The app for independent voices

WHY TEMU GOING INTO FOOD AND FMCG IS NOT STRANGE AT ALL

This week, the news that Temu was recruiting FMCG brands to sell on its marketplace in Germany was the talk of the town. Many people seemed surprised, but for those who have been watching Temu’s parent company, PDD Holdings, for a longer time, it’s not entirely unexpected.

A few things you should know.

▶️ Pinduoduo, PDD Holdings' first app, launched in 2016 and had an IPO in 2018. Relatively early in its development, it also began selling FMCG and food products. In fact, the Chinese nut assortment brand Three Squirrels was often used as a complimentary product in customer acquisition.

▶️Pinduoduo has specialised itself in e-commerce, directly from source to consumer. This doesn’t just apply to non-food products of manufacturers, such as those on Temu, but also to fresh produce from farmers.

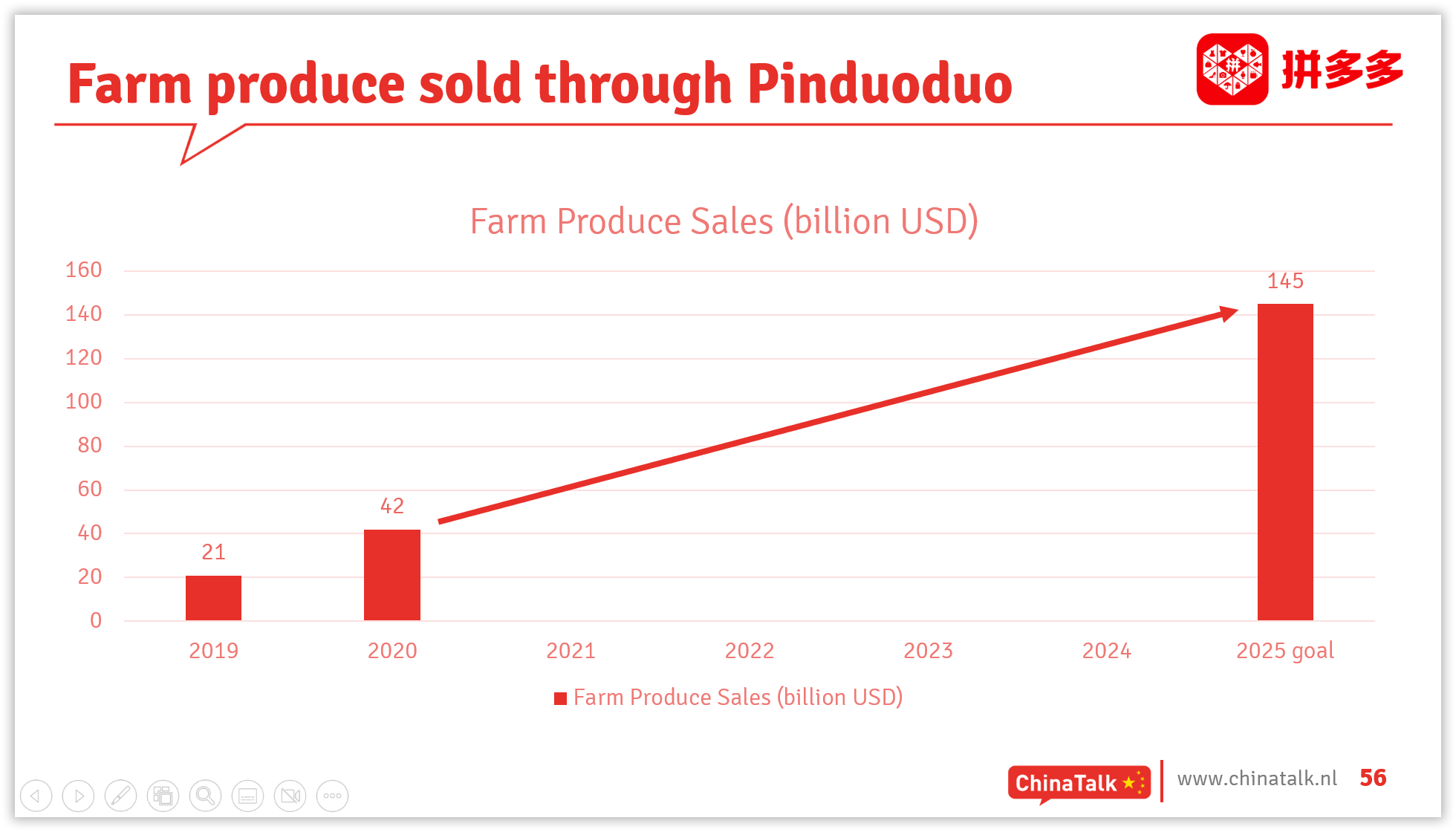

▶️Pinduoduo has made significant investments in the agricultural business. It once set itself a goal of selling $145 billion in fresh produce in China. I haven’t seen any recent figures, but in 2020, they were already doing $42 billion (see chart).

▶️Unlike other e-commerce platforms, Pinduoduo has never had major clashes with the Chinese government and did not receive a large fine in the 2021 tech rectification. I have always suspected that this is related to the fact that Pinduoduo helped alleviate poverty among farmers and maintained a steady volume of orders going to factories. Unlike some of its competitors, Pinduoduo effectively served the government's own goals.

