The app for independent voices

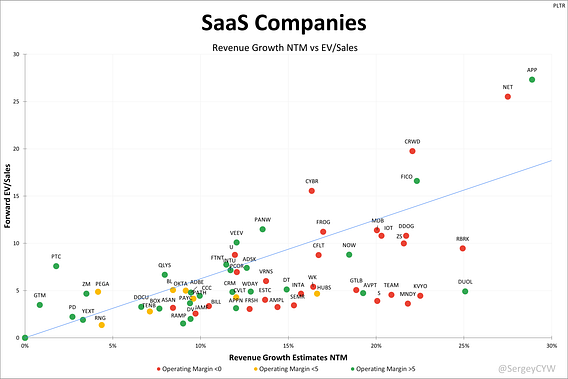

SaaS companies* are typically evaluated based on the ForwardEV/Sales multiple relative to their projected NTM revenue growth.

Evaluating growth stocks using forward projected revenue growth is crucial for investors because it provides insight into the company's future potential, rather than just its current performance.

Additionally, understanding forward growth helps investors make informed decisions by comparing a company’s projections with its industry peers and market expectations, offering a clearer view of its growth trajectory.

I also include data on Operating Margin in the chart, as it has a direct impact on company valuation. Companies with a high positive operating margin should be valued higher than those with a negative operating margin.

On the chart:

Companies with a negative operating margin are marked in red

Operating margin below 5% is shown in yellow

Operating margin above 5% is shown in green

In this case, I used the GAAP Operating Margin from the most recent quarter. It helps identify the latest trends and highlights companies that have recently achieved operating profitability. However, for companies affected by seasonality, the data may be distorted.

*-Selection criteria: software companies with the majority of their revenue subscription-based, EV over $1 billion, and a gross margin above 70%.

P.S. To make the data easier to read, I removed $PLTR, which is trading at an ForwardEV/Sales of 70.5 and +46.5% Est Revenue Growth.