The app for independent voices

CHINA’S SHOCKING ‘NEW SINGLES DAY’ IS ALL ABOUT HOME DELIVERY

Earlier this week, I wrote about Meituan and Alibaba’s Taobao going into battle over meal and instant retail deliveries (within 30-60 minutes) on July 5th, dubbed ‘Super Saturday’ by Alibaba.

Latepost shared some shocking details about what happened last Friday.

▶️In the afternoon of the 5th, Meituan noticed Alibaba’s orders starting to exceed expectations and initiated heavily subsidising (offering consumer discounts). This is in stark contrast to its relative lack of response to JD’s meal delivery activities since February (which I wrote about for Tech Buzz China).

▶️The two platforms mobilised tens of thousands of employees, hundreds of thousands of merchants, and millions of couriers.

▶️Merchants were unprepared (and often not notified in advance). In milk tea stores that were suddenly subsidised, the system kept spitting out orders and overwhelming staff. Stores were crowded with couriers waiting for orders, and some stores had to close their delivery options due to the high volume of orders.

▶️By the evening, extra couriers were mobilised by offering a bonus of more than 10 RMB ($ 1.40) per order. Despite having the largest courier pool (7 million), Meituan still couldn’t get enough couriers and offered consumers more discounts if they picked up their orders. It also offered deals on products like water bottles and instant noodles, which did not require preparation. Consumers started stocking up on such goods and even ordered delivery for all three daily meals. Taobao sold twice as much flour, oil, rice, noodles, frozen food, household cleaning products, and maternal and childcare items as on a regular day.

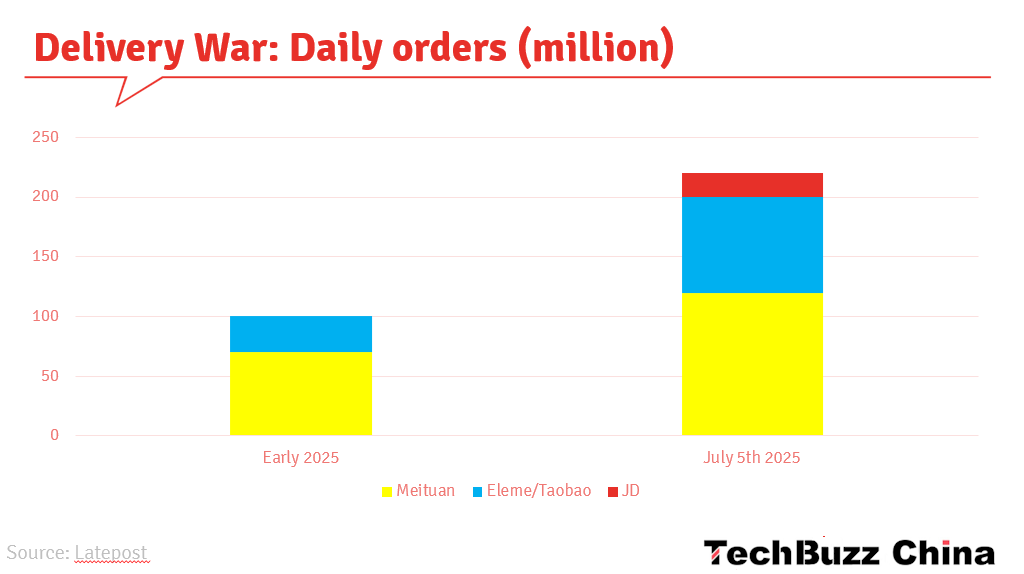

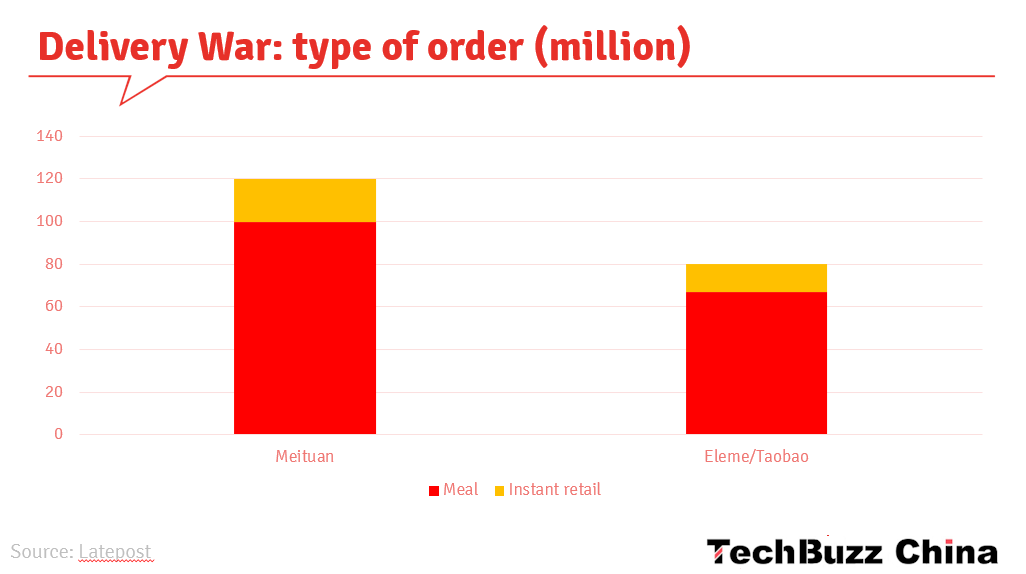

▶️ By 9 PM, Meituan has exceeded its own record with 100 million orders. Two hours later, it reached 120 million. Taobao’s orders reached 80 million. Refer to the charts below for additional data.

▶️ Alibaba aims to replicate Super Saturday every week for 100 days.

With traditional e-commerce seeing limited growth, Alibaba is going all-in on instant retail. It will invest 50 billion RMB in subsidies in the coming 12 months. JD has already spent 10 billion RMB this year, and Meituan typically spends 10-20 billion per year. Latepost estimated that the current delivery battle could cost the players 20 billion RMB ($2.8 billion) per month and that the three platforms have already spent 100 billion RMB this year.

Yes, China is in the middle of another bloody money-burning war.

Image by Copilot.

- Ed