The app for independent voices

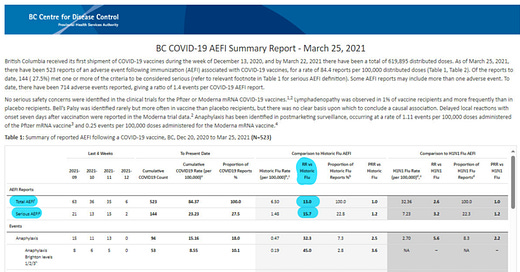

Byram, the reason the # of serious AEFIs dropped from 144 on March 25th 2021 to 26 on April 3rd 2021 is because they changed the definition of a "serious AEFI".

On March 25th, p. 208 footnote g - the definition of serious AEFI was stated as:

"Serious AEFI defined as any of the following events: anaphylaxis, Bell’s Palsy, cellulitis, seizure, encephalitis, transverse myelitis, GBS, intussusception, meningitis, ORS, paralysis, or thrombocytopenia; OR any of the following outcomes/recommendations: hospitalization, permanent disability/incapacity, death, or recommendation of no further immunizations." and the numbers came from epidemiologist Kyle Notfall, MPH

On reporting week of April 3rd, they adopted a new weekly standard reporting format that shows no particular authors... from April 3rd onward the definition of serious AEFI was stated as:

"Serious AEFI - For the purpose of this report, a serious AEFI is one that resulted in hospitalization, permanent disability/incapacity, or death."

The April 3rd definition is much more narrow.

Also note on p. 208 that the gender distribution of the 523 AEFIs is 466 female/57 males. This confirms the infamous Pfizer Post-marketing doc 5.3.6 - The covid vaccines are significantly more toxic to women than to men.

As for non-binaries, there's no data and I wouldn't want to spread misinformation, so it's probably safe and effective for they/them/... Lucky they are.

This new weekly reporting standard was for public use. P. 217 an email from Kyle Notfall to Heather Amos and Monika Naus reads:

"Hi Heather,

Attached is the final version of this week’s (and first!) public COVID-19 AEFI report. I’ve included a

Word and PDF, but only the PDF would be posted to the website. You were still deciding where on

the website it would make sense to include this report, as the COVID-19 Data section was being

reworked.

Monika was going to send you some key messages related to the report as well.

Thanks,

Kyle

Kyle Noftall, MPH"

This is a typical white collar fraud scheme were the benchmark/definition of something is changed.

This kind of behaviour, I've seen many times in the financial statements of publicly listed companies. Gaming the benchmark or a definition is a marker of fraud.