The app for independent voices

When looking at any business, it helps to get a (very) long-run view of financials and cash flows… how did the company get into their current situation?

Been following Stanley Black & Decker (SWK) for a while and very clearly:

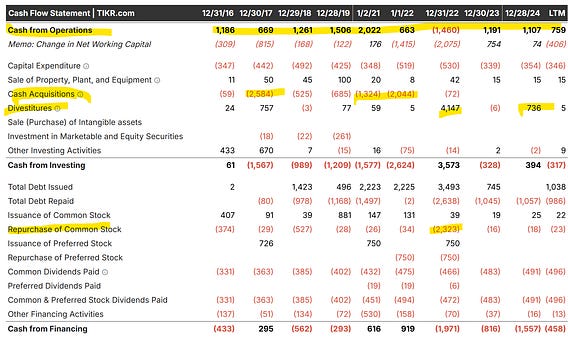

Lots of portfolio turnover (M&A + divestitures) — $7.3bn purchases / $5.8bn sells in past 10 years (vs. $11bn market cap!)

Huge buyback (ASR) — bet they wish they had that one back now

Dividend now severely restricting capital allocation / consuming most of FCF

Good brands, but caught up in pandemic over-earning

Oct 10

at

8:16 PM

Log in or sign up

Join the most interesting and insightful discussions.