The app for independent voices

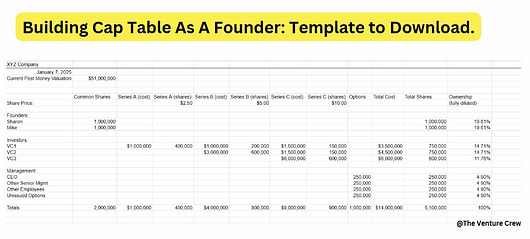

Building Cap Table As A Founder: Free Template to Download...

A cap table, or capitalization table, is a chart typically used by startups to show ownership stakes in the business. It lists your company's securities (i.e., stock, options, warrants, etc.), how much investors paid for them, and each investor's percentage of ownership in the company.

You can obtain a stockholder ledger from your lawyer, which lists all stockholders and shows how many shares or options they hold. However, I don't consider this document a comprehensive cap table. 🙄

In this post, I am sharing a cap table template that is used by some leading VC firm’s partners.

The basic outlines of this cap table are:

➞ It shows all the major stockholders of the company listed on the left side. It also shows the major option holders and buckets of option holders

➞ It shows all of the classes of stock and how much was paid for them across the top of the columns

➞ For each investor, you show how much of each class was bought and how many shares of that class they own as a result

➞ You total up the cost and shares and then calculate ownerships on a fully diluted basis (which means you include the options, whether issued or non-issued or vested or non-vested).

I like this presentation for its simplicity and because it shows the progression of financing activity. It also has the benefit of showing how much each investor has put in on a cost basis, which many cap tables leave out.

If you want to make a cap table for your company, feel free to replicate this format. If you have angel investors, put them in the angel section. I would include the largest ones and bucket all the rest into “other angels.”

👉 You can find the cap table template here: