The app for independent voices

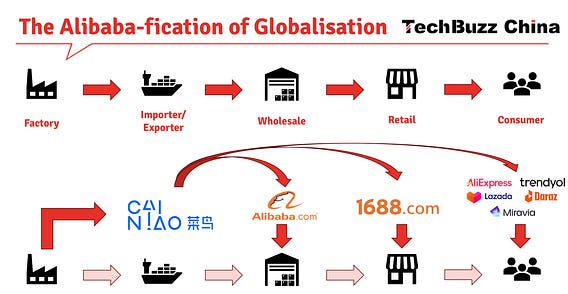

THE ALIBABA-FICATION OF GLOBALISATION

Most of us are focused on the Chinese B2C webshops from China, but a different development is taking shape.

1688.com China, 1688.com is Alibaba’s wholesale platform that sells to retailers. Many other market players, including Temu, use it to benchmark prices from merchants.

1688.com always focussed on large orders and targets wholesale buyers. It also has several other B2C webshops that sell to consumers. What is left is international retailers that order lower quantities (annual purchases of $100,000 to $5 million). They lack the bargaining power and logistics capabilities to connect directly with Chinese factories.

1688 Global will target them.1688 Global will use the Temu-invented fully managed model: sellers only need to send the goods to domestic warehouses, and Alibaba’s Cainiao Network will complete the subsequent cross-border logistics, customs clearance, and overseas delivery. By integrating China-Europe trains, Southeast Asian shipping lines and overseas warehouse resources, 1688 Global's logistics timeliness has improved by 30%, and its overall costs have decreased by 18%.

For now, Alibaba will focus on small- and medium-sized B2B buyers in Southeast and Central Asia, establishing overseas warehouses in Vietnam, Kazakhstan, Uzbekistan and other places. It plans to enter 15 countries, focusing on markets along the “Belt and Road”, in 2025.

Like Temu, 1688 can build on a powerful integration with China’s industrial belt resources (it covers 70%) and industrial clusters. For Chinese merchants, this has opportunities and risks. “On the one hand, the platform opens up new sales channels for them. These emerging markets have huge consumption potential and are highly compatible with China’s industrial belts. Sellers can bypass middlemen and directly connect with overseas end customers to obtain higher profit margins.”

“But on the other hand, when overseas local buyers purchase directly through 1688 Global, the original price and channel advantages of Chinese sellers may be diluted. The profit space that relied on information asymmetry in the past will be compressed, prompting sellers to improve product quality, optimize services, and transform to branding and high-end. (..) The platform also requires suppliers to provide English quality inspection reports, CE certification and other documents. The compliance costs of small and medium-sized factories may increase by 5%-8%.”

1688 Global also faces challenges:

▶️ Southeast Asia's logistics infrastructure is relatively weak, delivery timeliness is difficult to guarantee in some areas (such as Laos and Myanmar), and Cainiao's network coverage needs to improve.

▶️ The level of digitalization of SME factories is insufficient, and the flexible production response speed lags behind fast-response supply chain players such as Shein.

▶️ Competing B2C webshops have diverted some existing retail sales and thereby B2B procurement demand.

Source: 派代跨境电商