The app for independent voices

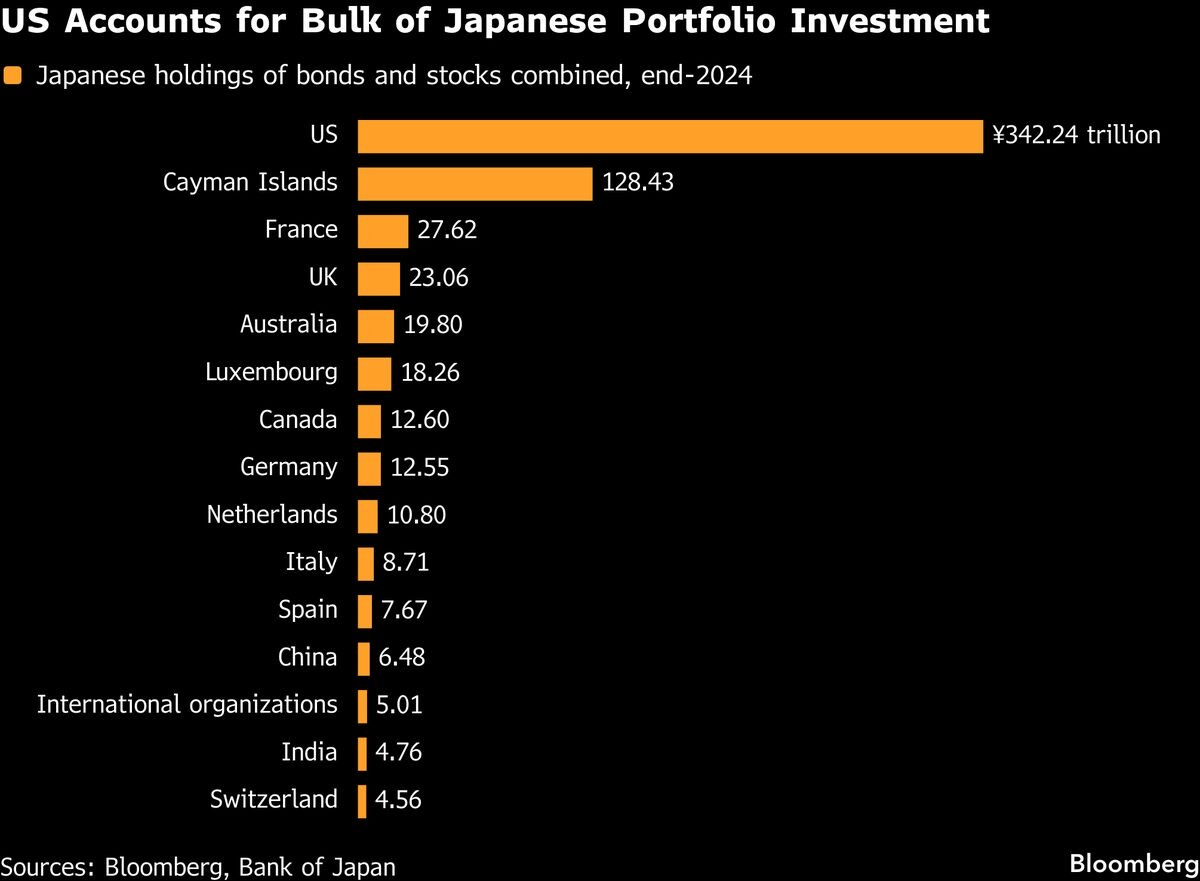

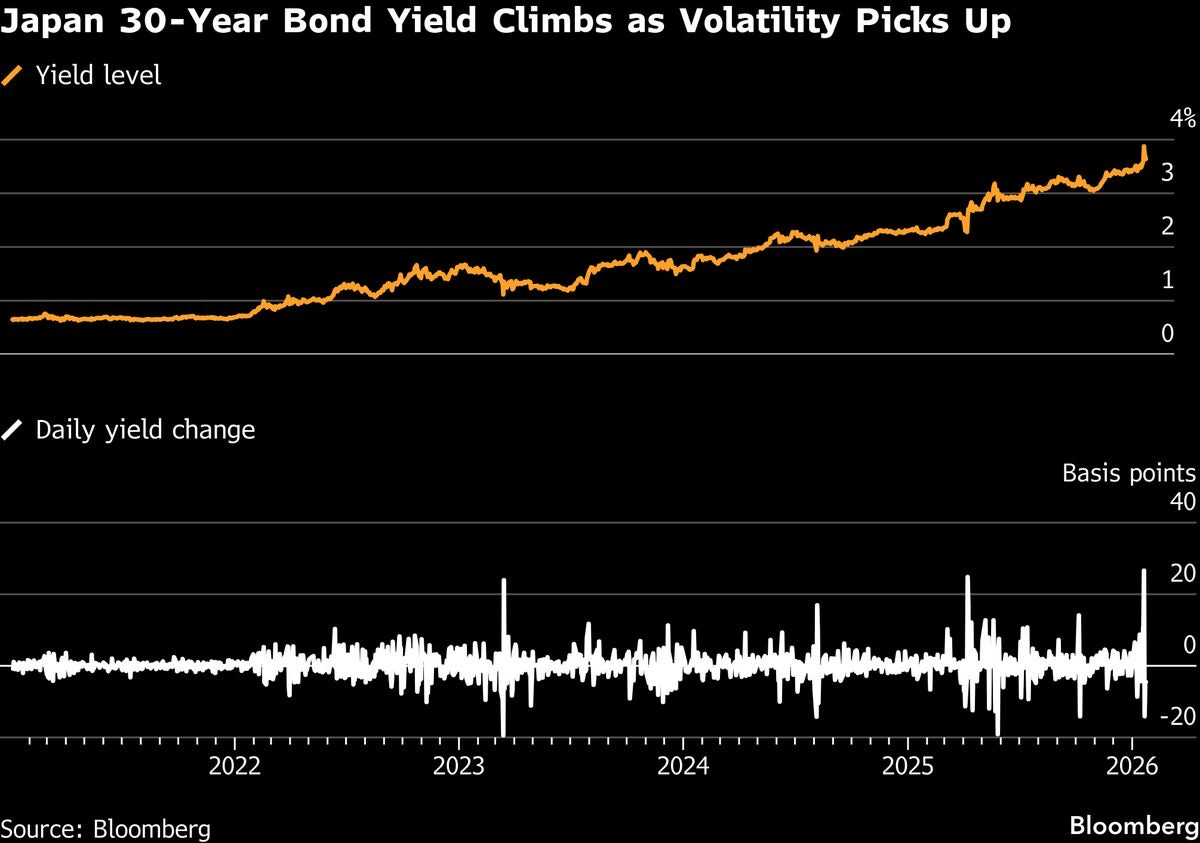

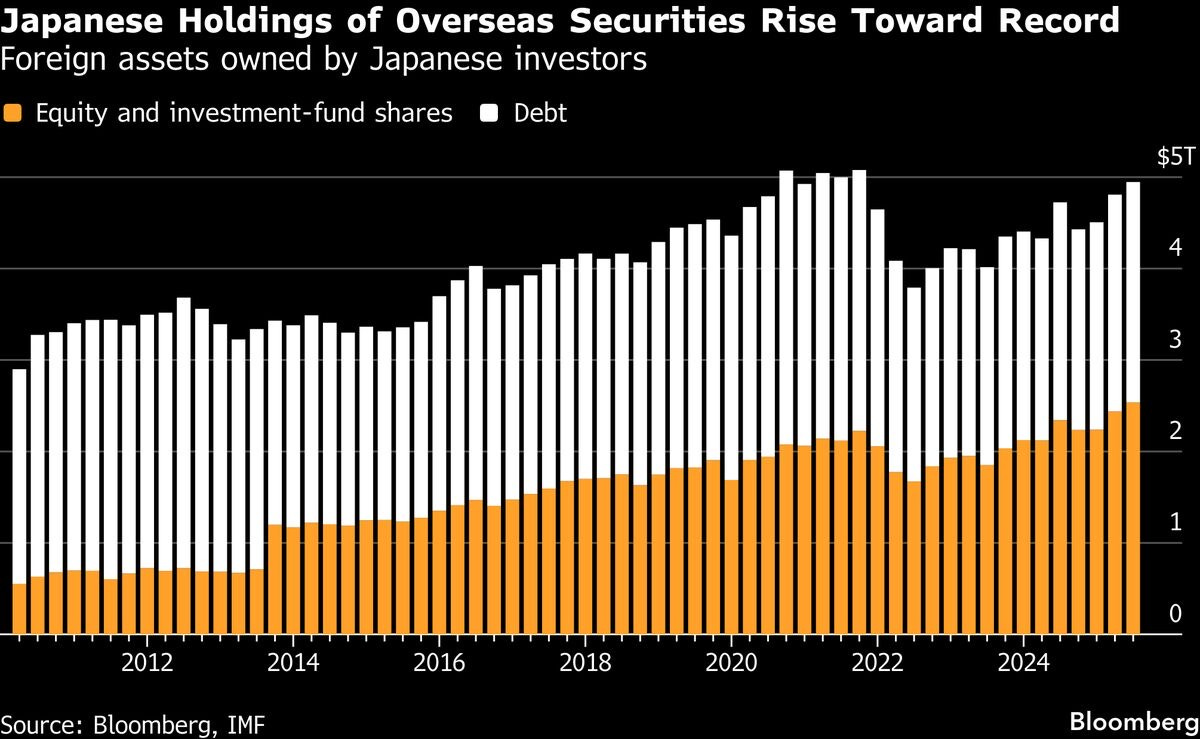

The Japanese yen is long, long overdue for a trend reversal. The consequences would be many, but investors in the US should be aware that repatriation of funds (chasing higher rates the other way) to Japan would be a significant change of direction of flows.

I do not believe this market needs a catalyst for anything at all, but this has been proposed as a possible one for well over a year.

The simple theory is that higher rates in Japan and lower rates in the US would hurt stocks and bonds in the US, much as the opposite circumstance has helped stocks and bonds in the US.

Jan 26

at

4:27 AM

Log in or sign up

Join the most interesting and insightful discussions.