The app for independent voices

🚨BREAKING: The $610 Billion AI Ponzi Scheme Is Not A Ponzi Scheme

Here’s why Nvidia isn’t the disaster the algorithms - and the bears, want you to think it is. Far from it.

Shanaka’s argument claims that Nvidia’s rising inventory, receivables, and DSO suggest demand is slowing and the company is pushing more product than customers can absorb, in terms of need and payment.

In brief: no more demand nor cash to pay for their GPUs.

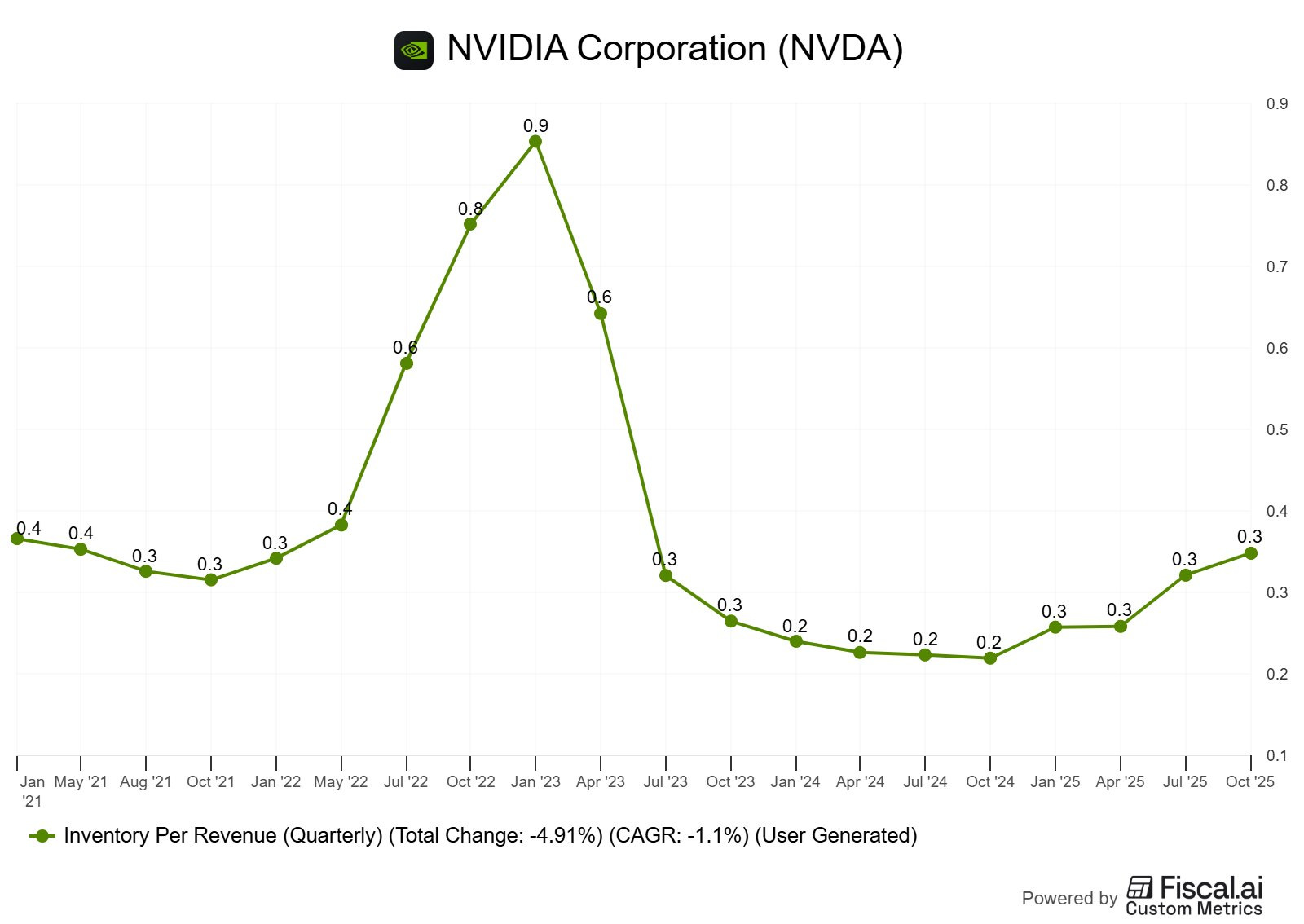

1. Rising Inventory ≠ Red Flag

Shanaka says rising inventory is evidence of weak demand, but ignores Nvidia pricing - and many other factors we'll talk about.

When unit prices double or triple, the same volume of hardware shows up as a larger dollar value in inventories.

You'll have more bananas for $1M that airplanes, right? Just like you'll have more H100 than GB200.

When we normalize inventory by revenue - or by units shipped, the trend is stable, suggesting this is a pricing effect, not a demand problem and rising inventory in volume.

This can also be illustrated with accounts receivable per revenue, which make the same point: when product prices increase, dollar-denominated metrics rise, so metrics taken individually may look bad but within context, the story looks normal.

