Disclosure: This is not financial advice, and is intended for sophisticated professional investors and company executives. This is a thought experiment of how two publicly traded companies could potentially create value in a hypothetical transaction via industrial specialization and financial engineering, inspired by similar transactions. I am personally long shares of Green Thumb (OTC: GTBIF) and Agrify (Nasdaq: AGFY) as of January 2, 2025, both of which are volatile and illiquid. I make no promise to update my holdings or ideas. Do your own due diligence, I am not responsible for any errors or omissions, and remember any long equity investment carries the risk of 100% loss. As of January 2, 2025, I resigned as the Director of Research of Excelsior Equities, and remain merely passive shareholder. This post represents my personal views and not those of Excelsior Equities. I know of no conflicts of interest between GTI/Agrify and Excelsior Equities.

Green Thumb Industries (GTI) surprised investors in November 2024 with the deft investment in nearly bankrupt Agrify and a quick purchase of a hemp derived THC drink brand Senorita that basically turned Agrify into a Nasdaq-traded venture/acquisition vehicle.

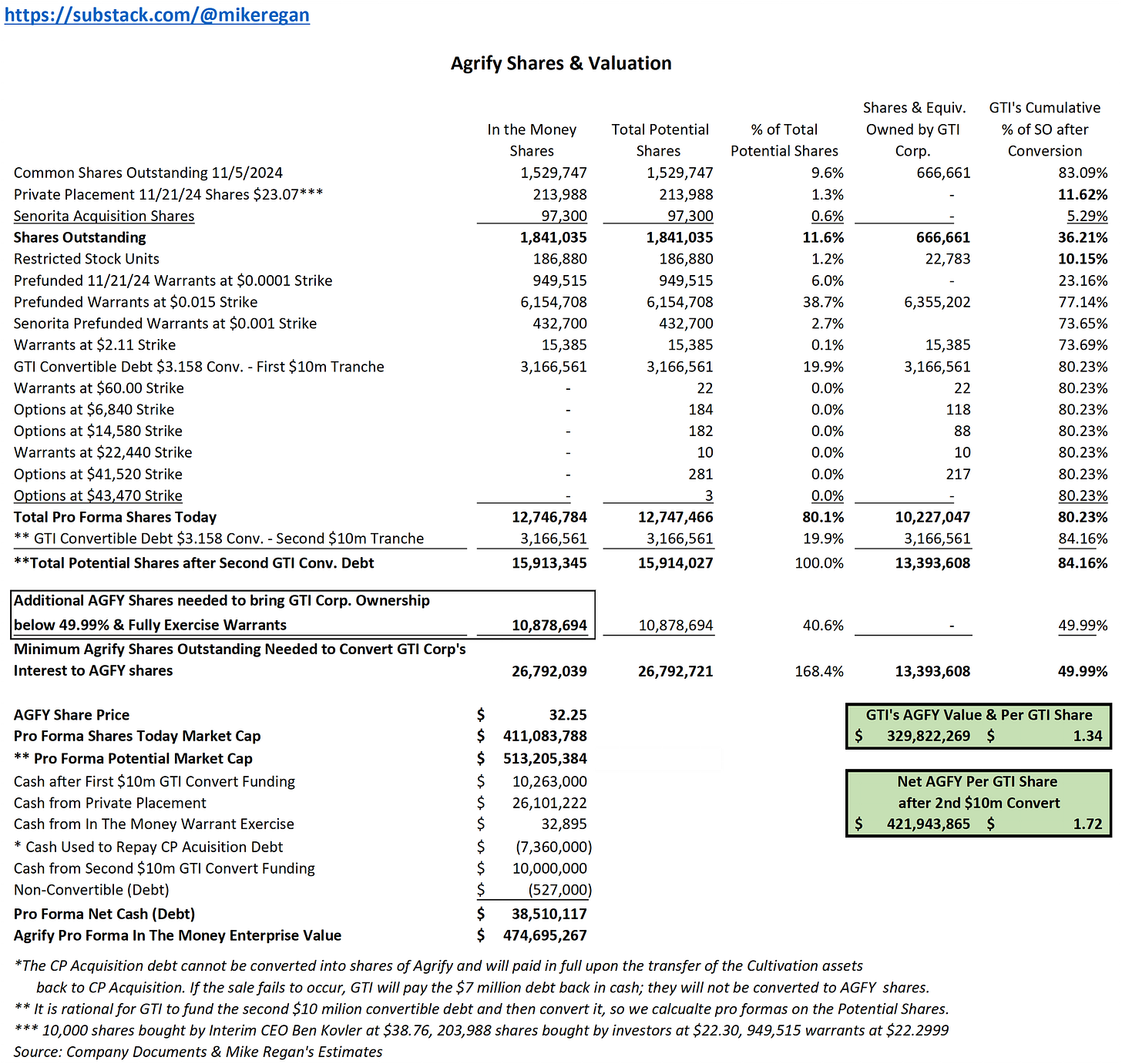

Agrify raised $26 million in a private placement at $22.30 (yielding a $355 million pro forma valuation) and now has a $411 million pro forma market cap at $32.25 (and $513 million assuming GTI rationally funds the second convert tranche). The market is baking in a lot of growth, as it only has maybe $11 million of current run rate revenue (

has a good summary here of the challenge for Agrify to grow into its valuation, focusing primarily on hemp drinks, which thinks will grow to $1 billion in retail sales in 2025 from maybe $384 million in 2024).GTI Corporate owns about 667k shares and another pro forma 12.7 million share equivalents via penny warrants and way in the money convertible debt, but it cannot convert its interest into shares unless it owns less than 49.99% of Agrify shares outstanding. With 15.9 million pro forma shares and equivalents (including the second $10 million convertible tranche at $3.158 which is a no-brainer for GTI), getting GTI’s total 13.4 million shares and equivalents below 49.99% would require Agrify to have at least 26.8 million shares, or issuing another ~11 million AGFY shares either to the market via sale or as consideration for an acquisition. At January 2, 2025 closing prices, GTI’s Agrify position is theoretically worth $1.72 per $8.19 GTBIF share.

