The app for independent voices

To everyone ‘copying’ my portfolio on eToro:

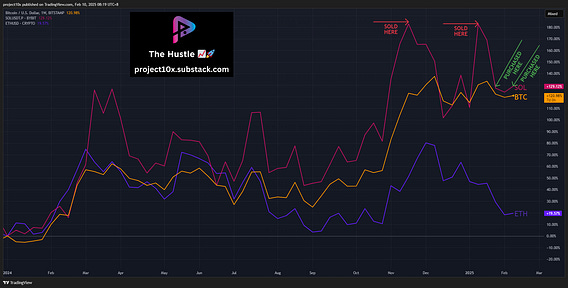

Over the past few weeks, we have been steadily allocating (gaining more exposure) to what I consider the 'fastest horse in the crypto race' throughout the cycle - $SOL

Now, what that means for you and your portfolio is that you may experience higher than normal volatility, given our crypto allocation has increased. This is completely normal and expected as I position our portfolio for the next leg of the bull run.

Remember when I said, "easy mode is over"?

Well, I meant it.

I have been actively trading the $SOL position to

➡️ reduce exposure during the euphoria we saw in Nov 2024 and Jan 2025

➡️ reduce the downside on the pullbacks

➡️ increase exposure at the lows.

This has resulted in a net positive return YTD, where many crypto portfolios are in the red.

From a tax perspective, this approach isn’t exactly ideal, but in my view, the days of HODLing solely for capital gains tax discounts are behind us. I’ve crunched the numbers for the highest marginal tax rate in Australia (~45%) and other CGT-applying countries, and the strategy I’m rolling out in 2025 offers a clear net benefit to our bottom line.

If you have any questions, please let me know; otherwise, sit back, embrace the volatility and let the good times roll 😎

Check out and Copy my public portfolio on eToro etoro.com/people/projec…

If you like this post, you'll love my newsletter! project10x.substack.com