This serves as a follow up on an earlier review I made in 2020, back when it was still called Melon Protocol. Let’s get started.

Enzyme Finance is still the most advanced web3 asset management protocol to date. Yet there are ways to go before it becomes mainstream. Below I break down the gaps based on personal experience, having managed both traditional fund structures and vaults via Enzyme Finance smart contracts.

No compliant onboarding process

Enzyme Finance provides efficient operational rails for on-chain asset management but currently lacks a robust onboarding process. Compliance with financial regulations is crucial, particularly in highly regulated regions. Presently, multiple steps in the onboarding process, such as verifying an investor's details and approving the fund’s offering, are performed offline. Coordination is required at each step and all the way to proceeding with the whitelisting of an Ethereum address, another manual operation.

To enhance this process, Enzyme Finance could integrate Know Your Customer (KYC) and accredited status verifications in a more streamlined manner. This could be achieved through on-chain attestation services like EAS or similar platforms, leading to the automation of investor whitelisting. Such an improvement would allow Enzyme Finance to entirely replace traditional administrative functions, rather than just supplementing them.

Asset universe limitations

The asset options in Enzyme Finance are highly restricted, mainly due to its reliance on Chainlink as an Oracle. As of November 2023, a number of popular assets such as Rocket Pool (RPL) or Arbitrum (ARB) are completely absent from Enzyme’s tradeable options. This limitation is significant because it hinders the platform’s ability to offer a diverse range of assets.

More broadly, this restricts investment strategies and the ability to differentiate funds. Exploring other blockchain ecosystems, like Cosmos, could broaden the asset pool, but this requires careful security considerations, especially in light of past incidents involving unsecured bridges between blockchains.

Redemption challenges

Path 1: easy for the manager and inconvenient for the investor

Redeeming shares in kind is the easiest path for the manager, as the investor agrees to receive all the assets in the fund’s portfolio proportionally to their shares. In this case, the fund's ending allocations remain unchanged. However, more often than not, investors do not want to manage all the different assets afterwards (questioning the purpose of the fund). This is when the alternative and more likely path becomes complicated.

Path 2: easy for the investor and inconvenient for the manager/fund

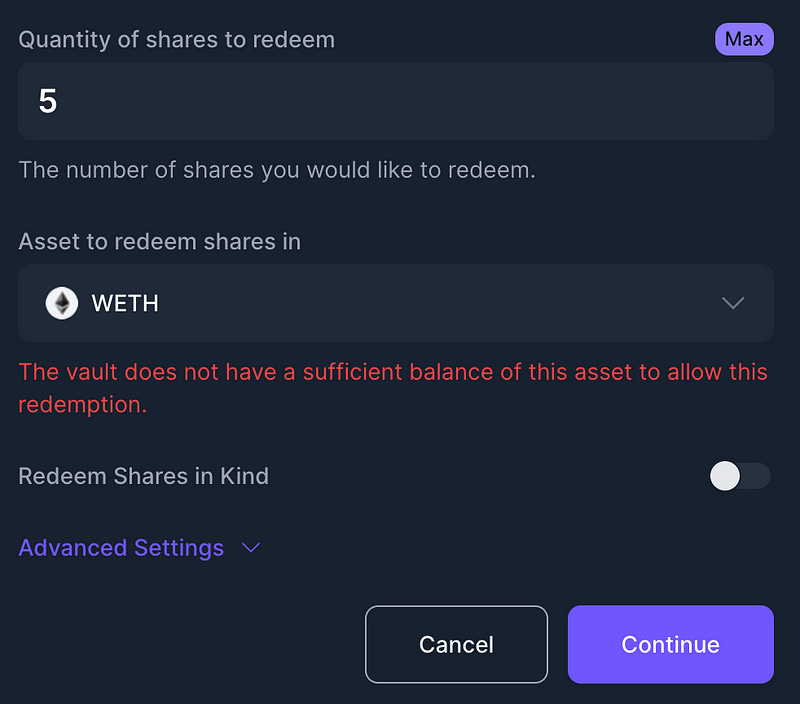

Selecting a specific asset for redemption is the alternative. This redemption process is cumbersome and in need of refinement. If the portfolio is well diversified or fully allocated at that time, there's a high likelihood that the necessary balance is insufficient, leading to errors in the process. Conversely, if there is a sufficient balance of the desired asset, it naturally creates an imbalance in the portfolio.