▶️When the community group buying war (about which I wrote extensively for Tech Buzz China) broke out, Pinduoduo launched Duoduo Maicai. Consumers can order fresh produce and other goods on the app and have them delivered to a pick-up point the next day. All platforms were trying to win this market, but in the end, it was Meituan Youxuan and Duoduo Maicai that were left standing. Meituan has recently pulled out of all but two provinces, so Duoduo Maicai is considered to be the winner of this battle…

▶️… but the profitability of community group buying is disappointing, and consumers have moved on to faster delivery options. Duoduo Maicai is now taking steps to enter the instant retail market, aiming to deliver goods within an hour.

▶️All in all, PDD Holding has significant experience in delivering fresh produce and FMCG in China. As such, it is not surprising that it is also trying to expand its product categories in Europe, which will stimulate the ‘local-to-local’ share of its business and reduce potential future tariff risks.

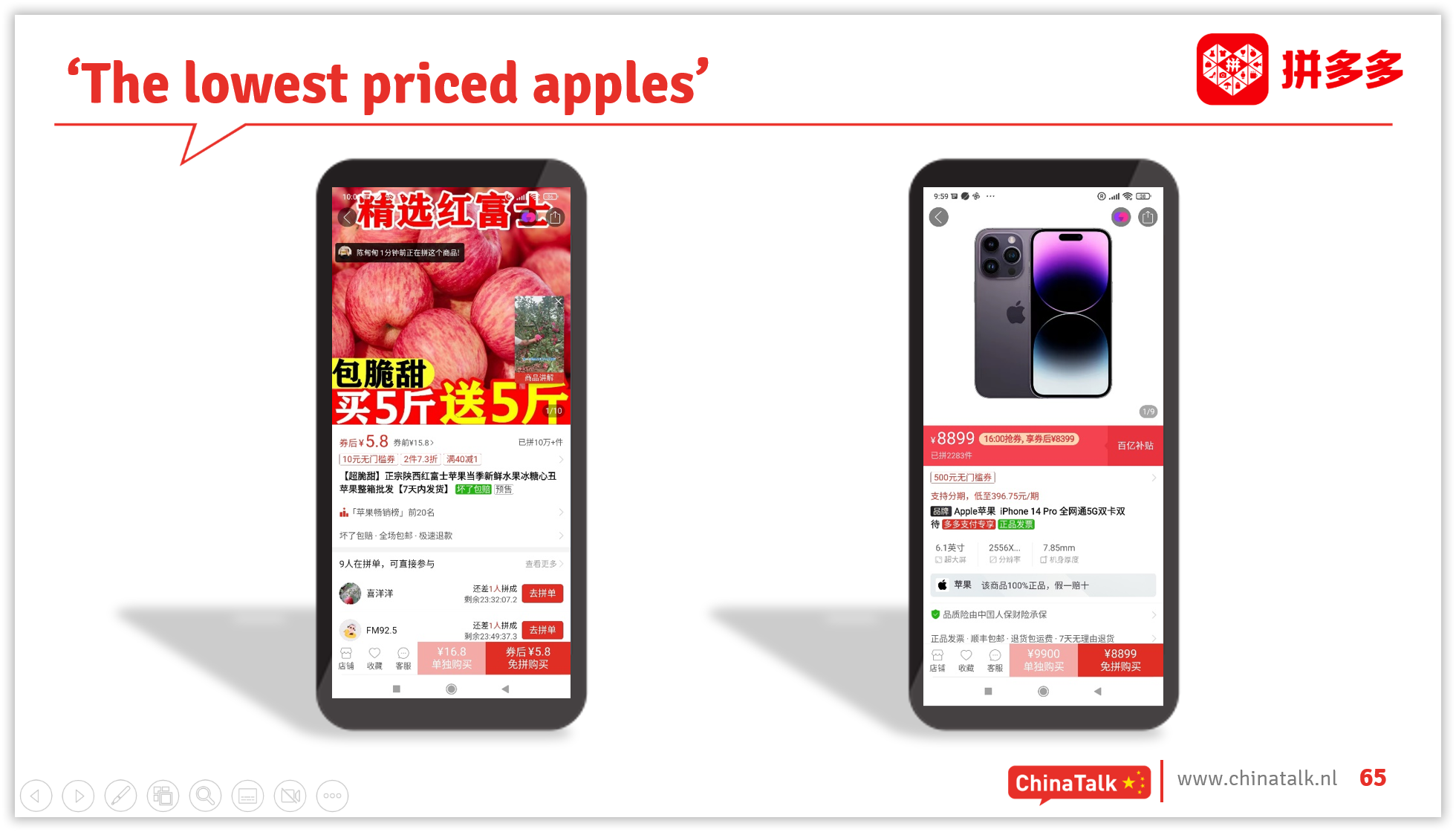

▶️One of the slides below, taken from one of the masterclasses I give during the ChinaTechTrip study tours, shows how people in China used to say that ‘for cheap apples, you need to go to Pinduoduo’. They referred to both fruit and iPhone.

‘iPhones?!’ you might think? Well … that’s a story for another post, in which I will explain that you might also find them on Temu in the future.

-Ed