That being said, many could point that even then, inventory is rising. To which we need to add context, something algorythms are incapable of.

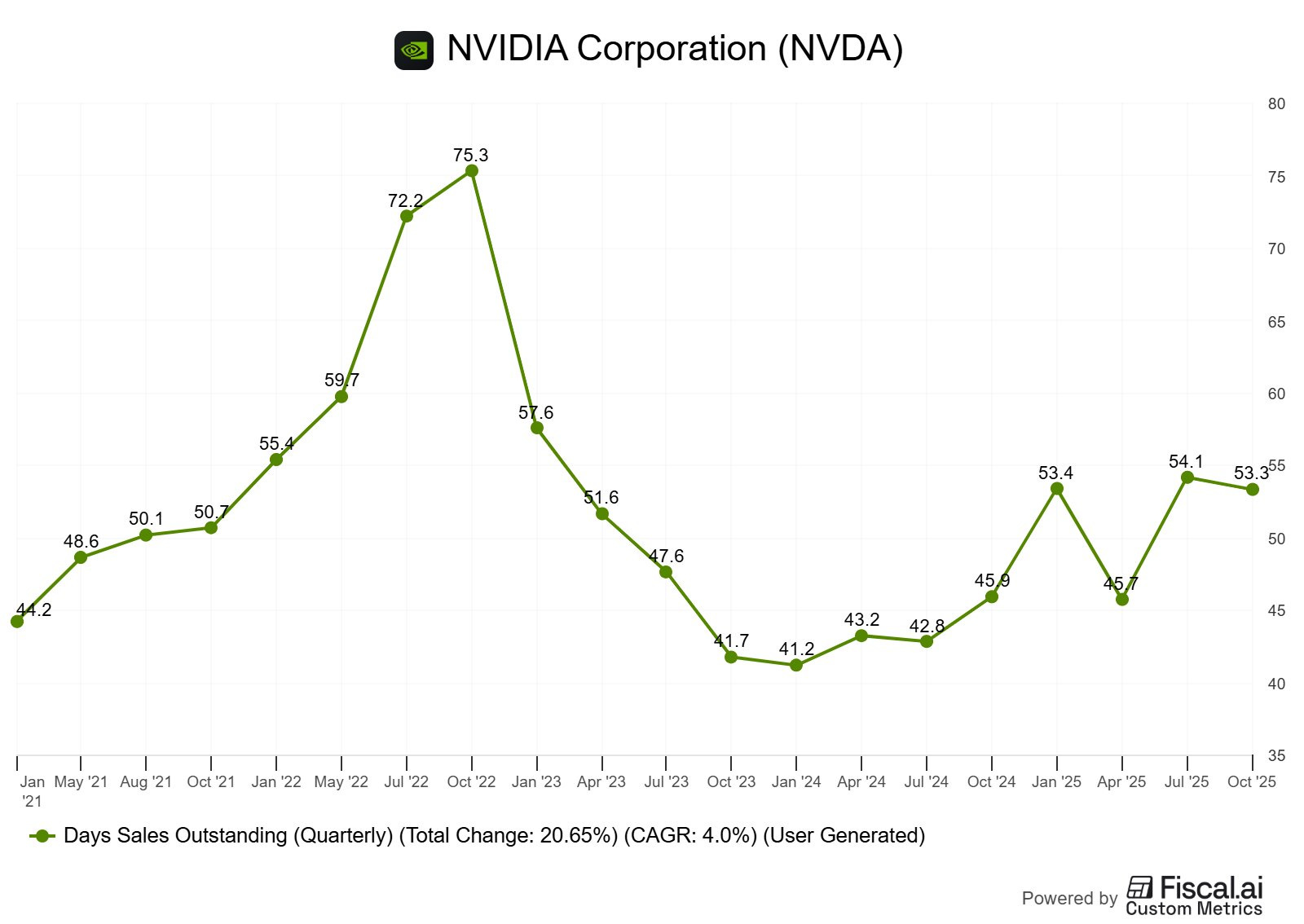

2. Higher DSO & Supply Chain Constraints

DSO - which represents the time before being paid, rising slightly is consistent with real-world constraints.

Nvidia doesn’t just ship GPUs anymore; they ship racks, custom configurations, integrated systems… These use third-party components, which require more coordination, harder logistics, and can temporarily increase time before revenue recognition and therefore inventory.

Add to this the fact that foundries, as proven many times these quarters during TSM & co earnings, run at full capacity, and you get even more delays.

More customization + constrained supply chains = longer installation cycles before revenue can be recognized and rising inventories until then.

This is an operational bottleneck, not a credit problem.

A move from 46 to 53 days is marginal especially considering this value has been roughly stable for three quarters.

