The app for independent voices

Old Dominion Freight Line (Earning review)

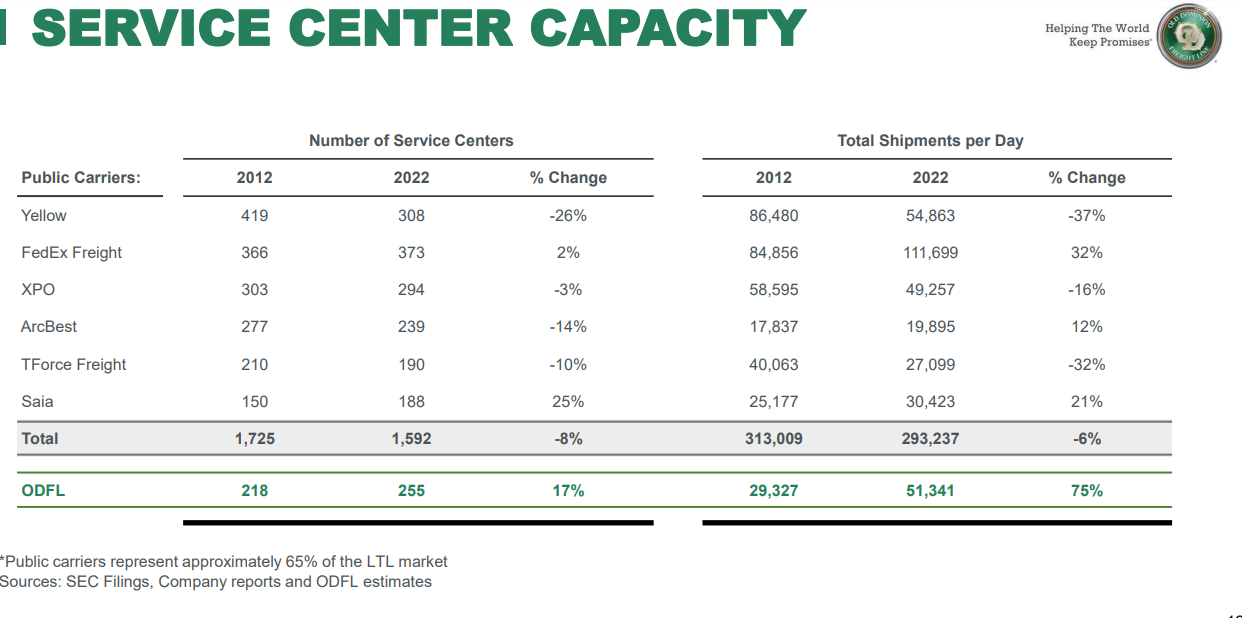

$ODFL is the leading Less than truck load (LTL) provider and it is operating in a high barrier of entry industry with enviable margin.

I have discussed the company before and feel free to read it in my previous post.

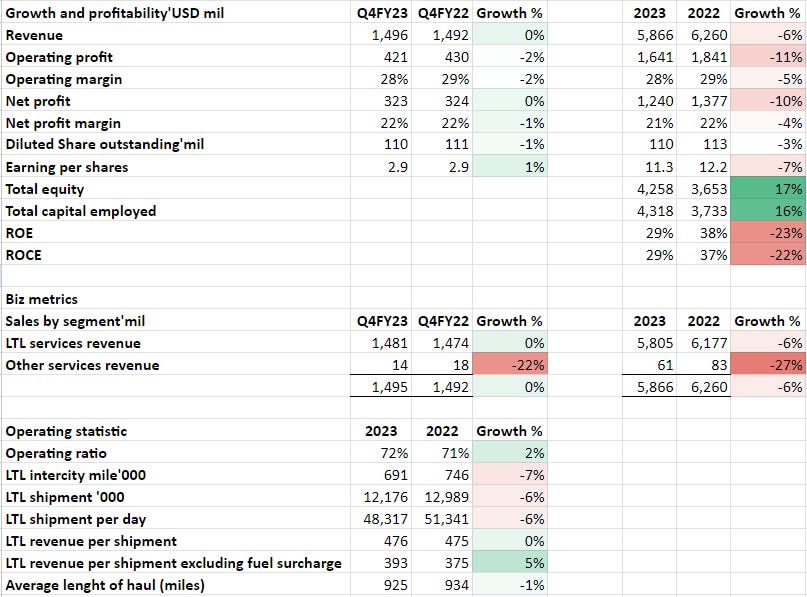

$ODFL FY23 Earnings

Below is a quick snapshot on its earnings call and key metrics:

On capturing excess demand:

“Typically, when we're in a slower macro environment like we've been in, our market share tends to be flatter. But once we start seeing a recovery in the economy, that's when we think our model signs the brightest.

If you look back in periods past, when the up cycle begins, that's when we've got plenty of network capacity, the job that we've done with managing our people capacity and equipment capacity as well, combining with the real estate positions us to capitalize on those upswings.

And that's when in the past, we've been able to outgrow the other publicly traded peers anywhere from 600 basis points to 1,000 basis points. So we're still waiting on that positive inflection in the economy, but I feel like we're better positioned than we've ever been to capitalize on it when the upswing begins.”

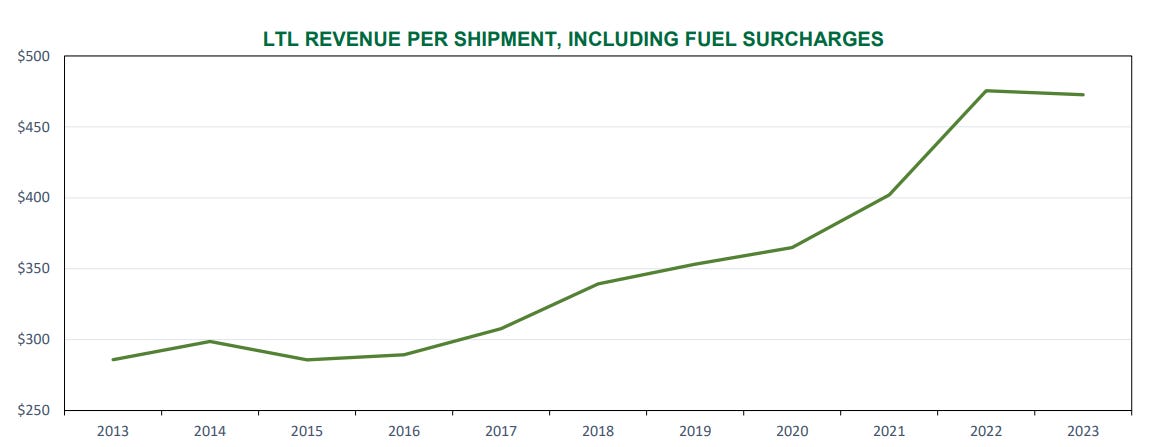

On yellow bankruptcy and normalized LTL freight

“Yes. When Yellow was in operations. I mean, obviously, they had, what, 45,000, 50,000 shipments per day, and they had how many other service centers that they did. And net-net, there's going to be a reduction in those number of service centers that were in operation. There's still quite a few that have not settled in any way. And that's what we had believed. We thought that they would be an exit of some percent of their capacity, if you will. But that same level of freight has got to be moved. And I continue to believe that some of it is currently in the truckload world.

And so I think that there'll likely be a second wave of freight that comes into LTL once the overall market is improving, the truckload world is getting back to normal, and if you've got truckload carriers they're looking for any payload and maybe willing to handle a 5,000 to 10,000 pound LTL and try to put multiple large shipments on one trailer together and do multiple stops. That's the type of freight that they will shy away from once the market improves, and will spill right back into the market and become normalized LTL freight again. So I think that that's another unique opportunity probably for 2024 that should provide a little bit of tailwind to everyone.”

On customer retention:

“And so – but it's just a disciplined focus of keeping our costs as low as we can, and then pricing, understanding our cost on a per customer basis and then having a yield that makes sense to try to constantly improve the profitability on each customer account. But we've never said that, that was the right long-term rate. We just want to be consistent and be fair with our customers in that 100 basis points to 150 basis points positive spread of yield above cost has worked for us.

