The app for independent voices

Immediately after writing up $ASLI.L and before the schedule publishing date, company is out with an update today, Jan 24th.

Asset Sales - Sold 3 assets, 2 in Spain and 1 in The Netherlands. In aggregate, +22% compared my market value estimate and +6% vs. the Q3 2024 balance sheet valuation. Also +4% ahead of the original purchase prices in 2018, ‘19, and ‘21. These sales are around €1,370 per sq m and a mid 4% NIY based on my NRI estimate. I think the asset quality is not super high relative to the rest of the portfolio and pretty representative.

Future asset sales - due diligence ongoing for the other 3 assets in the market, represent 90,000 sq m. Hard to figure out exactly what’s in the market but given 2025 debt maturities, and that the asset size is larger than the average for the portfolio, I’d guess more assets in the Netherlands.

Leasing - no new leasing but have indicated they are in advanced discussions for Unit 3C at Galivanes and have changed the letting agent at Unit 1B (clearly proving challenging to let this larger unit).

Wind-down - anticipate an initial return of capital in Q1 2025, which is a positive suprise.

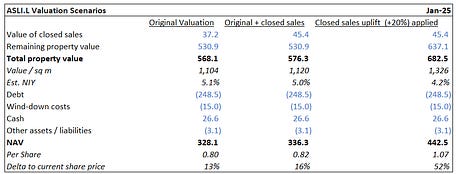

Valuation implications - Situation feels as interesting if not more so after these asset sales and despite the ~5% increase in the share price. Given the higher share price, incorporating the asset sales but making no adjustment to my other valuation estimates results in ~16% upside. Applying the +20% outperformance of closed sales vs. my valuation estimate (too optimistic IMO for the record) indicates +50% upside.

I think the outcome will be somewhere in the middle. If I have to guess, this feels like a 25% - 35% total return, 20% - 25% IRR situation, which is an improvement on my initial underwriting.

Have a great weekend!