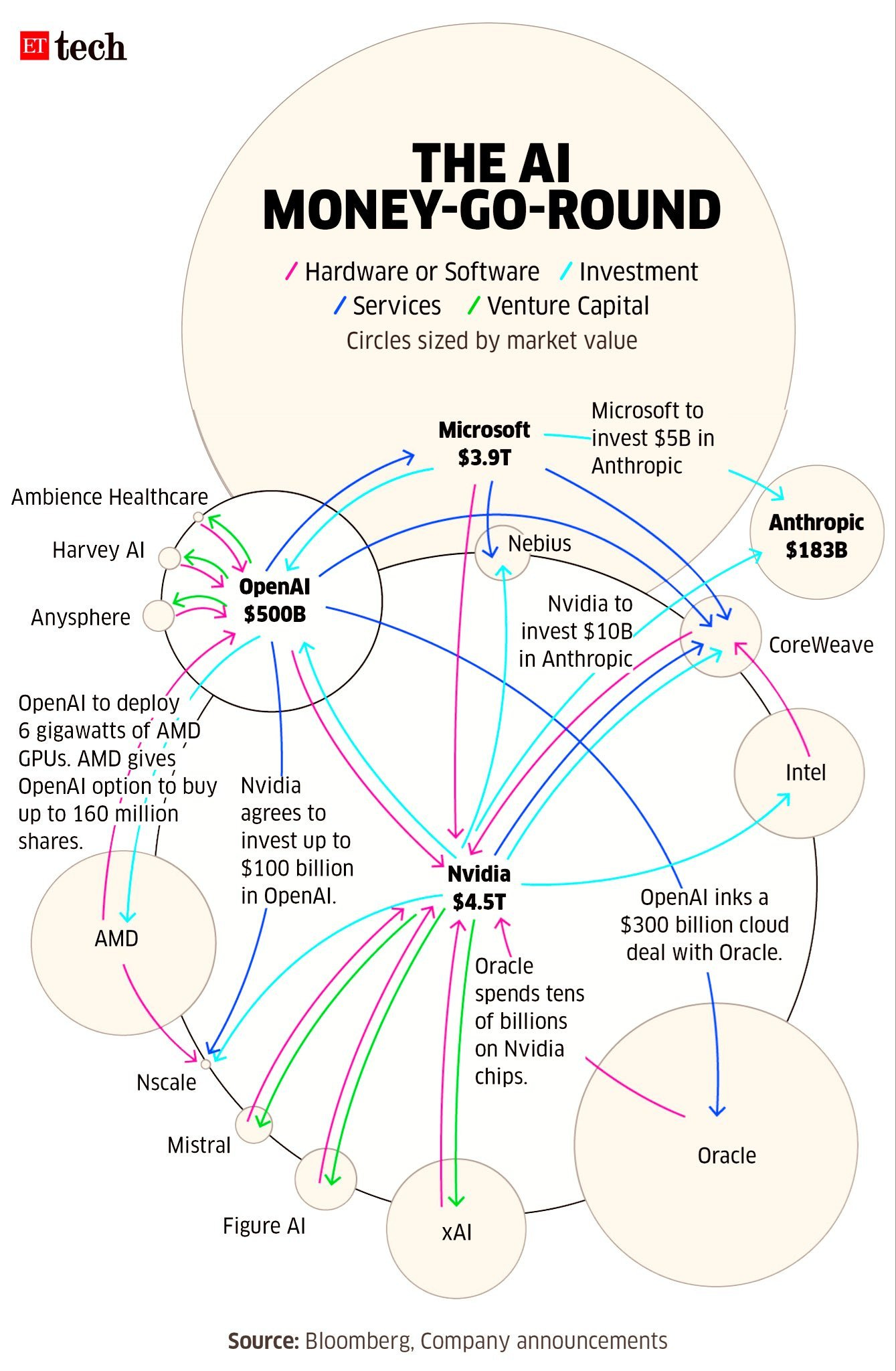

3. Circular Economy

As for the claims about a circular economy and the same dollars being used across multiple companies, I have no counters but this: circular economies are normal, that’s how economies work.

It only becomes a problem if AI services do not generate enough cash to honor commitments.

Because that’s what those are: commitments, not booked revenues. If those commitments can be honored, then what is the problem?

4. Algorithms Don’t Understand Context

Shanaka claims that this was thankfully found by algorithm - and I can agree with him based on the market's behaviour and violence. But he forgets that algorythm are built to find fraud in 99% of cases.

But Nvidia is the 1%.

When revenue grows 60–80% YoY, it's normal for inventories, receivables, and payables to grow at least comparably in dollar terms. Maybe even slightly higher when added real-world constraints.

What matters is whether these metrics grow disproportionately relative to revenue.

And once normalized, Nvidia ratios are stable, which is consistent with a rapid ongoing expansion, not accounting games or demand collapse.

That being said, everything isn’t necessarily perfect. But again: algorithms are configured to gauge 99% of the market, so of course the 1% will raise red flags.

Add some organic grey cells, context and reality, and the picture is very different, even if the stock continues to fall.

The market is about emotions, not rationality. And social medias are great at sharing emotions, less for rationality.

Conclusion.

I might be proven wrong in time and Nvidia might be an accounting fraud. I personally continue to believe in the AI revolution, have my own concerns about the circular economy but did not find any indications that AI won't yield cash flow and that commitments can't be honored as of today.

I continue to be bullish. And shared all my moves and reasoning with subscribers yesterday.

The future is bright for those with a system.