Contributions from Brian Gierke and CME Group.

For decades, LIBOR served as the backbone of global financial markets, setting benchmark interest rates for everything from corporate loans to complex derivatives. But its downfall—triggered by manipulation scandals and a lack of real transaction data—forced regulators to find a more reliable replacement. Enter SOFR, the Secured Overnight Financing Rate, a benchmark rooted in actual market transactions rather than estimates from banks.

Unlike LIBOR, which reflected unsecured interbank lending rates, SOFR is based on overnight borrowing costs in the U.S. Treasury repurchase (repo) market. This shift eliminated the credit risk embedded in LIBOR and created a nearly risk-free benchmark. However, the transition was far from seamless. Financial markets had to adjust to a backward-looking, collateralised rate rather than a forward-looking, credit-sensitive one. Institutions faced challenges in pricing loans, swaps, and futures, leading to the development of term SOFR and spread adjustments to bridge the gap.

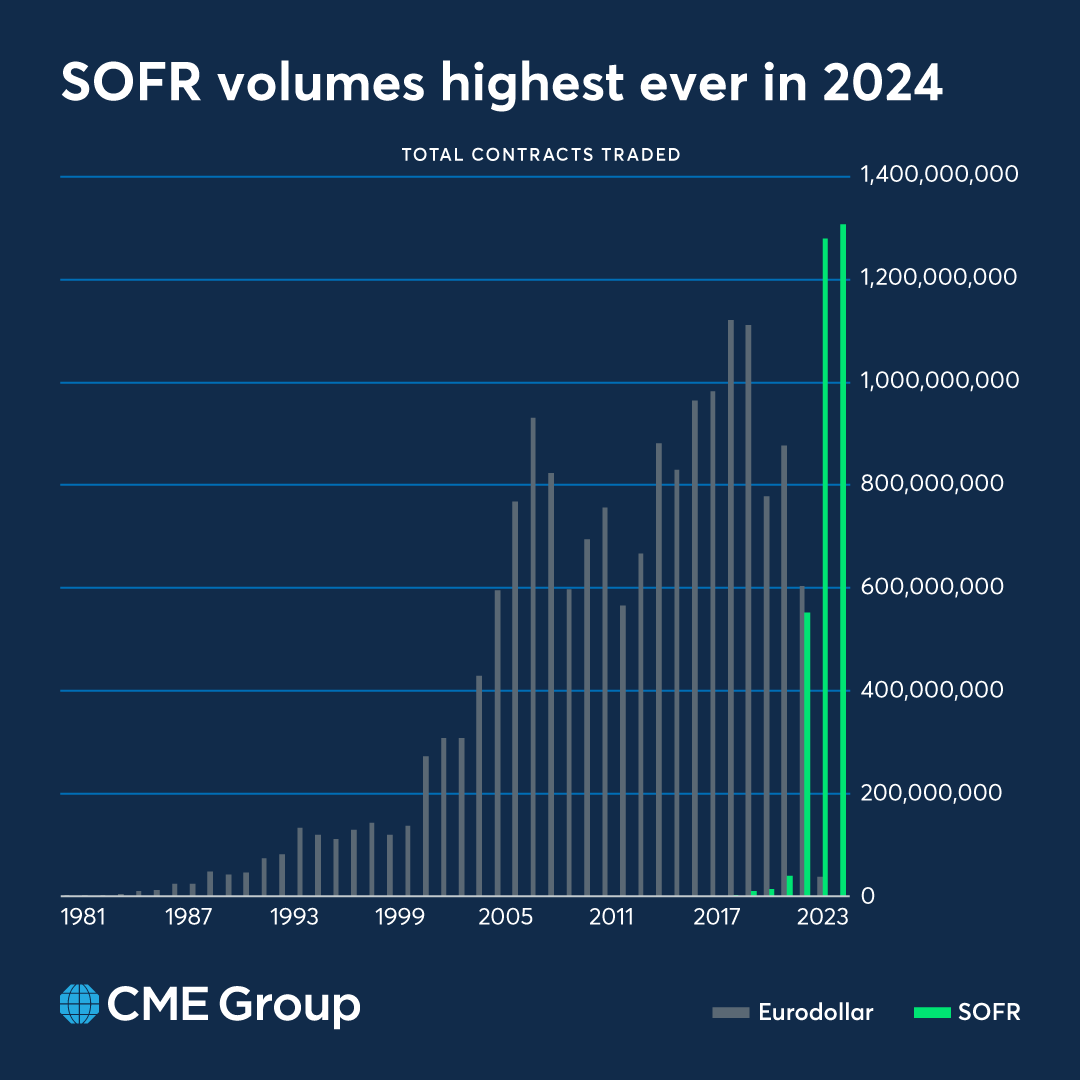

Despite initial hurdles, SOFR has now become the dominant USD benchmark. Futures and options tied to the rate have replaced Eurodollar contracts, and the derivatives market has adapted to its unique characteristics. The transition marked one of the largest shifts in financial history, reshaping how interest rates are traded, hedged, and managed.

SOFR trading is critical to Short-Term Interest Rate (STIR) trading, where traders focus on interest rate derivatives tied to short-term funding rates. The following guide explores SOFR and STIR trading in depth, covering the overview and participants in rate markets, the derivative securities and trading strategies employed across markets.

Overview of SOFR and STIR Trading

SOFR Basics: A risk-free rate based on overnight Treasury repurchase agreements (repo transactions). Since it is backed by high-quality collateral—U.S. Treasuries—SOFR is considered a nearly risk-free rate, eliminating the credit risk component embedded in LIBOR. This fundamental difference significantly affects how interest rate derivatives, loans, and financial instruments are priced and traded in modern markets.

STIR Markets: Includes futures, options, swaps, and repo transactions tied to SOFR or other short-term rates (e.g., EURIBOR or SONIA, the rate markets for the euro and sterling).

Key Players: STIR markets, including SOFR futures, options, and swaps, attract a diverse range of participants, each with different objectives. These markets provide liquidity, risk management tools, and trading opportunities that appeal to both financial institutions and corporate entities.

