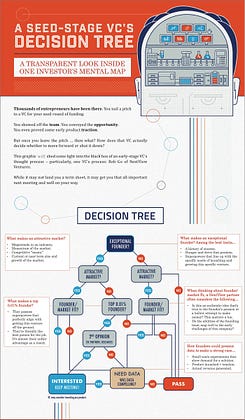

How a Seed VC Makes Investment Decisions?

While making investment decisions, VCs ask themselves three big questions, that revolve around the founder, the target market & founder-market fit.

1. Is this an awesome founder?

2. Is this a market I want to have an investment in? This incorporates both the total size potential of the opportunity and the attractiveness of the market itself.

3. Is there a strong founder market fit? Is this an authentic idea, and does the capability of the founding team map well towards the needs of the market in the early stages of the business?

If the answers check out, investors use a framework to dive deeper into gauging the opportunity, like:

If 1=yes (good founder), 2=no (poor market): Generally skeptical, but open-minded if the founder is exceptional. Markets tend to win, but a truly extraordinary founder could convince you the market is viable.

If 1=yes, 2=yes (good market), 3=no (poor founder/market fit): Difficult to invest pre-product without evidence of product/market fit. Founder/market fit is crucial early on, but exceptional early metrics can mitigate the risk.

If 1=YES YES YES (extraordinary founder): A rare exception where you might back the founder regardless of market attractiveness. Reevaluate your market assessment if an exceptional founder sees an opportunity.

If 1=Yes, 2=yes, 3=yes (good founder, market, and fit): Seriously consider investing pre-launch when all factors align favourably.

If 1=No (unimpressive founder), 2=yes, 3=yes: Need evidence of product/market fit or traction. Hard to get excited without belief in the founders, but stay open-minded as first impressions can be misleading. Integrity issues are a no-go.

As a founder, understanding the VC decision framework will help you on what things to focus on while pitching an idea.

What do you think about this framework?