Discover more from Market Forecasts and Trade Plans

A real failure of the bear market if this level breaks.

The odds of the downtrend breaking if rally continues here are very strong.

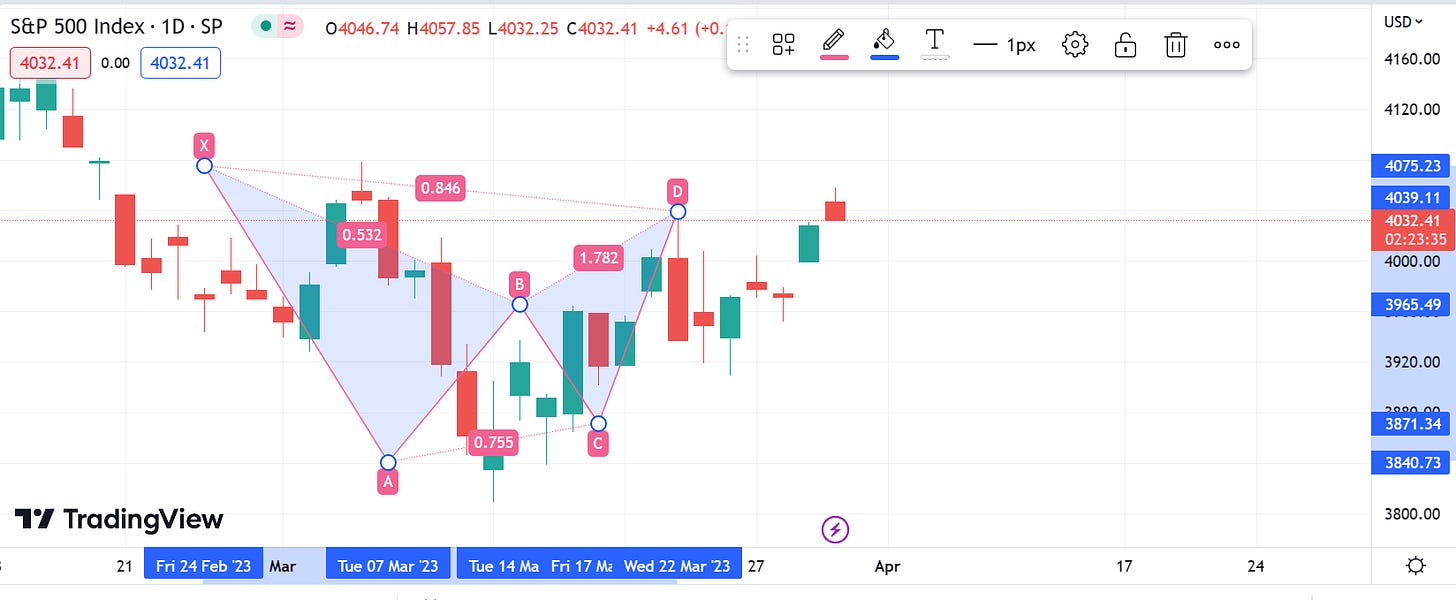

In our last newsletter we said the big decision would be likely to be made upon the completion of the butterfly pattern. We’d either see a successful butterfly pattern where the low breaks and we see a drop to under 3400, or we see a false start off the butterfly, failure to break the low and we’re in a bull trend if we rally through the high.

We now have a lot more development in this. We sold hard off the butterfly, failed to make a lower low and now we’re back up to the previous high.

I’ve traded many different types of bear moves over many years. The failure of the butterfly patterns off this type of move I’ve found to be a strong exit signal for shorts. When I’ve stayed short after this has happened, I’ve usually regretted that. Conversely, an easy long comes upon the breaking of this.

For this analysis to be valid, we’ve have to see higher lows holding. So the swing stop here would be no lower than the last pullback low.

If the rally succeeds here, I’d expect it to be no less than 10% and it can even be a full turn and the first signs the bear market move is failing and there’ll be no break before at least a retest of the highs.

Very strong buying opportunities here at 4030 - 4040 level with stop losses under 4000.

Extreme risk for bears if we get over 4060 - 4100. I’d go for tight stops if I was short here. I find if the tight ones above the highs hit, usually they’d all hit.

If we can see successful closes over 4060 - 4100 on weekly charts, I think this would be a strong hit the bear move has failed and we’re going to form some sort of squeeze (At this point the first target for that would be the previously discussed bat spike out).