- Hedge funds and proprietary trading desks are active in STIR markets for speculative opportunities, arbitrage, and yield enhancement strategies. They trade STIR futures and options to bet on Federal Reserve policy changes, engage in relative value strategies (e.g., SOFR vs. Fed Funds spreads), and capitalise on market dislocations. High-frequency trading firms are also involved, providing liquidity and exploiting short-term inefficiencies.

- Banks use STIR markets primarily for risk management, funding, and market-making. Since they provide financing through repo markets and are exposed to interest rate fluctuations, they use SOFR futures and swaps to hedge their own balance sheet risks.

- Large institutional investors, such as pension funds and asset managers, use STIR derivatives to hedge interest rate risk in their fixed-income portfolios. Since short-term rates influence the broader yield curve, managing exposure to front-end rate movements is crucial for long-term investment strategies.

- Central banks monitor and sometimes intervene in STIR markets as part of monetary policy implementation. They assess liquidity conditions, interest rate expectations, and the effectiveness of policy transmission through the short-term rate complex.

Market Growth: CME Group’s Three-Month SOFR futures are among the most actively traded contracts globally, offering deep liquidity and efficient execution.

Innovations of Interest Rate Trading Over the Past 40 Years

Interest rate trading has undergone significant transformation since the 1980s, shaped by technological advancements, economic events, regulatory changes, and the introduction of new financial instruments. Key innovations include:

Expansion of Interest Rate Derivatives (1980s–Present):

- Futures and Options: Eurodollar futures and Treasury futures/options emerged, enabling hedging and speculation on interest rates.

- Interest Rate Swaps: The swap market expanded, allowing the exchange of fixed-rate and floating-rate debt. Swaptions became vital for hedging and speculating on risks. The transition to SOFR-based swaps followed LIBOR’s phase-out.

Electronic Trading and Market Structure (1990s–Present):

The rise of electronic trading platforms shifted from voice to digital execution. High-frequency trading (HFT) increased liquidity in quiet markets but has led to less liquidity in times of stress, while central clearing of swaps was mandated to minimise counterparty risk. Something that continues to be ongoing—a reduction of the algos in times of stress reduces liquidity. This is relevant to the use and placement of stop-loss trades to manage risk in high-vol regimes, such as data releases or surprise Fed actions.

Impact of Economic Events:

- Events like Black Monday (1987) and the Global Financial Crisis (2008) prompted regulatory changes and innovations in risk management.

