The app for independent voices

Since the 2025 tariff turmoil hit, gold and silver have gained a lot of investors’ attention. However, I don’t think either gold or silver make for a no-brainer asset choice. Here’s why:

Unlike state-issued currencies, they can’t be inflated by printing machines. That doesn’t mean there’s no ‘new’ gold or silver entering circulation. On average, around 1–2% is added to the global supply every year.

Mining precious metals is expensive - sometimes it’s so costly that it’s not profitable. As prices rise, miners are incentivized to extract lower-grade or harder-to-reach deposits. In short, when precious metal prices surge, supply tends to increase (though it takes a lot of time to develop new sites).

Gold and silver aren’t just shiny objects. Over 50% of silver demand comes from industrial uses like electronics, solar panels, and batteries. Investing in silver means understanding the dynamics of these industries, which is complex. A lot of moving pieces here.

Usually there is more gold bought by jewelry makers than by investors and central banks combined. While investors often turn to gold during periods of inflation and uncertainty, it’s important to remember that these conditions can also reduce industrial output and weaken demand for luxury goods like jewelry. In short, the supply and demand dynamic isn’t as straightforward as it may seem.

About 75% of silver doesn’t come from… silver mines. Most silver is a byproduct of copper, gold, lead, and zinc mining.

Investing in gold or silver can protect against inflation for the simple reason that no mining company can increase the global gold or silver supply by 3–15-xxx % per year.

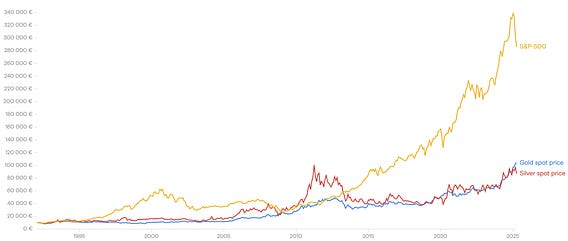

That said, unlike public companies, neither silver nor gold will generate profits. This explains why the S&P 500 has historically outperformed both gold and silver over the long run.

Personally, I don’t have exposure to gold or silver, except during periods of heightened uncertainty in the global economy.