The app for independent voices

🚗 Auto Retailers in 2024: Surviving the Storm, Betting on Reinvention 🚨The automotive retail sector just weathered one of its toughest winters. While the latest data from China’s Auto Dealers Association (CADA) shows some signs of recovery—41.7% of dealers reported losses in 2024 (down from 50.8% in H1)—the storm is far from over.

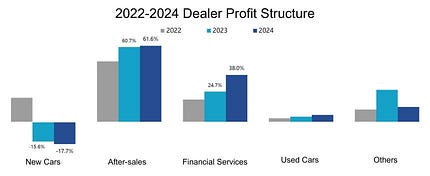

❄️ The Cold RealityProfitability Crunch: Only 39.3% of dealers turned a profit, with new car sales still bleeding money (-17.7% margin contribution).

Price Wars & Inventory Glut: Aggressive discounts, chaotic pricing, and rising inventory (1.5-month supply in July) trapped dealers in a “sell more, lose more” cycle.

Collapse of Giants: From regional leaders like Jiangsu’s Senfeng Group (60+ stores) to Guangdong’s YOAOA Group (40 stores), 2024 saw a wave of closures. Over 4,000 dealerships are projected to shut down by year-end.🔍 Why the Meltdown?

The traditional 4S model is under siege:

1️⃣ Sky-high costs (rent, labor, inventory) vs. razor-thin margins.

2️⃣ Consumer shifts toward online channels and EV direct sales.

3️⃣ OEM policies that prioritize volume over dealer viability.

🌱 Seeds of Reinvention

Dealers aren’t going down without a fight. To survive, they’re pivoting hard:🔧 Betting on After-Sales: Service, repairs, and financing now drive 61.6% of profits.

Mega-dealers are centralizing operations (e.g., shared collision centers) to slash costs.

🚙 EVs Revive Hope: Brands like Neta Auto, AITO, and XPeng are re-embracing dealers after costly direct-sales experiments. Their hybrid models (retain brand control + leverage dealer networks) could redefine EV retail.

🔄 Tapping the "Swap Economy": With China’s booming used-car market, dealers are monetizing trade-ins, refurbishment, and loyalty programs.

💡 The Big Question

Is the dealership model dying—or evolving? The answer lies in agility. Those doubling down on high-margin services, EV partnerships, and digital integration are carving a path forward. Meanwhile, automakers must rethink their “volume at all costs” playbook before the retail backbone fractures.

#AutomotiveIndustry #ChinaEV #RetailTransformation #Dealership