Discover more from Fusion VC

From Pitch to Signed Term Sheet: The Slide Deck and Methodology That Led to a $15M Series A

Masterclass, Episode 12: Learn how to maintain momentum with investors + tips on structuring your slide deck, including examples of slides that worked (and didn’t)

Watch the episode 👇

Episode highlights:

There will come a time, early in your startup’s life, where you’ll need to convince investors to give you millions of dollars based on a few dozens of Google Slides and a lot of good intentions. Raising your first ‘real’ round can be intimidating, especially for first-time founders – but there are ways to increase your chances of success and make it more manageable.

In this Masterclass, we’ll get into practical details of how to get your round from zero to done. Gal Biran, Co-founder and CEO of Base, will share some insider tips that helped his company close a $15M Series A – including the actual slides and emails he used to convince VCs like Wing and Vertex.

What You’ll Learn:

How to organize your investor outreach

Tips on structuring your slide deck, including examples of slides that worked (and didn’t)

How to manage the process with investors and maintain momentum

Meet the expert:

Gal Biran is the Co-founder and CEO of Base (formerly Crowdvocate). The company has raised $15M in Series A funding for its customer marketing platform, and counts Hubspot, Verbit, and Gong among its clients.

It’s a Job

The first thing you need to understand is that fundraising is not a side hustle that you can spend a few hours a week on. It’s a major project that requires careful planning, time management, and a lot of behind-the-scenes work before every meeting.

It’s not going to be your full-time job; but you’re going to have a few months where you’ll dedicate at least half of your time to preparing your pitch, researching potential investors, and attending meetings. This will inevitably slow down other processes - but you do what you gotta do, and then you can go back to building.

Managing Investor Outreach

Your systematic approach starts before you’ve even sent your first email. You’ll want to collect the relevant background information and personalize your approach – ‘spray and pray’ isn’t going to work here.

Make a spreadsheet

Treating fundraising like a job means being organized. Manage this like you would a B2B sales process. You don’t actually need to use a CRM – a spreadsheet should be perfectly fine to track your progress and collaborate with your team. Here’s what you’ll want to have in it:

The investors you’re planning to approach: including any relevant background information about their funds, such as companies they prefer to invest in. You're not just collecting names, you're building a roadmap for your fundraising strategy.

Your outreach method: For each investor on your list, make a note of how you're going to reach them and who can provide a reference. Is it your network? An existing investor? An industry acquaintance?

Track the current status. Keep tabs on the progress you're making with each investor. Record the last touch point (an email, a call, or a meeting), and update the 'lifecycle stage': due diligence, irrelevant, etc. If they’ve given you a hard no, record the reason: if someone told you to come back in a year, or when you’ve hit $100K MRR, you might want to take them up on their suggestion.

Investor cohorts

Look at the list of investors in your spreadsheet. You should have three types or cohorts of investors in there:

Proof of concept: These are the investors you don't mind "burning" - you’re mostly after their feedback and the practice you gain from pitching to them. (They can also be friends or people from your broader network.) Practicing on this cohort is actually really important - it helps you refine your pitch and identify any weaknesses before you speak to the investors that you’re really keen on. At least some of the investors in this cohort should show interest; if none do, it's a signal that something may be wrong with your pitch or strategy.

The cream of the crop: These are the best investors who you are most excited about partnering with, and should be your top priority once you've honed your pitch. Factors like personal connection, research, and personal fit should influence your decision on who to include in this bucket. Look for funds that have invested in similar sectors, and especially in other Israeli start ups.

The masses: Everyone else: there are hundreds of investors out there, and you’ll need to talk to a great deal of them before you close your round.

Your outreach email

Once you have a potential investor lined up – and preferably after an intro from your network – you’ll want to go ahead and make the first move. Showing up with flowers is a possibility, but email is probably the safer bet.

Here’s an example from Gal – the actual outreach email he used for Base’s last fundraise:

Short and to the point

Your outreach email should be concise and easy to read at a glance. Investors sift through hundreds of these emails every week. If they need to expend extra cognitive effort parsing through buzzwords and vague generalities, you’ve already lost them. Get to the point quickly and skip straight to the part that explains why they should care.

Prepare for the First Meeting

Sooner or later, one of the VCs you emailed would like to meet you. If you haven’t done so already, now is the time to start frantically creating slides.

Prepare the deck(s)

The best pitch deck is three pitch decks. There’s the version you’ll use at the face-to-face meeting, a pre-meeting version, and a post-meeting version. The at-the-meeting version should be clean and concise, so as not to distract from what you’re saying. The post-meeting deck should include more context and comments, as it will likely be shared with other members of the investor's team who were not present at the meeting (and you’re not going to be there to speak over it).