- The COVID-19 pandemic led to unprecedented monetary policies, influencing interest rate derivative pricing. From FOMC support with lower yields and increased liquidity as a backdrop to fiscal mistakes in Congress leading to an overly inflationary environment. We are seeing the beginnings of this currently as we shift from Bidenomics to Trump tape bombs. This shift is rather dramatic and will offer both risk and opportunities as the market gets it barring.

New Products and Strategies:

- The shift to SOFR, options, swaps and inflation-linked bonds provided new hedging avenues.

- Algorithmic and quantitative strategies gained traction, with AI and machine learning beginning to be utilised for macro predictions and fixed-income ETFs enhancing access to rate-sensitive assets offering additional tail risk potential. Just as a market maker needs to trade the underlying to hedge the book, ETF managers must do the same.

The Future Outlook:

Interest rate trading will continue evolving with technological advancements, including the potential for tokenisation or blockchain of fixed income and increased automation. Despite these innovations, human behavior remains a crucial factor in trading dynamics, influencing decisions through cognitive biases and market psychology.

SOFR Derivatives and How They Trade

A robust derivatives market has developed around SOFR. These instruments allow traders and institutions to hedge risk, speculate on interest rate movements, and engage in arbitrage strategies. The key SOFR derivatives include futures, swaps, options, and basis trades, each serving a distinct role in managing exposure to rate fluctuations. Liquidity has deepened significantly, particularly in CME-listed SOFR futures, making them the cornerstone of short-term rate trading. Below is a breakdown of the main SOFR-based instruments and how they are used in the market.

SOFR Futures:

- Three-Month SOFR Futures (CME) are the most liquid, used for hedging rate expectations and speculation. Traders often pair SOFR futures with Fed Funds futures to express views on monetary policy.

