The app for independent voices

Today, Jan 21, Rocket Lab (RKLB) is up 30% to $30.90 on news of a $35 price target from an analyst at Citi. Shares are now up ~356% since the release of my Deep Dive back in August.

How do I feel about this most recent move? Middling, to be honest. I do not honestly think RKLB should be trading up here, at 36x it’s annualized Q3 sales. This company does operate in an asset/capital intensive sector where margins are generally on the lower end of the spectrum. I’ve said before that analysts are not infallible, and they’ve been known to chase hot stocks, even at extreme prices, simply because the shares might keep going up and for no better reason (profitability improvements, etc.).

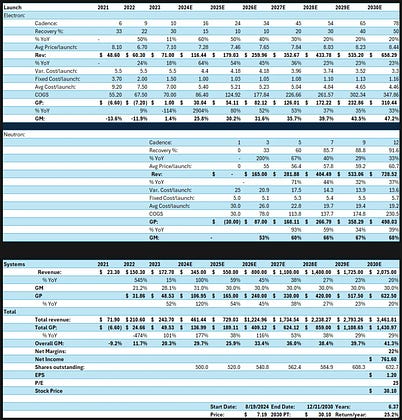

Previously, I modeled RKLB to 2030 revenues of $3.64Bn and net income of $760mm. So at today’s market cap, the company is trading at 3× 2030 est. sales and 20× 2030 est. net income, and that’s not even factoring in dilution. From a fundamental basis, this move makes very little sense.

Obviously, fundamentals aren’t everything when it comes to stocks like this - the mid-2025 Neutron launch we still expect could be a further upside catalyst, but I can just as likely see shares slide by a large margin if the launch fails, or even if it doesn’t fail. Sometimes binary events that have been priced in like this can result in significant downside even if the event itself is a success. I am very likely going to trim my position even further on this move, and I suggest anyone else holding the company to do the same. There are times when you can feel great about selling, and this should be one of them. If it goes down 50% from here (which it very well could based on its financials)? Not so much.