Yet another write-down coming for Altria (MO)?

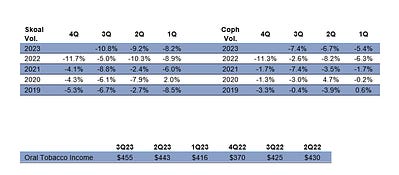

We noted yesterday that Altria (MO) faces an accelerating and compounding decay rate in cigarette volume which is now showing up as lower smoking income y/y. This represents 86% of MO’s total income. It is worth noticing that Skoal and Copenhagen are the largest products in its Oral Tobacco unit. These units have the same problem: (see pics below)

Oral Tobacco’s income has had periods of decline too. Recently, MO increased prices AND cut promotional spending in this unit. Promotional spending is netted against revenues and cuts revenue when promotions increase and boosts revenue when promotions fall. That is the explanation behind higher operating income in 3Q23 (see pics below)

-Promotional spending in this unit rises and falls and more often it increases as MO boosts pricing. That was the case in 4Q22, 1Q23, and 2Q23. 3Q23 reported lower spending, but could return soon and impact income.

-MO bought its way into this market and is carrying $5 billion in Goodwill and $9 billion in intangibles. Those are in danger of being marketed down via forecasts of operating income/cash flow declining and higher discount rates.

-In December, MO said the $3.9 billion valuation on Skoal’s trademark exceeded it forecasted value based on discounted projections by 12%. However, a 100bp increase in discount rate would shrink that cushion to 2%. We can see that the 10-year bond yield is up 110bp since the last test. Its volume has continued to decay and 3Q was particularly awful.