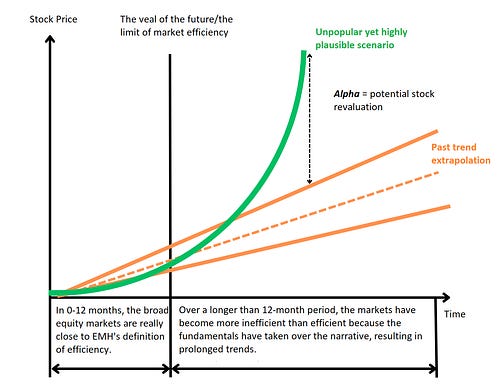

In the short term, the market is more efficient than inefficient because it is driven mainly by narrative. Market participants' consensus shifts are promptly reflected in the market price.

Meanwhile, fundamentals are miscalculated, at least to say, and not priced in. Therefore, investors keep extrapolating the recent past into the imminent future.

Beyond 12 months, however, the fundamentals outweigh the narrative, and the price goes out of equilibrium. Hence, the proverbial Alpha reveals itself.

In other words, unpopular scenarios driven by fundamentals gain traction and eventually become a new narrative while the old ones are abandoned.

1:08 PM

∙

Aug 25