“𝗣𝗘 𝗮𝗻𝗱 𝗩𝗖 𝗮𝗿𝗲 𝗷𝘂𝘀𝘁 𝗱𝗶𝗳𝗳𝗲𝗿𝗲𝗻𝘁 𝗳𝗹𝗮𝘃𝗼𝗿𝘀 𝗼𝗳 𝘁𝗵𝗲 𝘀𝗮𝗺𝗲 𝘁𝗵𝗶𝗻𝗴”

Wrong. And this misconception can be dangerous for founders.

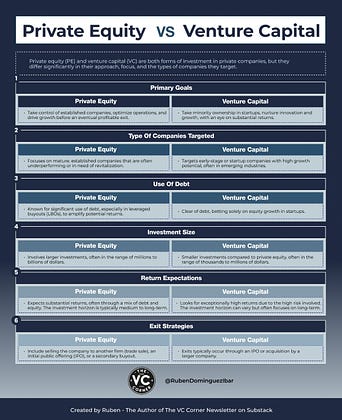

Here’s the difference:

1️⃣ 𝗢𝘄𝗻𝗲𝗿𝘀𝗵𝗶𝗽:

• PE: Buys majority stakes in mature, underperforming companies.

• VC: Takes minority stakes in high-growth startups.

2️⃣ Strategy:

• PE: Focuses on steady cash flow and operational optimization.

• VC: Bets on exponential growth and innovation.

3️⃣ Tools:

• PE: Leverages debt to amplify returns.

• VC: Invests solely through equity.

4️⃣ Team Approach:

• PE: Often replaces management.

• VC: Backs founding teams.

5️⃣ Return Goals:

• PE: Targets 3x returns in 5–7 years.

• VC: Seeks 10x+ returns over a decade.

𝗪𝗵𝘆 𝘁𝗵𝗶𝘀 𝗺𝗮𝘁𝘁𝗲𝗿𝘀 𝗳𝗼𝗿 𝗳𝗼𝘂𝗻𝗱𝗲𝗿𝘀:

The type of capital you raise impacts everything—

→ Who you pitch.

→ How you grow.

→ When you exit.

As often advises, “Founders need to understand the DNA of their investors. It’s the difference between aligned growth and clashing priorities.”

Don’t conflate PE and VC. Your startup’s future depends on it.