But we were in a much different position than a lot of other carriers, I think, in terms of that long-term consistency that we've had in our pricing, we didn't have the same need to go out and try to take advantage of that market change and really increase rates in any way. We kept the same measured, fair approach. And I think that pays dividends. I think it is a reason why we've had good volume stability as well when we've gone through this last slow period, is that we've got good customer relationships.”

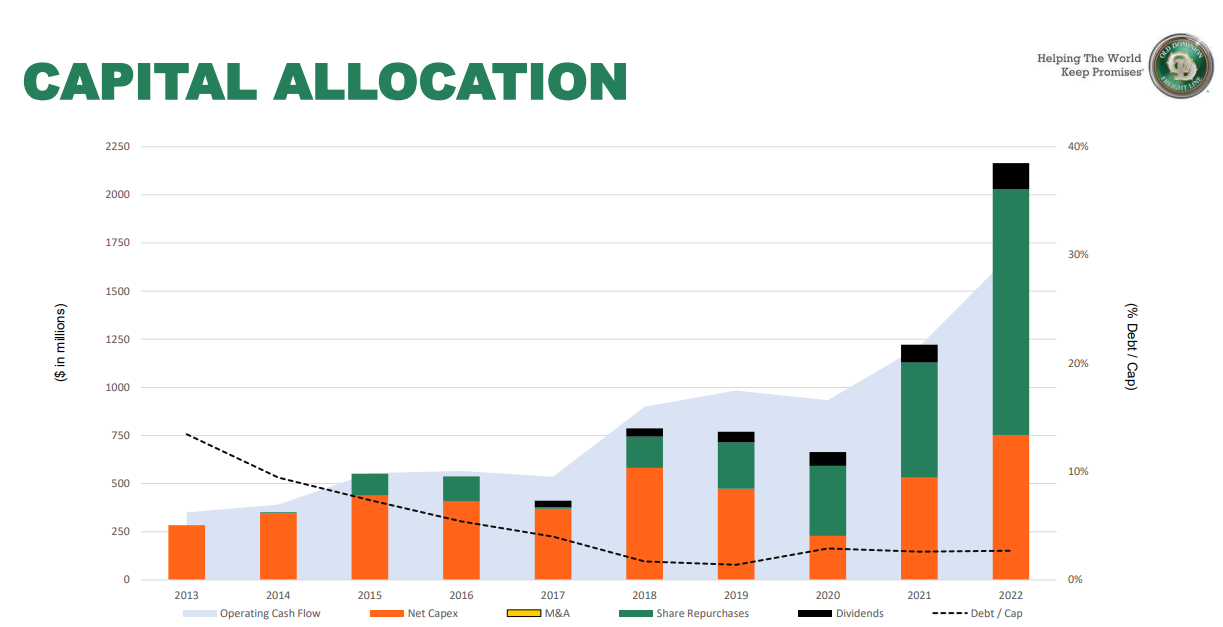

On capital allocation

“Well, we'll have the same approach that we always do. We start looking at what we think our cash from operations will be and then what we're going to spend with capital expenditures. And then we have the fixed dividend component. And the net cash balance, we target trying to return to shareholders through the buyback program. But we generally have a grid-brd approach where we're buying more when the stock is lower, and I mean, less when it's higher, but consistently in the market. And I think that's what you've seen. But that $1.3 billion was double what we spent, about $600 million the year prior. And so it was reduced this year in the back half, in particular.

But as we go into 2024, we'll just continue to look at how much free cash we think that we'll have and how much we try to return to shareholders and in what ways as we go through the year such that we don't obviously want too much cash building up on the balance sheet. But it's all about driving returns on invested capital, and we've done a pretty good job over time, with improving that metric.”

Conclusion

$ODFL continues to be discipline even though the market is slightly tough for them. That being said, their discipline in pricing and capital allocation truly differentiate them from the others.

Disclosure: Disclosure: It is not financial advice. It is for informational purpose only