Building out Senorita could take a while and the market is not currently liquid enough to sell $315 million worth of new Agrify shares.

Can GTI find a single $350 million acquisition at a $864 million pro forma valuation to fully realize its Agrify value? I see one acquisition candidate of assets that GTI already knows intimately.

How about a John Malone style spinoff of GTI’s Brands to Agrify, Separating the IP from Ops like Coke and its bottlers?

In this hypothetical transaction, Agrify would buy the GTI Brands through a pro-rata share distribution to all GTI shareholders. Like a dividend or a tracking stock distribution, GTI shareholders would receive Agrify shares representing the brands they already owned in GTI, and shareholders could then buy or sell either GTBIF (Operations) or AGFY (Brands) shares as they see fit.

Agrify BrandCo would license the brands back to GTI OpCo for a license fee based on GTI OpCo’s revenue, giving Agrify BrandCo substantial ($50-150 million) a base of revenue to support the current valuation and fund additional marketing and hemp drink expansion.

The industrial logic is similar to what The Coca-Cola Company Inc (NYSE: KO) figured out over 120 years ago: separate the brands from the ops. KO owns the trade secret syrup recipes, focuses on advertising the brands, and sells syrup to over 68 regionally owned and managed capital-intensive operationally focused bottlers who may also bottle non-Coke drinks (eg Coca-Cola Consolidated (Nasdaq: COKE) also bottles Dr Pepper and Monster).

The financial logic is like John Malone’s 1991 separation of underappreciated cable channels Discovery, AMC and BET from TCI into a new company, Liberty Media, to highlight the channels’ asset-light branded businesses value. Though TCI’s scale allowed Malone/TCI to invest and support the upstart channels in the first place, the channels’ value was not realized when the market focused only on the more capital-intensive cable businesses with more uncertainty on new competition and regulatory change, and comped the TCI buisness to smaller cable operators who didn’t own channels.

