The app for independent voices

STATUS OF CHINA’S INSTANT RETAIL BATTLE - PART 1: WHAT HAS IT BROUGHT ALIBABA?

Before I headed out to deliver two ChinaTechTrip tours, I had been extensively writing about the food delivery/instant retail battle between Alibaba and Meituan. The dust on this battle has largely settle,d and Latepost just released a long article on the current status, which I will summarise in two posts, today and tomorrow.

▶️ In October, the daily order volume of Taobao Instant Commerce and Meituan Instashopping stabilised around 70-80 million. JD Take-away's was 11 million. 10 million of Taobao’s daily orders concern non-meal deliveries, including orders from Tmall Supermarket.

▶️ At the end of July, Meituan stopped suppressing Taobao’s order volume and focused on retaining high-value users. While it has lost market share in the full instant delivery market, it claims to still hold 70% market share for orders over RMB 30.

▶️ JD withdrew from the battle and instead launched attacks on the supply chains of various industries, including catering, travel, discount supermarkets, consumer electronics, and fast-moving consumer goods.

▶️ Alibaba has announced an investment of RMB 50 billion in consumer subsidies over three years, but is already approaching that total after half a year. The average loss per order is RMB 3, which it now tries to reduce to RMB 2 by the end of the year.

▶️ Meituan has invested about RMB 30 billion. Its profit per order of RMB 1.49 in 2024 had changed to a loss of RMB 1.

▶️ Alibaba will not solely focus on the profitability of food delivery, but will consider the overall revenue of e-commerce, emphasising the positive impact of instant commerce on the platform as a whole.

▶️ The biggest benefit of the battle has been the increase in users on its platforms. Taobao went from 375 million DAU to 431 million DAU at its peak.

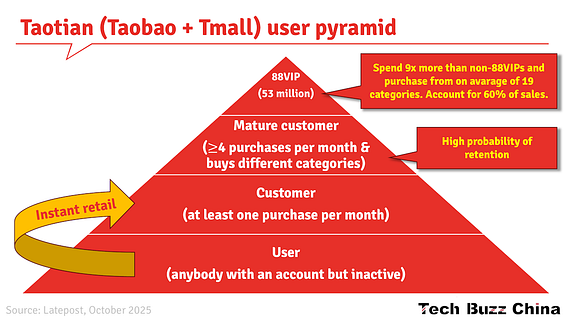

▶️ Instant retail has helped Taobao activate many previously dormant users. Taobao gained 300 million registered users in August, who had made at least one purchase within the past month. Among these, more than 100 million had never shopped on Taobao's e-commerce platform before. The goal of instant retail is to (re)activate inactive users. When they become ‘customers’, they can be upgraded to ‘mature customers’ and ‘88VIP customers’.

▶️ As of November 5th, new users acquired through Taobao Instant Commerce had placed over 100 million e-commerce orders during the Double 11 shopping festival. That seems like a lot, but Alibaba's total orders during last year's Double Eleven period were approximately 5-6 billion.

It remains to be seen whether Alibaba can retain these customers when the subsidies for consumers end. Meanwhile, everyone is holding their breath for the arrival of the Q3 results from Alibaba, Meituan, and JD. Halloween will fall late this year … 😱

Tomorrow, I will share what Alibaba plans to do in the next phase of this battle.

-Ed