The app for independent voices

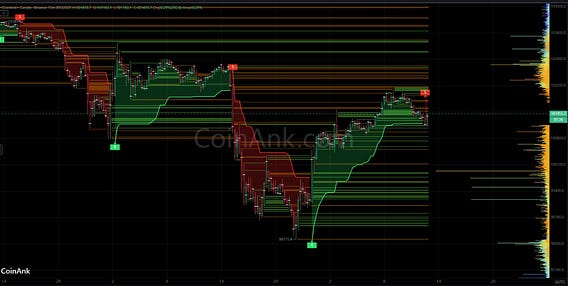

Bitcoin rejected near $102.2K and is now hovering around $101.4K.

The bounce from sub-$98K was strong, but the rally is now losing steam under supply pressure. Bulls must defend $101K to keep the structure intact.

Full liquidation and trend breakdown below 👇

📊 Bitcoin (BTC/USDT) Liquidation & Price Analysis – Binance 15m. Current Price: $101,455

🔄 Trend & Market Structure:

📈 Rebound from $98.1K to $102.2K

📍SuperTrend flipped green during the rally

📍Multiple sell signals near $102K area

📉 Price pulling back after rejection at supply

💥 Liquidation Zones:

🔴 Short Liquidation Zones (Resistance Above):

• $102,000 – $102,400 → Heavy resistance and short trap zone

• $103,000+ → Next breakout level if bulls push through

🟢 Long Liquidation Zones (Support Below):

• $101,000 – $100,200 → Local support zone

• $99,500 – $98,200 → High volume base and demand cluster

📢 Market Sentiment & Summary:

🔸 Bulls still in control structurally, but fading momentum

🔸 Sell signals stacking up under $102K

🔸 Holding $101K is key, it’s the pivot to maintain the trend

🔸 SuperTrend support barely holding — volatility ahead

🔥 Key Takeaway:

Strong recovery, but fading at resistance.

If $101K fails, price may retest the $100K zone.

Break above $102.4K? Then we might see a fast move to $103K.