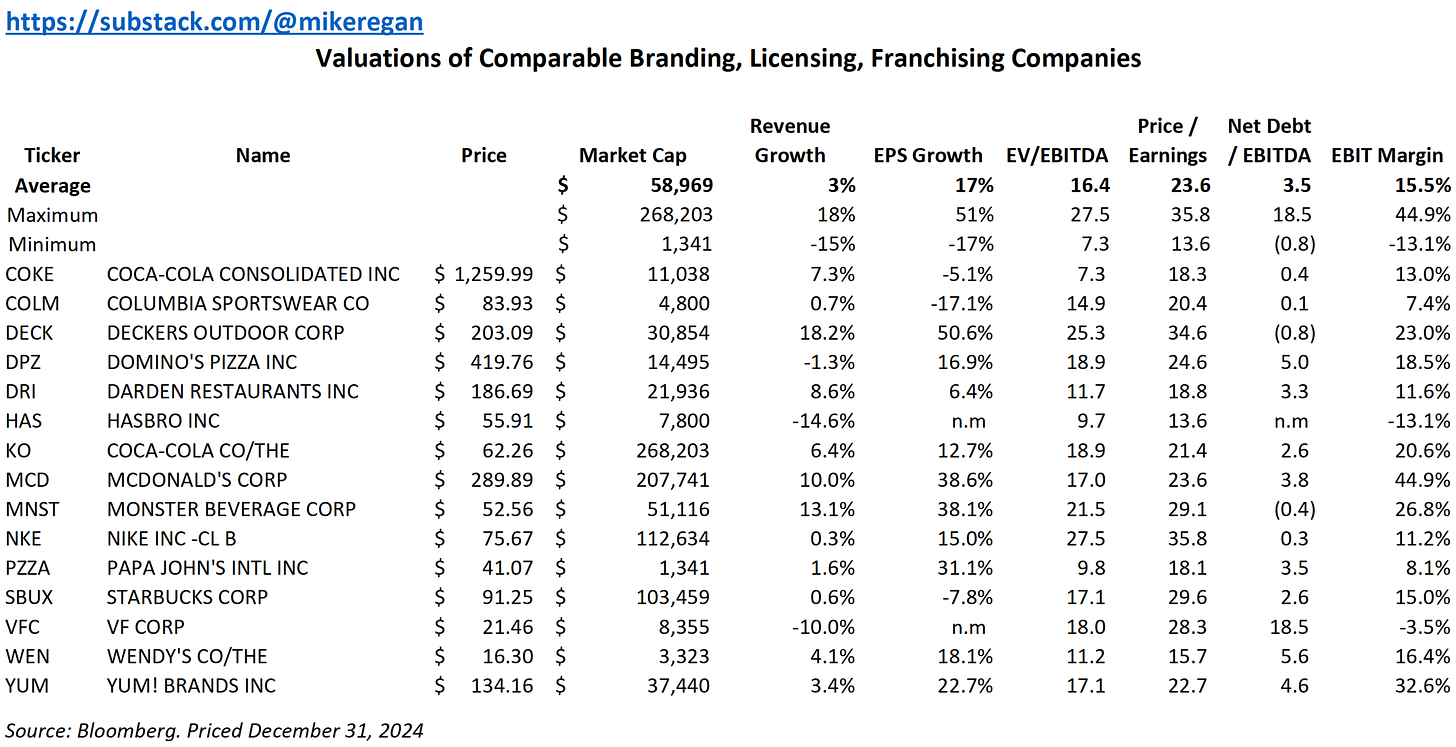

With GTI trading at 5-6X EBITDA and branded CPG companies trading at 16X EBITDA and 24X Earnings, the market is ignoring the value of the GTI brands in GTBIF.

This transaction would make Agrify BrandCo an asset-light, Nasdaq-traded, fully legal, normal tax paying, high net margin, positive net income stock akin to many other branded consumer franchising companies that currently trade at 24X Price/Earnings and 16.4X EV/EBITDA – but would be unique in that it would provide direct fundamental exposure to the secular trend of increasing US legal cannabis consumption in a more regulatory-agnostic way. If Agrify BrandCo could successfully license brands outside of GTI OpCo, then it would also be a growth stock.

The transaction would also allow GTI to convert its corporate-owned 12.7 million AGFY share equivalents into normal AGFY shares, making them more liquid and more “real” so they can be valued as a non-operating asset by currently skeptical investors - or with enough volume, even sold to raise cash for other GTI OpCo uses. Of GTBIF’ $8.19 share price, $1.34-$1.72 is its Agrify investment, but many investors don’t ascribe the full value since they cannot justify Agrify’s market cap on current operations nor see a path to liquidity (both of which this transaction would do).

New branded consumer package good institutional investors currently have no interest in OTC traded state-legal but federally-illegal cannabis stocks but might be interested in a Nasdaq traded branded CPG stock, improving price discovery and liquidity for Agrify, and generating cash for GTI if it chooses to sell its AGFY shares.

