All the talk is of recession and in particular the long awaited recession in the US. The most obvious catalyst for all this recession talk is the weakness in equities. Weakness is a strong word in this case - as we are still above the 200MDA.

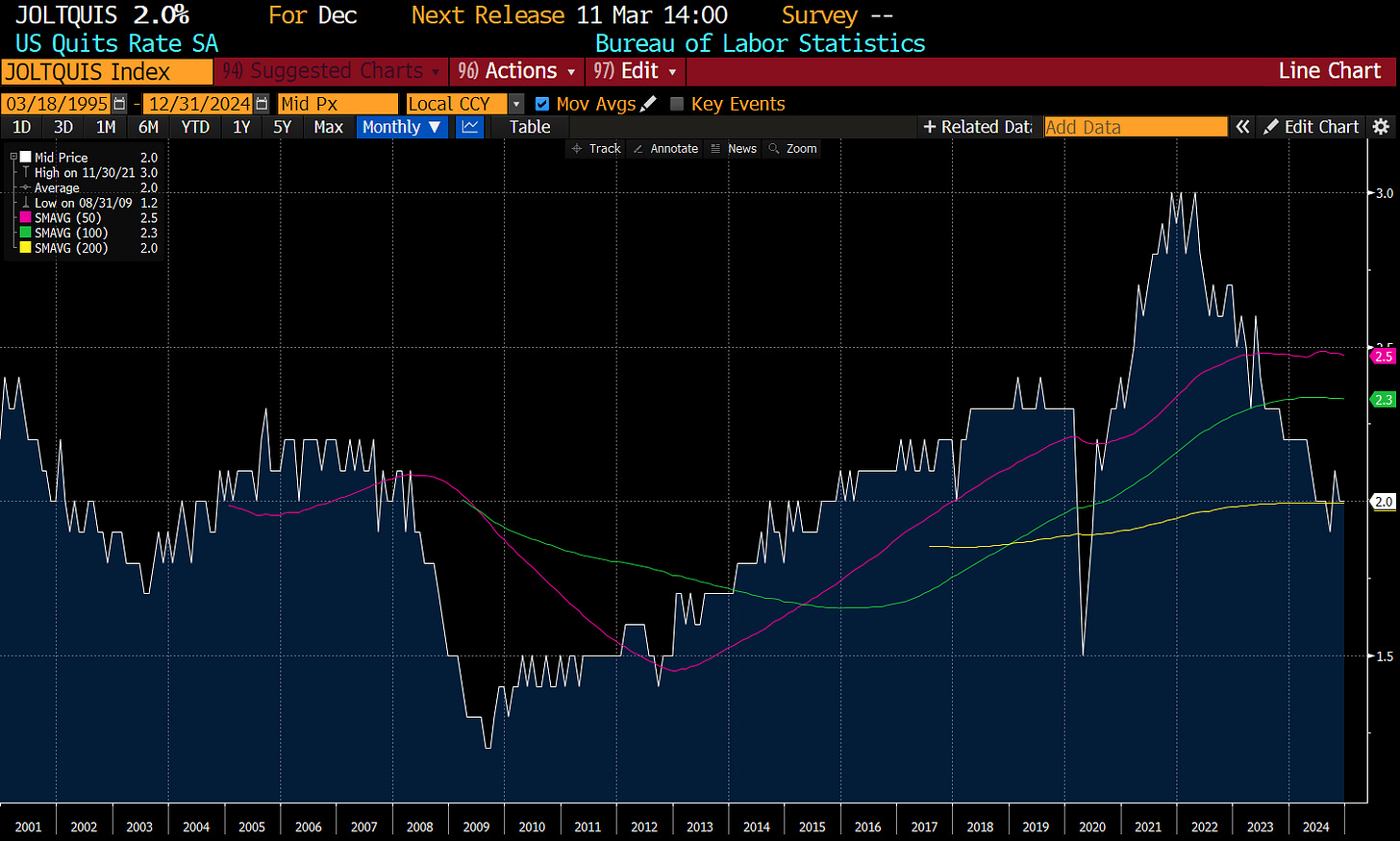

On a more realistic level, lead indicators in the US, such as the Quits Rate has been pointing to a slow down since 2022, as higher interest rates has slowed growth in the US.