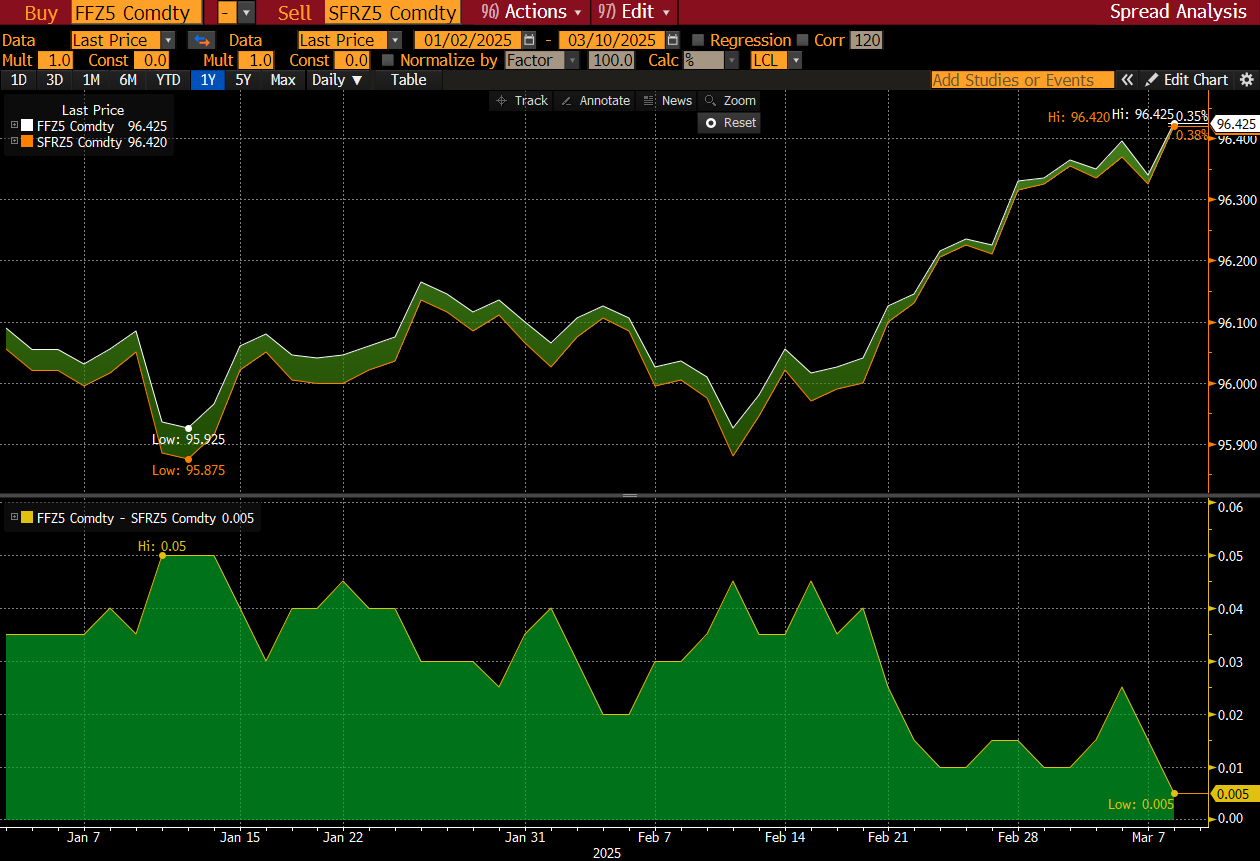

- Pricing: SOFR futures generally trade as a quote of 100% less the interest rate (taking the IMM Index form). If interest rates were 4.50 %, the futures would be quoted as 95.50. At the time of writing, the Z51 (Dec. 2025) contract is currently 96.3250, indicating a December pricing of rates at 3.675% (see chart below).

- Sizing: 1 basis point = $25. Gains or losses on a contract position are calculated simply by determining the number of interest rate basis points (“bps”) by which the contract price has moved, then multiplying by the value of one bp per contract. As with Eurodollar futures, each basis point of contract interest is worth $25. Thus, SFR contract size is $2,500 x the contract IMM Index.

SOFR Swaps:

- Used to hedge floating-rate exposure or speculate on interest rate movements.

- Standardised Overnight Index Swaps (OIS) allow traders to exchange fixed payments for SOFR-linked floating payments.

SOFR Options:

- Includes caps, floors, and swaptions for hedging or trading rate volatility.

- Volatility traders use options strategies like straddles and strangles when expecting large rate swings.

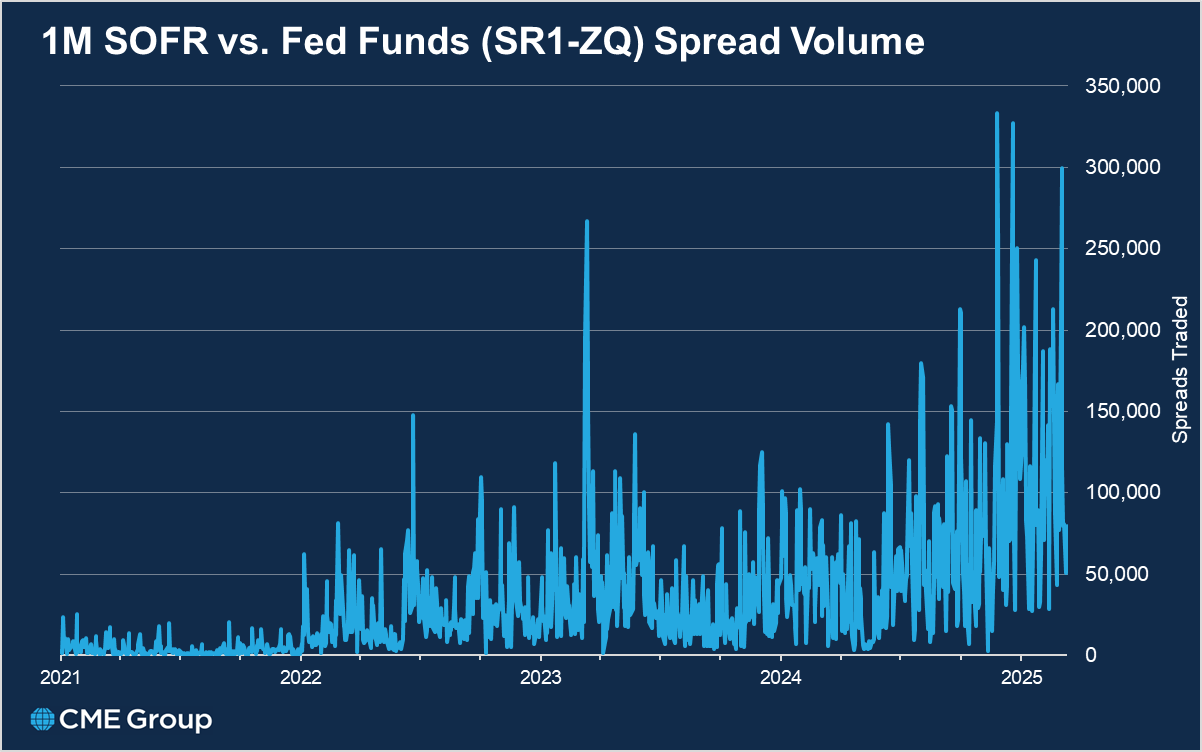

Basis Trading:

- Arbitraging spreads between SOFR and other rates like Fed Funds or Treasury yields.

