The app for independent voices

Model Portfolio Transactions

Sold:

NTDOY (4.8%) at $13.53

CACI (4.2%) at $467.2

-

Bought:

LSXMA (5%) at $21.95

MC - LVMH (4%) at €658.10

-

CACI has been one of my top performers with YTD at 44%. It started at around 15x fwd P/E and is now at 20x P/E. I hate the saying, but I think that “the easy money has been made” here.

NTDOY: the long term story seems intact, but I like the risk/reward of the stocks I bought more at current prices.

-

LSXMA: In less than a month, LSXMA/K and SIRI shares will collapse into one share class. Berkshire will own almost 30% of the company after this. I don’t recommend following BRK into stocks, but I think in this case you can frontrun the publicity (and share price increase that can come with it)

As a European, I don’t really “get” SIRI & and I don’t really love the company. But a story of declining capex/increase in FCF around the corner & buybacks will return… that’s one I usually like

More background here: alwaysinvertit.substack…

MC - LVMH is back at 20x fwd P/E, and fwd estimates have already come down a bit. In my Q1 24 Overview (nodeepdives.substack.co…), I discussed LVMH and talked about how I occasionally will buy a temporarily out of favor '“compounder”. I think the time is right again.

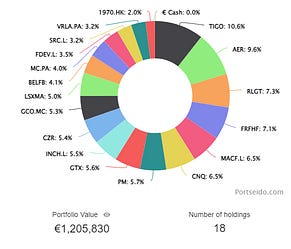

Pictured: The portfolio after the transactions