This process often requires manual coordination between the investor and the manager, potentially leading to temporary portfolio imbalances. An ideal solution would be an automated system that maintains portfolio allocations while facilitating real-time liquidation of assets during redemption.

Inadequate activity data

Tracking and reporting are crucial for any asset management platform for various reasons, including providing readable data to investors, aiding third-party service providers, and facilitating tax calculations. However, there are some key features that are currently lacking in this aspect;

No NAV data for specific events

While Enzyme Finance runs subgraphs to provide 24/7 NAV reporting in real-time, it seems there are limitations in providing NAV for specific transactional events. This deficiency could require users to manually consolidate data, which is a time-consuming and error-prone process. For instance, there appears to be no direct way to crystallize events like subscriptions or redemptions for regulatory purposes without additional manual calculations;

In cases where the amount of shares being redeemed and the total currency given for them are known, NAV can be calculated by dividing the two (Amount/Shares Redeemed = NAV). However, this remains a manual process that needs to be performed on a per-event basis. And although the main dashboard tracks NAV daily, it does not do so at specific event times.

No export capabilities

Furthermore, Enzyme Finance may lack robust data export capabilities. Users might need to manually consolidate these activities in an appropriate document, a task that could be significantly time-consuming. They might also resort to using third-party tools or accounting software to view and export the activities.

Additionally, most crypto tools might not fully understand the transaction types configured within Enzyme smart contracts, necessitating a consolidation exercise. Therefore, it is crucial for Enzyme Finance and its community to enhance these features, allowing institutions to more effectively manage a vault throughout its full lifecycle.

Acknowledging progress and security

Following was a brief Q&A with Avantgarde Finance in 2020, the main developers and maintainers of Enzyme Finance. I’d like to end this review with a few positive notes since that time;

Various audits have been performed, and continue to be performed on a regular basis as promised, even more so before major release.

Enzyme Finance remains one of the only early project (2016 ICO) that has never been hacked. Action speak louder that words here.

Compared to the first version of the Enzyme UI, the manager and experience is a breath today, as well as that of the manager.

Intro: No custodian needed, all the assets are held in smart contracts and have trading permissions for the manager only. Investors are responsible for the security of their own ethereum wallet.

Q: Are the contracts audited? If so could you send the reports? If not, why and what are your plans in this regard?

A: Two audits completed as of Dec 16th, and another one is on the way. The aim is to constantly audit the new developments.

Q: Is there any insurance or recovery policy? How can you or your managers reassure the investors about the safety of the funds?

A: Not yet but maybe coming with the recent smart contracts developments on insurance.

Q: How many assets there are, and will there be the possibility to have smaller projects onboard?

A: More assets coming on eth, cross-blockchain assets is a possibility, but not before 2021.

Q: How do investors subscribe and redeem?

A: They will be able to do it directly from the website in the coming version.

Conclusion

We summarize here what we think should be high priority items for Enzyme Finance to be considered more seriously in the asset management industry.

Integrate attestation services for investor verification, thus ensuring compliance without sacrificing the decentralized nature of the platform.

Proactive exploration and testing of new technologies could position Enzyme for future expansion.

An automated system that maintains proportional allocations and executes immediate asset liquidation during redemptions would enhance efficiency and uphold portfolio integrity.

Enzyme should develop solutions to provide comprehensive, real-time activity data, compatible with common financial tools.

Despite these gaps, Enzyme Finance has shown considerable progress since its inception. Regular security audits and a history of avoiding major hacks since its 2016 ICO are commendable. The improvements in the user interface and management experience since 2020 highlight the platform’s commitment to growth and user satisfaction.

10102 Etherbase Vault

10102 Etherbase Vault symbolizes our strategic initiative to invest in the fundamental components of Ethereum for the long-term. This fund is rooted in the core principles of Ethereum, embodying a forward-thinking approach to blockchain investment.

Contact Us

For inquiries or document requests, please reach out to us at info@10102.io.

Note: Participation is open to US accredited investors only.

Our Team

10102 Etherbase Vault is managed by 10102, a team dedicated to futuristic blockchain research. 10102 previously managed Tokenpot Capital (2015-2019).

Subscribe to 10102 Insights

Crypto insights by 10102