You’re going to encounter investors who request specific information or materials that you hadn't initially prepared. Don't hesitate to ask them what they want to see and how they prefer to receive it – e.g., if they have a preferred template for the data room report or business plan. Be transparent when you don't have everything they're asking for, but be ready to address their requests promptly.

What to include in your slide deck

Competition. “We have no competitors” = 🚩🚩🚩. Don’t say this. If you do, investors will deduce that either you don’t understand the market you’re in, you're hiding something, or there's no real opportunity. Addressing the competition head-on shows that you understand the landscape and have a plan to differentiate yourself.

Traction: Traction is validation. It’s a de-risking signal from the market that tells investors you’re building something people want. If you don’t have paying customers yet, work with what you have: POCs (proof of concepts), pilots, angel investments. Just an idea is rarely enough, even for pre-seed or seed funding.

Progress: If you've previously pitched to an investor, tell them about the progress you've made since then. It shows your ability to execute (and that you remember the last meeting).

Predictions: Clearly explain what you plan to do with the money. Investors aren't just looking at this round of funding; they're considering the next one and how you'll get there. Describe your plan in terms of inputs and outputs – you don't need to provide an exact headcount or detailed budgets, but give a high-level overview of how the investment will be used to grow the business and reach your objectives.

How much should you ask for?

Okay, now’s the moment. You’ve got your first meeting. What number are you going to say you’re looking to raise?

While some may suggest providing a range, we’d usually advise to present a specific figure. Research the investor you’re speaking with beforehand to understand what size check they’d usually write. If they tnd to give $1-2M and you’re asking for $5M, you’ve already put them in an uncomfortable situation (and given them an excuse to brush you off). It’s not always a negotiation – if your ask is too far off the mark, investors may simply say no.

Also remember: Fundraising is a dynamic process, and the amount you initially request may not always be the final outcome. It depends on momentum, relationship dynamics, and ‘reading the room’. Stay flexible.

Slide Examples: the Good, the Bad, and the (Literally) Ugly

Let’s look at some of the slides that helped Gal close Base’s Series A… as w/ell as some slides he will never use again.

