The app for independent voices

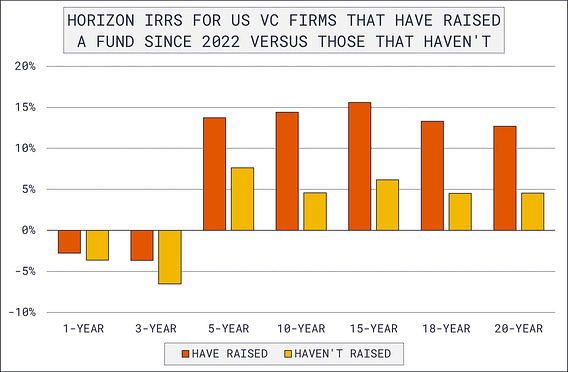

2–3x ➡️ That’s the performance gap between firms who’ve raised a fund post-ZIRP versus those who haven’t, according to PitchBook’s Q1 data.

Why the split?

🔹 LP dollars are consolidating into top-performing, well-established firms (success begets success)

🔹 Firms with stable capital bases may be better positioned to invest with confidence, either to doubling down on winners or protecting downside where necessary

It's wide-reaching:

🔺In the three-year period of 2020-2022, approximately 4,300 venture funds were raised

🔻Based on current fundraising trends, for the following three-year period of 2023-2025, we're on track for less than half that (approx. 2,000)

🔸This means half of funds could be in "zombie" status—potentially still deploying, but only into existing portfolios, and unlikely to raise additional capital

Why this is important: Instability in funds impacts companies too… whether it be which meetings to take in a fundraising process or how to think about board construction after the fact.

Never been a more important time to be putting points on the board.