But if it is a recession - its not like one I have seen before. First off all, JGB yields continue to surge. Typically they start falling well before US recession becomes apparent. Falling JGB yields happened before 1991 Savings and Loans Crisis, Asian Financial Crisis, Dot Com Bust, GFC, Euro Crisis, China Deval Scare, and even Covid. JGB investors seem not to be thinking deflationary crisis anymore. Perhaps they expect a Trump administration is more likely to raise tariffs and do a fiscal push rather than accept a recession. Seems a reasonable to me.

Certainly, corporate credit spreads are not shouting recession here. Typically fears of recession are at their highest when spreads widen, as they did in 1998 (Asian Financial Crisis), 2000 (Dot Com Bust), 2008 (GFC), 2015 (China Deval), 2020 (Covid) and 2022 (rapid monetary policy tightening). As of today, spreads are near all time lows.

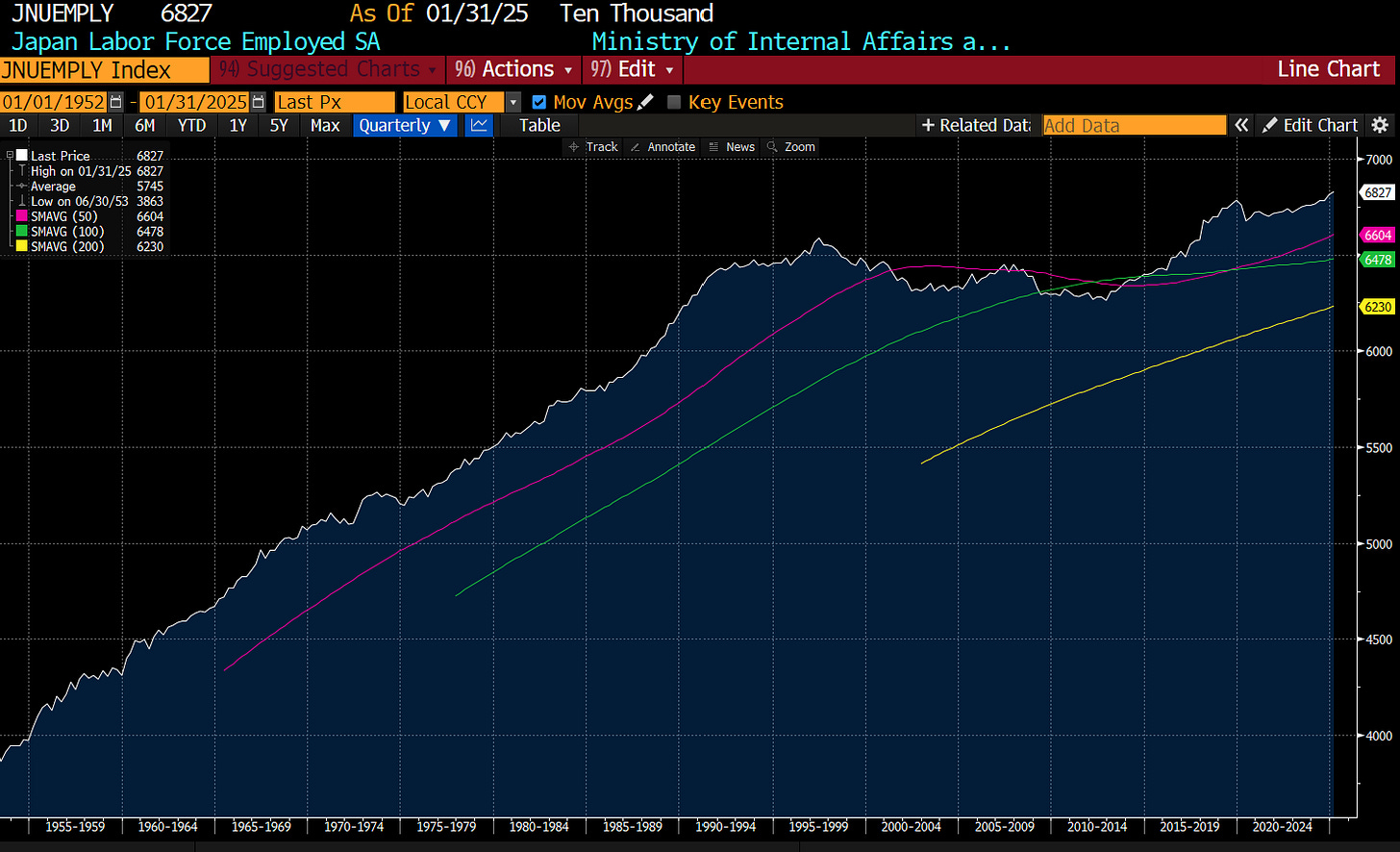

Given that US pressure is now forcing most nations to boost military forces, the more reasonable question is where is that labour is going to come from, and who is going to pay for it? Japanese population is in decline, but labour force employed is at all time high, even before they remilitarise.

