The app for independent voices

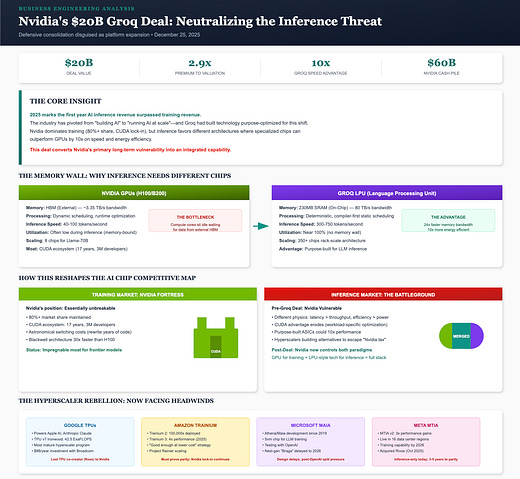

the mechanics of Nvidia-Groq’s $20B “license and acquihire” structure: shareholders get paid at full valuation despite no equity changing hands, 90% of employees join Nvidia, and the deal is designed to avoid antitrust triggers while delivering acquisition-level outcomes.

∙ The payout structure: 85% paid upfront, 10% mid-2026, remainder end of 2026. Shareholders get distributions tied to $20B valuation even though technically no acquisition occurred.

∙ Employee treatment: 90% of Groq staff joining Nvidia get cash for vested shares, unvested shares convert to Nvidia stock at $20B valuation with vesting schedule. Around 50 employees get fully accelerated cash payouts.

∙ Staying employees protected: Those remaining at Groq get paid for vested shares plus “economic participation in the ongoing company.” Even employees under one year get their vesting cliff dropped for immediate liquidity.

∙ The investor math: Groq raised $3.3B total including $750M at $7B valuation just months ago. $20B payout represents nearly 3x that last round, around 6x total capital raised.

∙ The regulatory arbitrage: No equity transfer means no Hart-Scott-Rodino filing, no extended antitrust review, no FTC scrutiny. Same economic outcome as acquisition, completely different legal classification.

This is the “license and lift” playbook in full detail: Nvidia eliminates its only credible inference chip competitor, acquires the founding team and 90% of staff, gets perpetual IP rights, and pays acquisition prices while avoiding acquisition rules. The template Big Tech is using to consolidate AI capabilities.