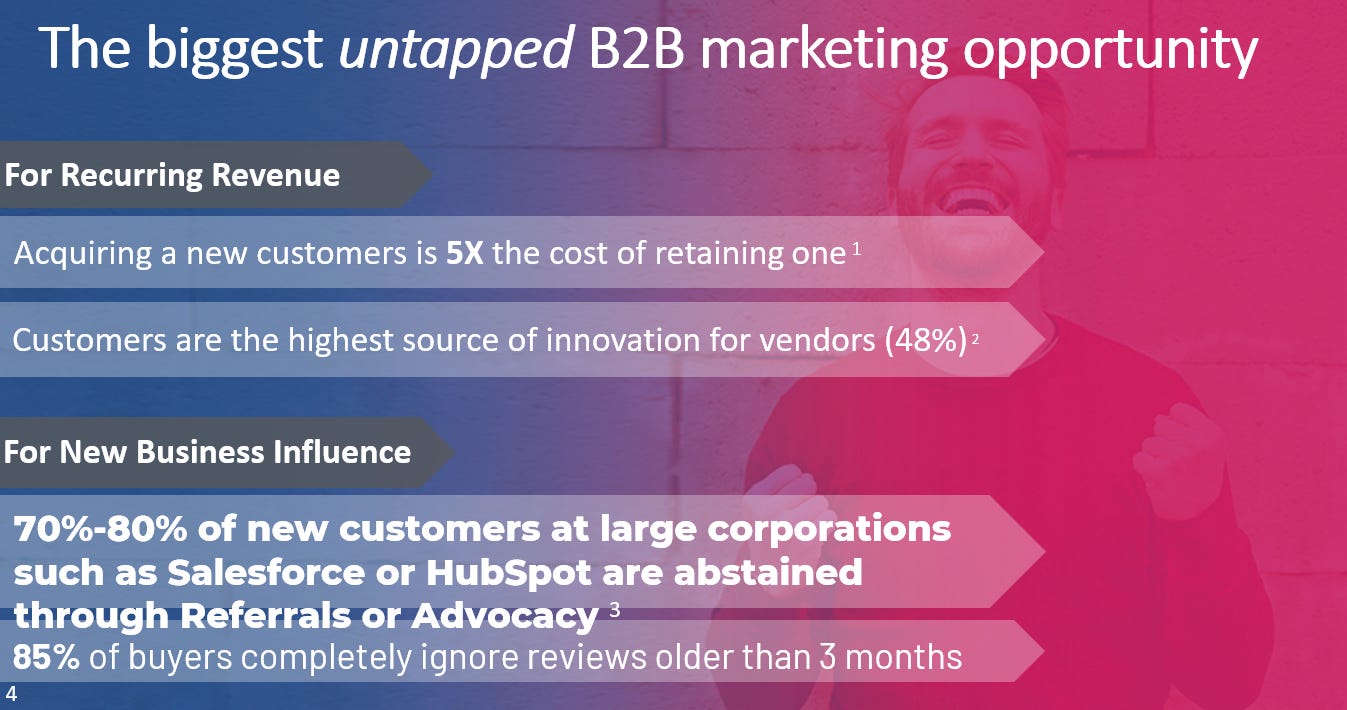

Market opportunity – before and after:

This is the slide Gal originally used – and which he now describes as ugly and ineffective: “The main problem is that it has too much information, and it’s all over the place. Every slide should convey a single message.”

Here’s how it looks like today:

A simple, single point, conveyed through a strong statement with strong evidence to back it up.

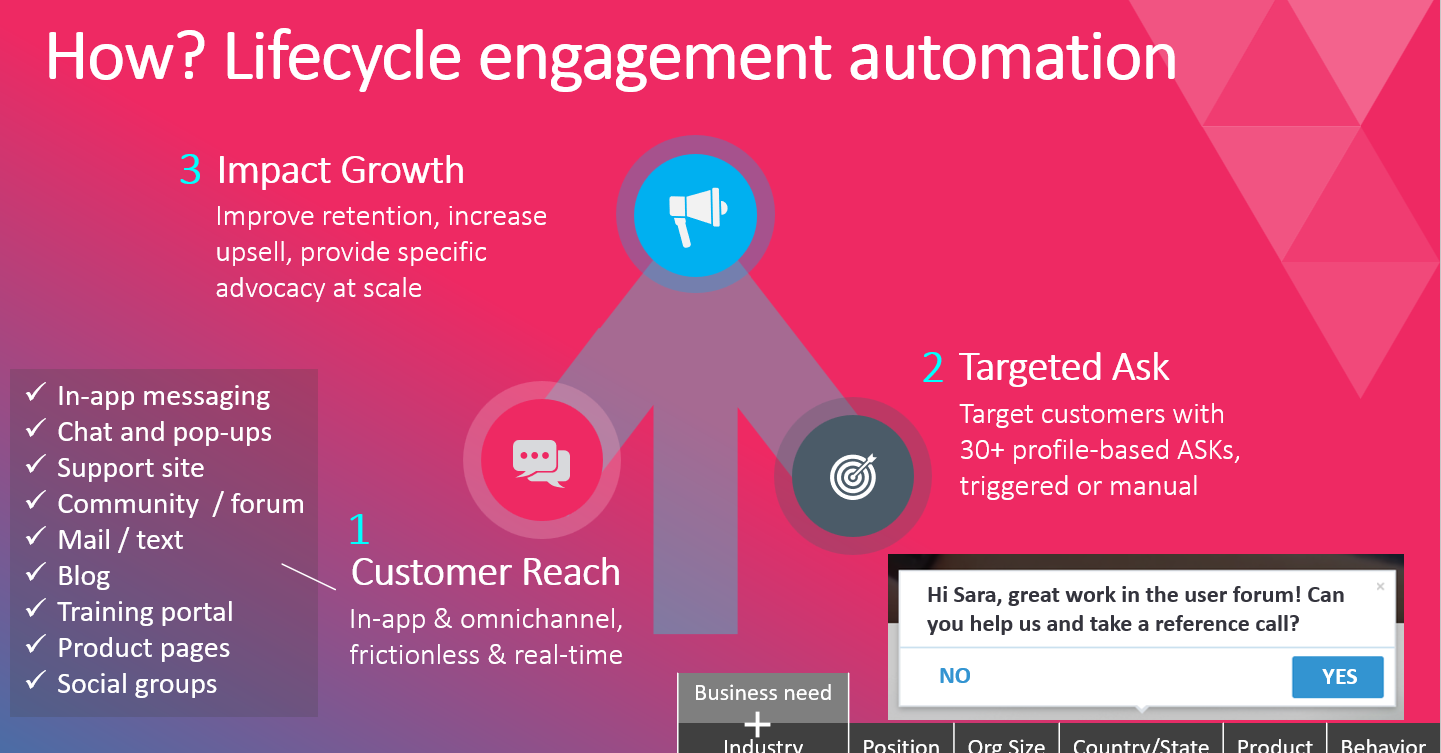

Product - before and after:

This slide suffers from many of the same problems as the first one: information overload, no clear overarching story, and design that looks outdated and visually unappealing.

