The app for independent voices

INSTANT RETAIL: THE 1 STORE + N FRONT-END WAREHOUSES

Lianshang has reported that Alibaba's Hema (Freshippo) has launched a '1 store + n front-end warehouses' model in China's Hebei province. Those who have been following the Chinese instant retail (quick commerce) market will know that this is a model that has been used by Walmart's Sam's Club in the Chinese market.

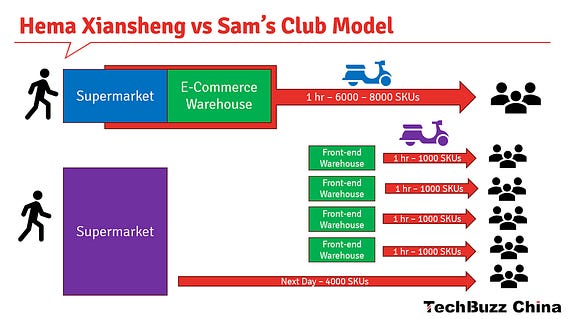

In the slide below you'll see the difference between Sam's Club and Hema's traditional store + warehouse model.

Hema's Xiansheng stores (the ones with the conveyor belts in the ceiling) use order picking in the stores, packing in a warehouse attached to the store and delivering from the stores in a 3 km radius in 30-60 minutes. The disadvantage of this model, which intersects with offline customer flow, is 20% less efficiency in order picking and fulfilment.

Sam's Club stores offer next-day delivery for about 4000 SKUs. Still, for the 1000 fast-moving SKUs, they have front-end warehouses (a.k.a. satellite stores or cloud warehouses) available throughout the city it operates in, from which this selection can also be delivered in a comparable range and time as Hema.

In 2023, Hema had RMB 60 billion in revenue with 360 stores. Sam's Club had RMB 80 billion revenue with 47 stores and 500 front-end warehouses. The big difference is that the small front-end warehouses are much cheaper to set up than Hema stores that are open to the public. However, a Sam's Club warehouse still costs about one million yuan to set up.

Both models differ from those of Dingdong Maicai and Meituan Xiao Xiang, which only use front-end warehouses but have no stores open to the public.

Hema has previously tried to copy Sam's Club by opening Hema X stores. As I recently wrote, it is currently closing half of these (substack.com/@techbuzzc…). But Sam's is clearly still an inspiration to Hema, which is now copying the 1 Store + N Warehouses model.

The advantage of the 1 Store + N Warehouses model is that the warehouses can be used for more efficient home delivery. At the same time, the store remains a brand experience centre for offline customers that can also drive increased average order value. Previously, Hema already found that customers who shop both online and offline at Hema have the highest value.

After ten years, instant retail players like Dingdong Maicai and Hema have become profitable, but business models continue to be tweaked and fine-tuned. And the instant retail market is now heating up further with the upcoming clash between JD and Meituan ... but more on that tomorrow.

Source: Lianshang

- Ed