The app for independent voices

THE CHINESE E-COMMERCE MARKET STAGNATES … AND THAT SHOULD WORRY YOU

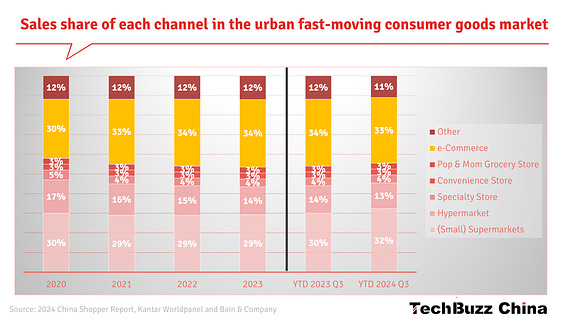

Online sales in China have grown from half a trillion yuan in 2010 to 15 trillion in 2023. Its share of the retail market multiplied tenfold over the same period. But according to a Kantar Worldpanel and Bain & Company 2024 China Shopper Report, FMCG e-commerce in China stagnated in the first 3 quarters of 2024.

The proportion of online sales in total retail of consumer goods reached a record high of 32.7% in 2023 but dropped to 31.7% in the Jan-Nov 2024 period. For fresh food, it even dropped from 13% in 2021 to 10%. Community group buying fell 21% YoY.

Alibaba, JD, and other traditional (‘shelf’) e-commerce companies have recently had single-digit or even negative growth. Pinduoduo’s growth, while still impressive, has gone from triple to double digits. Most of the growth is still in short video apps (Douyin, Kuaishou). Still, Douyin’s GMV growth declined from 60% at the start of 2024 to 20% in September. Kuaishou’s was 15% in the same period. Xiaohongshu (RED) and WeChat Channels are still maintaining rapid growth, but they are in the initial stage of monetization through e-commerce and have relatively limited GMV.

But GMV figures alone can be deceiving. The main reason for the decline is lower prices. Since 2023, there has been a fierce price war in the e-commerce space. While the sales volume is actually still growing at 6% YoY, prices have dropped by 6% as well.

Negative experiences with live commerce have also impacted online sales. Consumers no longer blindly trust livestream hosts.

Meanwhile, some offline stores have improved sales after upgrades and renovations and improving categories like prepared food.

Warehouse/membership stores like Sam’s Club have done exceptionally well, showing 17% growth. Other formats, like hypermarkets, are continuing their decline.

Source: The text above is a summary of an article by第三只眼看零售

So, assuming these figures are correct, why should a stagnating e-commerce market in China worry you? Because the leading players like Alibaba, JD, Bytedance (TikTok), Pinduoduo (Temu), Kuaishou and others will want to maintain growth. And to grow, they need to enter new sectors or double down on e-commerce. The first option is relatively unlikely, with companies like Alibaba and Bytedance ‘getting back to their roots’ and selling non-core businesses (think of Intime and Sun Art/RT-Mart). So, putting even more emphasis on cross-border e-commerce is a more likely strategy.