Notes

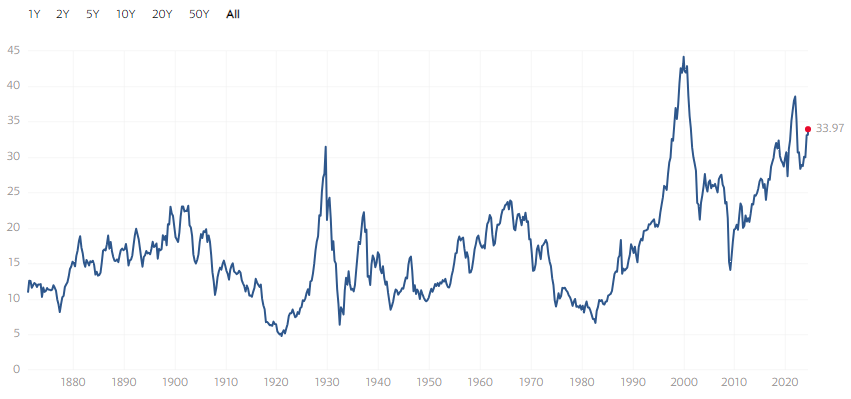

When you have a CAPE ratio of 34 vs a median of 16 since 1880 shouldn’t you think the market is overheated? i.e. when the share prices are 34x more than inflation adjusted 10 years average of earnings, does not feel expensive?

I definitely do think so, especially when the periods that we had such extreme outliers or higher, beginning of 2000 and in 2021, preceded significant market crashes!

This is important not only for the individual investors, but also for all the M&A activities this are currently going on!

Of course, the music is still playing, and no one wants to leave the dancing floor, but we all know that usually who foots such kind of bill is not professional investor, or at least at length, and on the M&A side are the management teams that need to generate value to justify such high valuations!

The Intelligent Investor by Benjamin Graham has several insights about times like this one (a must read book).

I will wait for it to burst and start my investor endeavors when it happens.

This article from the Economist is a great read on the subject!

What is your opinion?

“…Reversion to anywhere near the mean would take an earth-shaking drop. Worse, the high cape makes such a fall more likely, by giving investors reason to dump low-yielding stocks. …”

More on the CAPE ratio below llink.

investopedia.com/terms/c/cape-ratio.asp

How far could America’s stockmarket fall? economist.com/finance-and-economics/202… from The Economist

Dive into your interests

We'll recommend top publications based on the topics you select.