The app for independent voices

Most equity anomalies are the same trade — just badly disguised.

A new paper shows that short-term reversal, MAX, IVOL, salience, and lottery effects all come from one source: the last month of daily returns.

Instead of engineering dozens of signals, the authors let the data learn the mapping from 21 daily returns → next-month performance.

What they find:

Timing beats magnitudeWhen returns happen matters far more than how extreme they are.

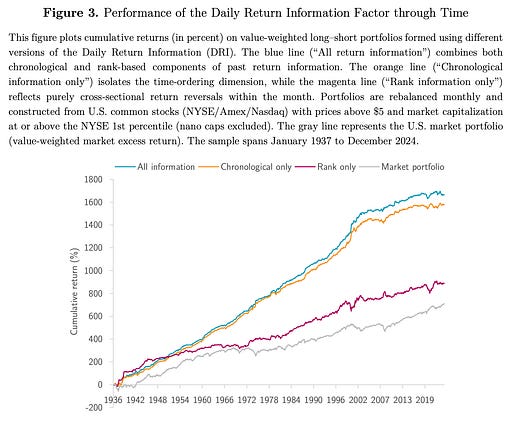

A single factor — DRIF — earns ~1.6% per month, Sharpe > 1,

Subsumes most short-horizon anomalies (reversal, MAX, IVOL, tail risk),

Survives 150+ factors, multiverse tests, and modern markets.

Bottom line: The factor zoo isn’t crowded. It’s redundant. Daily returns already contain the signal — we just kept slicing them the wrong way.