The new version of this slide shows how Base’s product looks like in an actual customer’s environment (Powtoon). Investors can clearly see what the product does and what it’s meant to achieve, and also understand there’s an actual product that is already deployed in production.

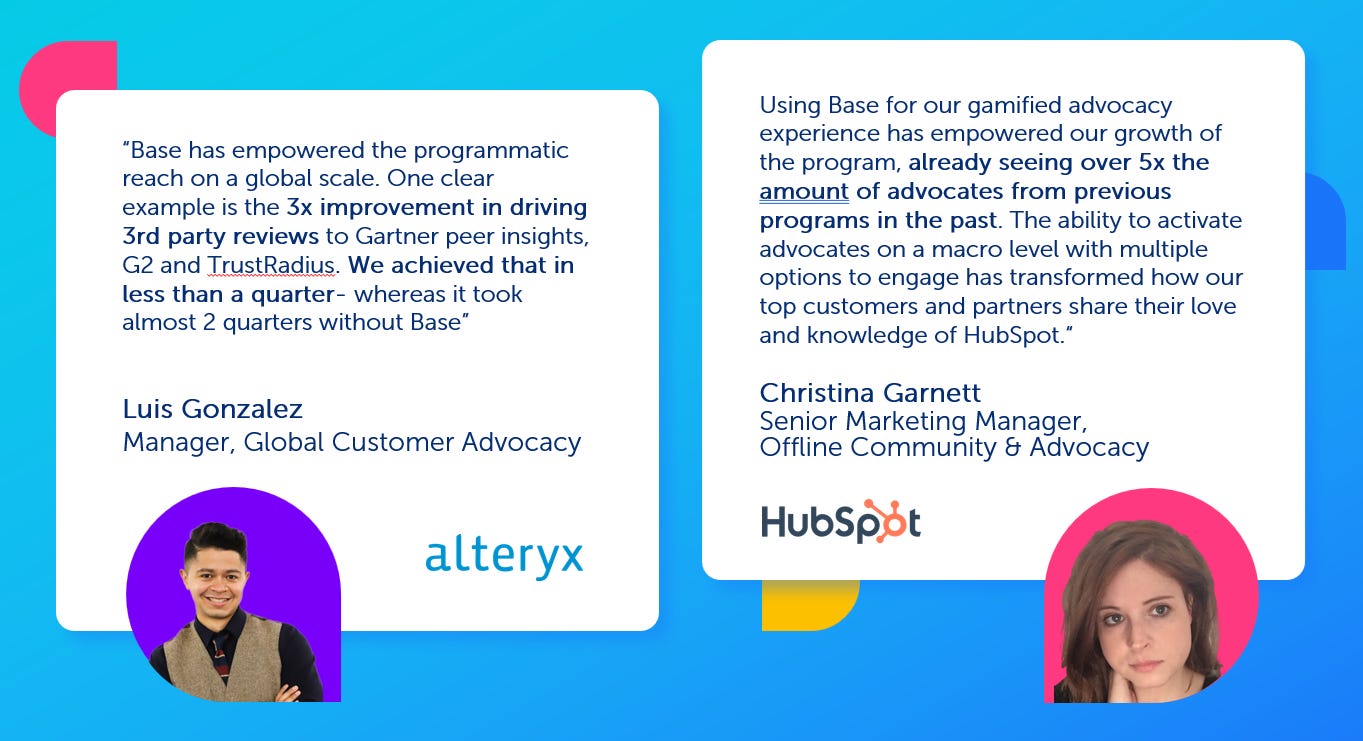

Customer proof

All the trust-building signals you need: big logos, photos of real people, and easy-to-understand quotes. (We’d try to shorten those a bit!)