Operationally Like Coca-Cola Inc and its Bottlers: Ads vs Ops

Operationally, Agrify BrandCo would expand the GTI brands to new customers beyond GTI’s current states, without any new capital investment or incremental industry capacity by GTI, by licensing the brands (RYTHM, Dogwalkers, Incredibles, Beboe) to other state-licensed marijuana operators, hemp operators, and RISE to dispensary owners, and branded general merchandise to more mainstream retailers (think RYTHM and Dogwalkers hoodies in stores like Macys, which sells Cookies merchandise).

Agrify BrandCo could also invest more in advertising and marketing with a scale advantage for both GTI OpCo and its the brand franchisees (which is the incentive for those operators to franchise; just like “McDonalds” may sell more than a single generic “Mike’s Burgers”, perhaps a “RISE” dispensary would sell more than a single generic “Mike’s Dispensary”).

This follows GTI CEO’s Ben Kovler’s long term vision and strategy of GTI: management has always viewed GTI as a builder of long term cannabis brands and has often said they their brands are “worth a billion dollars”.

The lack of a mature cannabis supply chain and patchwork of state markets with no legal interstate forced GTI into vertical integration in the state-legal cannabis industry for the last 10 years. The long-term goal of GTI has always been to sell their brands to as many customers as possible, and look more like a CPG co with packs of Dogwalkers sold in as many retailers as possible (gas stations, convenience stores, dispensaries, etc.). As more states have adequate-to-excessive cannabis capacity, the GTI brands can reach more customers by working with existing well-run cultivators vs. GTI OpCo securing licenses and adding capacity across more legal states.

It’s not just Coke that deverticalized: most mature industries show that vertical integration is usually not the ideal structure longer term. Ford was forced to own its supply chain all the way to raw materials in a Model T (eg iron mines, forests, glass works, even sheep), because of shortages during World War 1, but now it designs and markets trucks assembled from dual-sourced parts. Altria doesn’t grow tobacco, Starbucks doesn’t grow coffee or own all of its stores, McDonalds doesn’t raise cattle or own all of its stores, and Apple designs but does not actually build its phones. If there was a bizarre separate tax structure like IRC 280E on hamburgers vs. french fries, all McDonalds would be franchised and there would be some kind of tax efficient MeatCo / FryCo structure.

The base GTI brand licensing revenue at Agrify BrandCo revenue can also fund expanding Senorita and other potential hemp drinks, and may make Agrify BrandCo shares more attractive to potential hemp drink targets as acquisition consideration by giving a more solid valuation foundation.

Operationally, GTI OpCo would benefit from increased marketing spend that is spread amongst more franchisees likely leading to either/both pricing power and/or market share gains. Marketing expense may also effectively become tax deductible under 280E by converting what would have been marketing spend at GTI into a COGS license fee at GTI OpCo (though confirm this with an accountant). As noted by GTI management in their November 7, 2024 3Q24 call, GTI is planning to reduce EBITDA margins below the historical target of 30% in 2025 to invest in its brands; this transaction would do exactly that by incurring a licensing fee to Agrify BrandCo.

To be perfectly clear, neither GTI nor Agrify have announced or even mentioned anything like this transaction, with management stating only that their investment in Agrify “provides optionality” with many potential paths to create value. This transaction is purely my speculation based on years of experience investing, connecting disparate dots into coherent narratives, and seeing similar deals done, especially in media/telco (more on that in a future post).

I never in a million years expected Kovler & Co to remake Agrify into a Nasdaq acquisition vehicle, so they may have something more interesting than this up their sleeve.

So What’s the Math?

While I have a built a detailed transaction model for myself, I will not share it on a free Substack.

But I will share that generally the math works under most scenarios, as at the end of the day this transaction is pretty simple: it would basically shift a sizable portion of GTI’s EBITDA valued at about 5X and taxed at 21% of gross profit into a brandco (Agrify) that could be valued at ~15-20X EBITDA and 20-30X Earnings with normal taxation, and then grows those earnings with additional high margin licensing revenue. That should create value.

