The app for independent voices

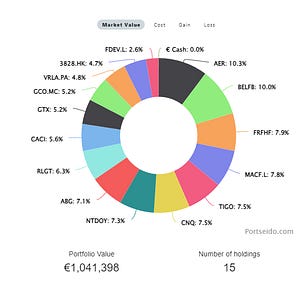

Trimming $CNQ from 8.9% down to 7.5% ($72.25)

CNQ has gone up nicely after ER & announcing they hit their debt target and shift to paying out 100% of FCF to shareholders (they already announced this policy, but hit their debt target a Q earlier)

Selling remainder (3.6%) of LVMH (€846.5)

LVMH up 15% YTD. While it’s a nice “compounder bro” buy & hold, it was more of a short term trade for my portfolio. Making room for new opportunities

Upping $TIGO from 5% to 7.5% of portfolio at $18.41.

Stock is up 15% since their ER this week, but the results were good & outlook very bullish.

Putting remainder in a small (2.6%) FDEV position at 126p.

This is a severely beaten down gaming stock that actually owns some good IP. They branched out too far, but are now cutting costs and focusing back on the core, the games they did well.

A bit of an option like investment, hence the smaller position