- Example: If SOFR trades persistently below EFFR (Effective Federal Funds Rate), a trader might short EFFR futures and go long SOFR futures to capture the spread narrowing.

Volatility in overnight SOFR since Oct/Nov has made the SR1-FF basis market more active than ever.

Trading Strategies in SOFR Markets

SOFR markets, with their deep liquidity and increasing sophistication, offer a variety of trading strategies for market participants. These strategies cater to both speculative traders and those looking to hedge interest rate exposure. Whether betting on future Federal Reserve actions, managing rate curves, exploiting market inefficiencies, or trading volatility, SOFR derivatives provide flexible instruments for numerous approaches. Below are the main trading strategies employed by participants in SOFR markets, each aimed at navigating the complexities of rate expectations and economic shifts.

Directional Trading:

- Taking long or short positions in SOFR futures based on expected Federal Reserve rate changes.

- Example: If the market expects rate cuts, traders might long SOFR futures to benefit from falling short-term rates. This is a fairly straightforward speculative trade expression, however, keep in mind that going long = cuts and short = hikes.

Curve Trading:

- Trading spreads between short-term and long-term SOFR contracts to express views on the yield curve.

- Steepener trades: Long near-term SOFR futures, short longer-dated contracts (expecting a steeper curve).

- Flattener trades: Short near-term SOFR futures, long longer-dated contracts (expecting a flatter curve).

Basis Trading:

- Exploiting differences between SOFR and other short-term rates.

- Example: SOFR vs. Fed Funds Spread Trading – traders hedge funding costs by going long/short these rates when spreads widen or narrow.

Volatility Trading:

- Using SOFR options to trade rate volatility expectations.

- Straddles and Strangles2 allow traders to profit from rate swings without picking a direction.

- Another advanced volatility strategy is gamma3 scalping4, which involves dynamically managing options positions by adjusting the hedge based on changing market conditions.

- Example: If a trader buys a call option on SOFR, and SOFR futures begin to move in favour of the call option (prices rise), the trader will need to sell SOFR futures to maintain a neutral position. Conversely, if SOFR futures move against the position, the trader might buy more SOFR futures. This continual rebalancing allows traders to profit from small movements in the underlying rate while managing their exposure. Gamma scalping can be highly profitable in volatile markets where the underlying rates experience frequent swings, and it provides a systematic way of managing options risk while profiting from volatility. However, it requires constant monitoring and quick adjustments to capture those small gains before they evaporate.

(A similar trade can often be seen in convertible note markets. Please see our previous primer here, and find the “Adjusting the Hedge: Rebalancing the Short Position” section.)

Key Behavioural Insights and Opportunities in STIR Trading

By DCP:

While technological and trading vehicle advancements in interest rate trading are significant, the influence of human psychology across all markets continues to shape market behavior and outcomes. As a new generation of traders learns to manage rate risk in an ever increasingly complex market (after the decades of QE and misguided Fed policy), there remains a robust market to express directional views. When the disconnect isn’t about the data, it was more about the market participants wanting a certain outcome, leading to self-reinforcing speculation, or more simply, you can just do stuff.

Herd Mentality:

Collective psychology often drives market reactions, leading to liquidity crises during panic situations—traditionally expressed as flight to quality or long treasuries as a risk-free safe haven in the short term. This, however, can lead to becoming an “investor” once the stress resolves.

FOMO and Overreactions:

Over-interpretation of central bank signals results in exaggerated market movements, both in indices and along the curve. This offers opportunities for market participants to greatly mis-price the futures and offers one of the better reduced risk trades to fade the herd.

Cognitive Biases:

Traders exhibit biases such as anchoring and recency bias, impacting decision-making.

- Anchoring Bias: Traders often rely too heavily on past rate levels and mindsets, struggling to adjust to new economic realities.