Again, please remember that all the numbers below are driven by guestimates about a hypothetical business after a hypothetical transaction unprecedented in this industry, based only on comparable business models and industry practices mostly from other sectors (but there are a few precedents and rules of thumb for licensing in cannabis). Changes in franchising fee rates can impact these significantly.

Assuming no multiple expansion at GTI OpCo, the net change in the total equity market caps of GTI OpCo+AGFY BrandCo on day one could be $150 million, assuming the market pays 21X Earnings for Agrify BrandCo (a 10% discount to branded CPG comps and the same 5X EBITDA for GTI OpCo), and no additional franchising revenue at Agrify BrandCo. This is the financial engineering portion of the return. Any multiple expansion at GTI OpCo is incremental to this return.

A base case could see a net increase in total equity market cap of GTI OpCo +Agrify BrandCo of $715 million, assuming Agrify BrandCo can successfully license the brands to other operators and still trade at 21X earnings, while GTI OpCo is unchanged and still trades at 5X EBITDA. This adds the operational return component.

A bull case could see an incremental $3 billion total equity market cap, assuming Agrify BrandCo trades at 30X earnings and is more successful franchising the brands to non-GTI operators, and the added marketing drives higher GTI OpCo revenue as well, but again GTI OpCo still trades at 5X EBITDA.

Bear case is a total market cap decline $530 million as GTI OpCo revenue declines, Agrify BrandCo fails at franchising, and Agrify BrandCo gets valued at 12X PE and GTI OpCo continues at 5X EBITDA. This negative scenario would also like weigh on the valuations regardless of this transaction taking place, however.

Again, I have outlined the concept, but do your own math with your own assumptions and due diligence. You may come to a different conclusion. I may have also made a mistake somewhere.

Risks: Market Still Doesn’t Care About Cannabis

A key risk on the financial engineering aspect is that the market may not value Agrify Brandco at a higher multiple than GTI, viewing both with disdain as dead money cannabis stocks. But then again, that would apply to GTI as well, and so far there are no new investors in cannabis, so I don’t see what there is to lose.

Or maybe the market only wants to invest in pure-play hemp drinks, and would view the inclusion of revenue supported in part by traditional legal cannabis brands as a negative to the valuation of Agrify story and valuation. This is similar to the “market just hates cannabis” risk.

However, if the spin doesn’t create value as intended or things change, the companies can always just re-merge the brands, since they are both controlled by Kovler & Co. Liberty Media re-merged back with TCI and then was spun out again in the AT&T acquisition of TCI, along with TCI (Liberty) Satellite, and Liberty Media spun out and remerged a bunch of Liberty spins over the years like Liberty Global, Liberty Digital, etc.

While GTI has excellent interest coverage of its new $150 million credit facility and would still have under 1X credit facility debt/EBITDA in the GTI OpCo scenario, GTI might still need approval from its lenders for this transaction. Obviously I would expect GTI management to figure that out before announcing such a transaction.

There is a risk that the Nasdaq could view revenue based on a percentage of cannabis sales as “plant touching” and force Agrify to delist, but again I doubt the companies would pursue this transaction if that was the case. This concern could also be easily rectified by shifting to a fixed franchise fee adjusted periodically (monthly, quarterly, or even annually) that would still approximate the desired percent of sales over time while not being directly tied to sales. This is in part why Weedmaps (Nasdaq: MAPS) never entered the payment processing business as Nasdaq considers revenue directly driven on a % basis cannabis as “plant touching”, but does not mind Weedmaps adjusting advertising fees charged to its dispensary clients monthly as the clients’ sales fluctuate.

Nasdaq also explicitly approved Silver Spike Investment Corp’s (now Chicago Atlantic BDC (Nasdaq: LIEN)) business model of lending against cannabis cash flow when SSIC went public, so between the two precedents there should be ways to manage a Agrify BrandCo licensing fee correlated to revenue while remaining on Nasdaq.

Could GTI just franchise its brands itself?

Yes, GTI could indeed just franchise its brands in new markets to other operators without first transferring them to Agrify (and that would be an additional growth avenue most investors have not considered in their valuations), but it may not gain the valuation expansion of branded CPG vs cannabis. If that incremental franchise profit is valued at 5X EBITDA at GTI and 21X Earnings at Agrify, then then spin makes sense; if GTI sees multiple expansion or the market wants Agrify as a pure play hemp drink stock, then the spin doesn’t make sense.