The app for independent voices

Tariffs Beat Consumer Preferences

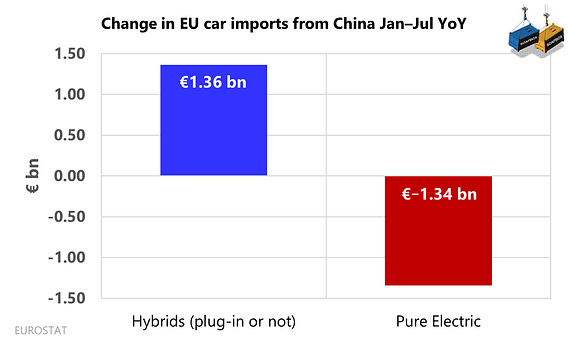

January–July 2025, EU imports from China tell a clear story. Pure electric cars (BEVs) fell by €1.34 bn while hybrids (plug-in and non-plug-in) rose by €1.36 bn. That is a near one-for-one value swap. It looks like rerouting around policy rather than hearts and minds changing overnight.

Our working hypothesis is simple: the 2024 EU countervailing duties on BEVs from China bent the flow. Hybrids sit outside the BEV duty scope, so exporters shifted the mix to keep presence in showrooms.

We tested this using monthly EUROSTAT flows by CN code. We treated China-BEV as the policy-exposed group and non-China-BEV as the control, then added hybrids as a placebo and for a triple-difference check. The estimates point to policy-driven substitution: tariffs matter.

One caution on interpretation. This is a swap in euros, not cars. China Customs data indicate the average FOB unit price for BEVs and hybrids is similar, so the near euro-for-euro change likely maps to a comparable number of vehicles shifting from BEVs to hybrids. Still, EU import values are measured at the border and include freight/insurance; differences in weight and model mix mean we shouldn’t read this as a perfect one-for-one swap.

Even with that caveat, the conclusion stands.

Tariffs beat consumer preferences.