The app for independent voices

CHINESE INTERNET COMPANIES ARE TAKING OVER THE GROCERY MARKET

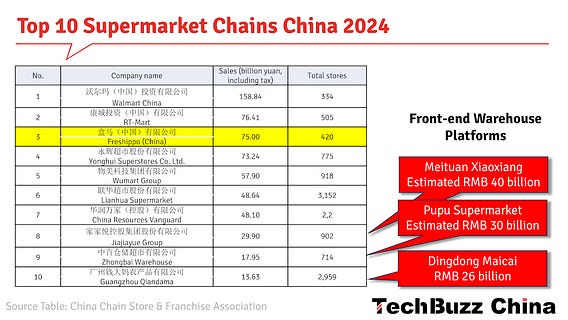

The China Chain Store & Franchise Association released its annual ranking of China’s supermarket chains. In 2024, total sales of the top 100 companies were about RMB 900 billion (roughly $126 billion).

Twelve companies had sales exceeding RMB 10 billion. The market remains highly fragmented, with numerous regional supermarket chains, and the top 10 account for approximately two-thirds of the total market.

Upon reviewing the list, a few items stand out.

▶️ Walmart is number one for the fourth year. This is largely due to the success of Sam’s Club, which accounts for about 2/3rd of Walmart’s total sales. And about half of that gets delivered from front-end warehouses.

▶️ The struggling RT-Mart is number two. For about 10 years, it was part of the Alibaba Group, but was recently sold as Alibaba moves away from physical retail investments. RT Mart is attempting to drive new growth by opening membership stores, modelled after ... Sam’s Club. As far as I know, Alibaba still owns a stake in #6, Lianhua.

▶️ Alibaba’s Hema has reached third place. It has been profitable for a year after the resignation of founder Hou Yi and has focused on two formats: Hema Xiansheng (Freshippo) and Hema NB (Neighbourhood). It has closed many of its Hema X stores, which are membership stores modelled after … Sam’s Club.

▶️ Numbers 4 and 5, Yonghui and Wumart, are in a bit of an identity crisis. They are transforming their stores into ‘Pangdonglai’ stores, following the consultancy advice of this successful supermarket from Henan province. It remains to be seen if it can turn the tide for them.

The influence of Chinese internet companies and internet technology, like online sales and offline delivery (instant retail), can surely be felt in the top 10.

But there is more …

A few days ago, I wrote about the success of the front-end warehouse (dark store) model in China. These platforms are not in the list because, while they are self-operated, they are not supermarket chains that consumers can visit.

However, if we were to add them to the list, we can see that the three major platforms (Meituan Xiaoxiang, Dingdong Maicai, and Pupu) have sales that would earn them a spot in the top 10.

And there is more …

▶️ Meituan is opening 10 physical ‘Happy Monkey’ community supermarkets this year, and like Alibaba’s Hema NB, wants to grow to 1.000 stores.

▶️ Meituan (Youxuan) and Pinduoduo (Duoduo Maicai) operate next-day grocery delivery platforms (community group buying).

▶️ Meituan Shangou, JD Miaosong, Taobao Shanghou (Eleme) deliver a lot of purchases from offline stores and ‘lightning warehouses’ of partners selling on their platforms. Sales that are likely to be counted as revenue for the supermarkets.

▶️ JD operates its 7Fresh supermarkets and aims to enhance its position.

While the New Retail era saw numerous failed experiments, China’s internet companies now have a strong foothold in the grocery market.

-Ed