The app for independent voices

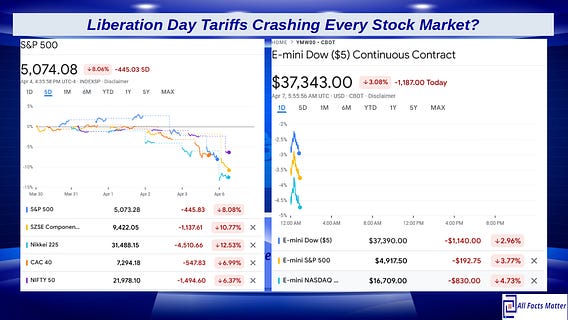

Liberation Day Tariffs Crashing Every Stock Market?

Apparently, President Trump’s “Liberation Day” tariffs are the bane of EVERY stock market around the world…literally.

Every major stock market index is seemingly in or near correction territory over the past five trading days.

The overnight stock futures indicate the Dow is not yet done hemorrhaging, which would suggest that other indices from London to Shanghai are not done hemorrhaging.

All of this because Donald Trump imposed reciprocal tariffs. Reciprocal tariffs are sufficient to crash the global economy.

A large number of the tariffs have not even taken effect yet, and before the tariffs were announced US equities were steadily rising—despite Trump having talked about reciprocal tariffs for weeks prior to actually implementing them.

If this was merely a question of the cost of trade with the US going up, we should see global stocks flourishing as the prospect of trade elsewhere should surely loom large. Only that is not happening.

What the stock markets are communicating in the clearest possible terms is that trade with the US is indispensable to the global economy. Global stock markets are also communicating in the clearest possible terms that goods designed for the US market cannot be sold elsewhere.

If the global economy is really built on such shifting sand, one might even argue that, in the longer term—and even in the relatively near term—President Trump is doing the world a huge favor by knocking it down, so that it may be rebuilt on a hopefully more substantial foundation. If the global economy is really built on such shifting sand, this collapse was always fated to happen.