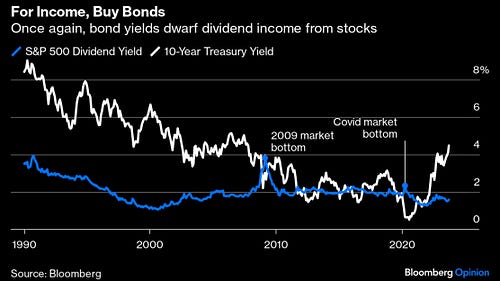

The 10-year Treasury yield is higher than the average dividend stock.

If you're an income investor, you might be looking to buy the 10-year instead of stocks.

If you're a dividend growth investor, you might not care too much about this.

What are your thoughts? Will dividend stock prices fall to bring up yields, or will the 10-year rally, causing the yield to fall?

Sep 23, 2023

at

1:19 AM