Among the smaller, pure-play AI infrastructure names, the declines were sharper: IREN fell 19%, Applied Digital (APLD) dropped 18%, Ondas Holdings (ONDS) declined 18%, and Navitas Semiconductor (NVTS) shed 13%.

On the surface, this does not reconcile. If AI is disrupting entire industries, the logical inference is that AI compute demand is accelerating, which should be a tailwind for infrastructure providers. The consensus explanation is sector rotation: investors are moving out of richly valued technology into cyclicals, energy, and consumer staples. That mechanical explanation has merit, as the Dow rose while the Nasdaq fell over 2%. But it does not fully explain why AI infrastructure names, the direct beneficiaries of increased AI adoption, are declining in lockstep with the companies that AI is displacing.

I believe the answer lies in a structural contradiction embedded in the AI infrastructure demand thesis itself.

Additive vs. Substitutional Demand

The bull case for AI infrastructure has been constructed on the assumption that AI compute demand is additive. New AI workloads are expected to generate incremental cloud and data center spending layered on top of existing enterprise IT budgets. Hyperscalers are projected to deploy over $470 billion toward AI infrastructure in 2026. Data center capacity remains constrained. GPU availability is tight. The supply-demand imbalance appears favorable for infrastructure providers.

However, this model treats the demand side as static when, in reality, AI is actively restructuring it.

Consider the legal technology sector as a case study. Prior to this week's repricing, the legal software ecosystem included Thomson Reuters, RELX/LexisNexis, Wolters Kluwer, LegalZoom, CS Disco, and numerous smaller vendors. Each of these companies maintained independent cloud infrastructure, paying separately for compute, storage, networking, and data processing. From the perspective of a cloud provider or data center operator, this represented five or more distinct enterprise customers generating recurring infrastructure revenue.

AI disruption does not redistribute market share among these incumbents. It consolidates the entire demand structure. The addressable market does not transition from five customers to five smaller customers. It transitions from five customers to one. And that single surviving entity, whether it is an AI-native platform, an adapted incumbent, or the model provider itself, is by definition operating at higher efficiency per unit of output. Efficiency is the core value proposition of AI adoption: fewer computational resources required to deliver equivalent or superior outcomes.

This is not additive demand. It is substitutional demand with a deflationary coefficient.

Cross-Sector Implications

Legal technology is simply the most visible example this week due to the Anthropic catalyst. The same consolidation dynamic is unfolding across every vertical where AI is compressing competitive structures.

In enterprise SaaS broadly, when AI reduces the headcount that utilizes software tools, seat-based revenue models contract proportionally. As SaaStr noted, if 10 AI agents can perform the work of 100 employees, the requirement shifts from 100 software licenses to 10, a 90% reduction in seat revenue for equivalent output.

In advertising and marketing technology, the Cowork announcement triggered immediate repricing: Publicis fell 9%, WPP declined nearly 12%, and Omnicom dropped over 11%. In financial data and analytics, S&P Global fell 11% and Gartner lost 21%. Each of these disrupted companies represents a paying cloud customer whose infrastructure spend does not transfer to a replacement entity on a one-to-one basis.

Even the counterargument that AI inference workloads are sufficiently compute-intensive to offset legacy demand destruction has a limited shelf life. Inference costs have been declining rapidly as model efficiency improves with each generation. Distillation techniques increasingly enable smaller models to approximate the performance of larger architectures at a fraction of the compute cost. The buffer that inference demand provides against legacy demand erosion will narrow over time.

Positioning Implications

To be precise about the thesis: I am not arguing that AI infrastructure demand will collapse in absolute terms. Near-term hyperscaler capital expenditure commitments remain robust, and the supply-demand imbalance in GPU-ready data center capacity is real and unlikely to resolve quickly.

What I am identifying is that the terminal demand assumptions embedded in current AI infrastructure valuations contain an internal contradiction. The same technology that is expected to drive sustained, exponential growth in data center and cloud revenue is simultaneously eliminating the enterprise customer base that generates a significant portion of existing infrastructure spend. The net demand trajectory is not zero, but it is meaningfully below what a purely additive model would project.

The simultaneous decline in both enterprise software and AI infrastructure this week is not coincidental. It may represent the early stages of the market repricing the AI demand curve from additive to substitutional, and that repricing, if it continues, has significant implications for how we value the entire AI infrastructure stack.