- Recency Bias: Market participants overweight recent events, assuming current trends (inflation, rate hikes) will continue indefinitely, i.e. short term reactions to inflation and jobs data.

Delayed Sentiment Shifts:

Markets struggle to adapt to new realities, reflecting the inherent resistance to change or a disbelief of potential tail outcomes. This is a shift in market dynamics from mean reversion and trend-following strategies to contrarian directional bets as old narratives are laid dead.

Confirmation Bias:

Many traders seek data that supports their pre-existing view, whether dovish or hawkish. I prefer to consider how I am wrong.

Current Paradigm

Markets struggle to accept paradigm shifts—whether moving away from LIBOR, transitioning to SOFR, adjusting to structurally higher rates, following the self-assuring narrative, or failing to spend some brain cells thinking about tail risk and alternative outcomes.

Even policymakers fall into this trap. The Fed itself was slow to recognise inflation persistence in 2021 because they wanted their prior low-rate policies to be justified. You can’t fight the fed but you can fade them. Not many saw the potential for rate hikes to 5.25% out of QE… including Jerome Powell.

A good example of a sentiment shift occurred in early February. Expectations were for 0-25bps of cuts going forward based on sentiment and a strong economy. Yet the Dec 25 SOFR contract couldn’t punch through support and put in a double bottom on a 4-hour chart. Why? Traders didn’t want to commit further into the uncertainty of tariffs all while discounting the harmful potential of tariffs and Trump’s commitment, presenting a contrarian opportunity: Enter a long position and test the waters, add at key levels.

And here we are, with three cuts priced now and the indices tumbling, adding fuel to the fire. “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”—Mark Twain

Conclusion

The transition from LIBOR to SOFR reshaped interest rate markets, replacing a credit-sensitive benchmark with a nearly risk-free one rooted in actual transactions. While this shift eliminated certain risks, it introduced new challenges—such as adapting to a backward-looking rate and navigating liquidity in evolving derivatives markets.

For traders and institutions, SOFR markets now offer deep opportunities in futures, swaps, and options, enabling speculation on Fed policy, hedging rate risk, and capitalising on inefficiencies. Strategies like curve trading, volatility plays, and basis arbitrage have gained prominence, while behavioral factors—herd mentality, bias-driven mispricing, and delayed sentiment shifts—continue to create both risks and opportunities.

Ultimately, success in STIR trading requires both technical expertise and an ability to adapt to market psychology. Whether positioning for policy changes, exploiting structural dislocations, or fading consensus narratives, the key takeaway is clear: understanding the mechanics of SOFR is just the beginning—navigating its market dynamics is where the real edge lies.

We hope you enjoyed this primer and insights on STIR trading. Please leave a like to show your support. As always, comments and opinions are welcome in the comments.

AP and DCP

The ticker code for a specific contract typically consists of a letter, each corresponding to a specific month. For example: F=Jan, G=Feb, H=Mar, J=Apr, K=May, M=Jun, N=Jul, Q=Aug, U=Sep, V=Oct, X=Nov, Z=Dec. The year in which the contract expires is included. It is represented by the last digit of the year. For instance, “5” would represent the year 2025. If we talk about SFRZ5, we’re talking about the SOFR Futures contract expiring in December 2025.

Straddle: A straddle involves buying both a call option (which profits from an increase in rates) and a put option(which profits from a decrease in rates) with the same strike price and expiration date. This strategy profits when SOFR moves significantly in either direction, as the price movement in one option will outweigh the loss in the other.

Strangle: A strangle is similar to a straddle but involves buying both a call and put option with different strike prices. It’s generally cheaper than a straddle because the options are out-of-the-money, but it still profits from large movements in either direction.

Gamma refers to the rate of change in an option’s delta, which measures the sensitivity of the option’s price to changes in the underlying asset (in this case, SOFR futures).

Gamma scalping requires traders to actively adjust their positions in SOFR futures to maintain a neutral delta(i.e., a position that is not exposed to small movements in the underlying asset’s price). As the market fluctuates, traders will buy or sell SOFR futures to offset changes in their options position. This dynamic adjustment helps traders lock in profits from volatility, regardless of the direction of price changes.

Excellent. Very Useful.

Great primer! very insightful and useful info for someone hoping to eventually get into STIR trading.