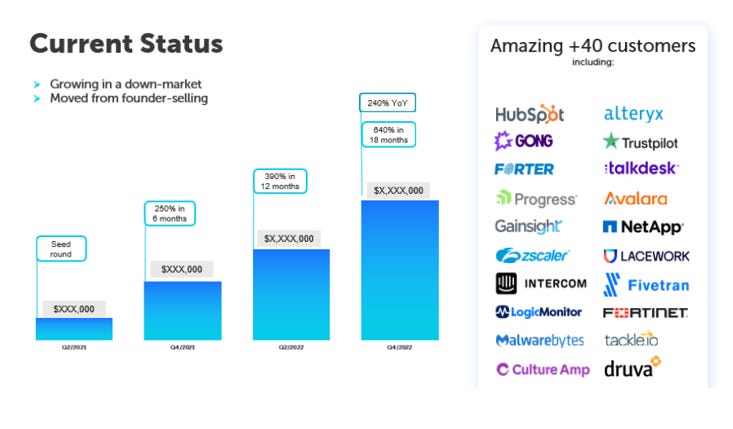

Momentum

A nice, clean slide showing traction. Keep it simple and show your strongest validation signals: in this case it’s revenue growth and familiar logos (if you have these, you don’t need much else). Note that the bar chart on the left is arranged by half-years rather than quarter or month: this makes it more digestible and removes unnecessary detail.

Team

Above is the version Base used to raise its Seed round - at that stage, there is barely any team and it’s all about the founders; below is the version used for Series A, where investors want to see who’s already on board.

In both cases, you want to highlight the strengths of each team member, their past experience, and how they compliment each other.

Managing the Process

No matter how heroic your first meeting is, it’s just the first step. If you’ve passed, there’s going to be a second and third meeting, technical due diligence, legal, and many other hurdles to overcome. Nothing is final until you have a signed term sheet – and in the meantime you’ll want to juggle the same process with multiple other investors.

Create FOMO

We’ve already mentioned that fundraising is essentially a sales process. And as any good salesperson will tell you, time kills every deal. You need to create a sense of urgency to propel the other side to move forward. Make sure they understand that there's something interesting and valuable at stake, and that they only have a limited time to act. Emphasize that your fundraising process has a timeline – perhaps a month or two, but not six.

If you have another investor that’s ready to give you a term sheet, say so. Name the other investor. You can bluff – within reason. If you're expecting a term sheet or have had productive conversations with other investors, it’s okay to slightly exaggerate; but remember that investors talk amongst themselves so don’t try to bullshit them. You want to create FOMO without resorting to deception to strengthen your position during the fundraising process, or to give interested parties the small nudge they need to get a move on.

Build momentum

You’re going to have at least six touchpoints with the investor you close with, spread out over a period of several months. You want to maintain a sense of momentum, progress, and growth throughout – and it’s equally important to communicate this to the investors you’re speaking with.

Gal Biran: Momentum was the reason I ended up receiving four term sheets in the same week. I timed it right, I reverse engineered it, I nagged the people I needed to nag to get an intro - and I kept showing investors the progress we were making as a company.

Momentum grows with small wins. Develop a bank of shareable ‘goodies’: updates on new customers, user growth, successful pilot projects – any milestones you can collect along the way. Sharing good news (such as through email updates) is an excellent excuse to remind investors you exist and keep them engaged.

Be strategic in how you dole out information: ration your good news and create a sort of ‘nurture campaign’ to keep investors excited about your progress, and remind them what they saw in you in the first place.

2023 Addendum: Fundraising During a Down Market

When money is a bit tighter - as is the case at the time of this writing - investors are more cautious. They’ll focus on health metrics that show your ability to preserve runway, rather than the growth-at-all-costs mentality that comes with cheap money. You’ll need to have good answers about your burn rate.

As we’ve mentioned – investors are thinking about the next round, not this one. In a down market, you can’t count on raising again in a year’s time; you need to explain what your trajectory is going to be in the next two years. Reverse engineer your plan from where you expect to be at the time of your next raise.

Keep in mind that benchmarks for what's considered reasonable or successful can change rapidly in a fluctuating economic environment. You want to keep your ears open to what other founders ar esaying, and adjust your pitch and expectations accordingly.

Closing Thoughts: It’s Always About the Next Round

With any luck, your first funding round is not going to be your last. In 12-24 months, you’ll need to do it all again – and it’s not necessarily going to be easier. Keep a close eye on what’s working and what isn’t, and document your learnings - every bad meeting or unanswered email should be an opportunity to improve and deepen your understanding of what makes investors tick.

You're likely to hear many. many "no's" before you hear a yes. Stay on track, keep your momentum going, and stay persistent until you get there.

This concludes the Fusion Masterclass! As always, we hope you found this episode useful. For more great content in the future, feel free to subscribe below; and as a reminder, all of our episodes are aslo available via Od Podcast.

Subscribe to Fusion VC

Fusion - Israel's top pre-seed platform. Invests $150k in ~20 startups/year. Acceleration in TLV, CA, NYC. Mentorship in hiring, sales & fundraising.