The app for independent voices

SILVER

Another morning, another deluge of commentary from so-called silver experts playing the familiar manipulation tune—often from people who either do not understand, or choose not to understand, what futures margin is and why it has to move with market conditions.

Yesterday, CME announced a shift in how it sets margins, moving from a fixed dollar amount to a percentage of notional value, with silver set at 9%. Historically, that is probably not far from the long-term average. In a market where precious metals are trading with extreme intraday volatility, CME has a clear obligation to manage the risk being taken by both longs and shorts—not any one group of traders—so that all participants are able to meet margin calls during large price swings, of which there have been plenty in recent months.

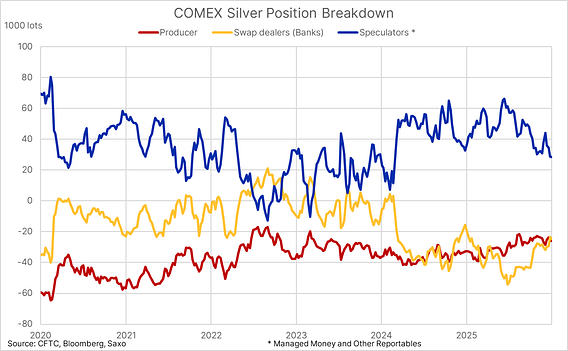

The COMEX silver open-interest breakdown shows the swap-dealer net short (banks) has been steadily reduced and is now broadly in line with the producer short, both around 25,000 contracts, while the long is mostly held by speculators and 'others' That is hardly consistent with the narrative of an ever-growing, predatory short position. The risk of a short squeeze is increasingly pointing to producers who unless they have deep pockets may eventually end up struggling meeting their cash flow mismatch between paying margin and the timing of their actual sale of produced metal.