Similar analysis can be applied to German and Poland. Poland has been far more serious about remilitarising than almost any other nation in Europe - for obvious reasons. Unsurprisingly, Polish bond yields are not pointing to recession either.

US conference board inflation expectations are also flagging problems for a recession call. They have popped to 6% in the most recent months.

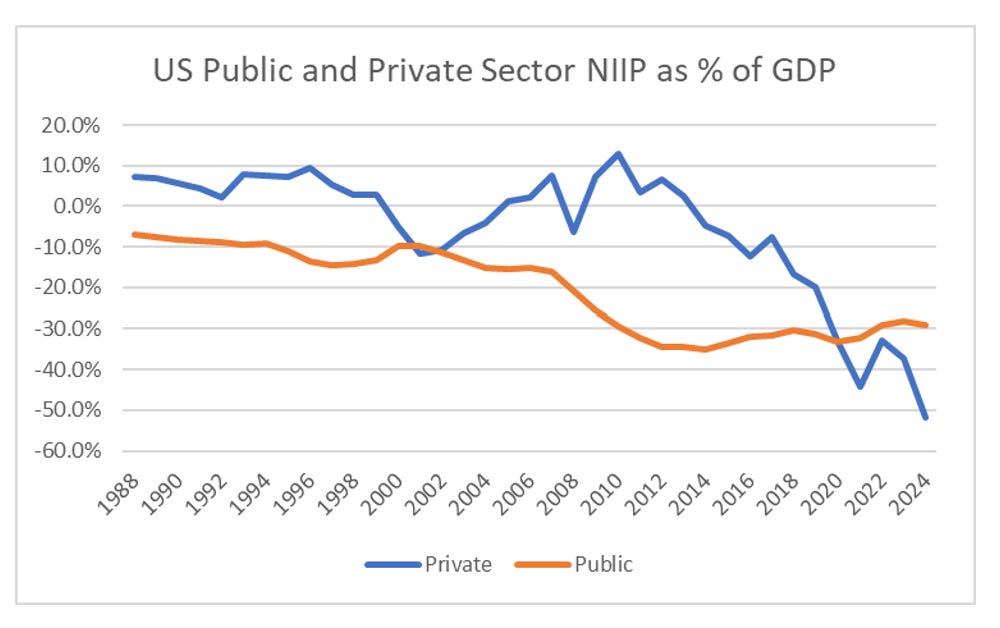

Using NIIP data, we see that the US has been sucking up capital for over 15 years, with a private sector NIIP the largest since the dot com bust. In 2000, we had China join the WTO, and this was a catalyst for capital to leave the US. I am wondering if the remilitarising of Europe and Japan will lead to a similar capital flight?

All of this is a long way of saying, I do not see recession, but I can see US assets weakening at least relatively. With Trump in the White House, and Europe and Japan spending, a recession is actually hard to see - but I could see a financial crisis driven by tighter monetary policy - but these days, financial crisis does not mean recession. Welcome to the new macro world.

Share this post