Discover more from Kyla’s Newsletter

This is a weekly market update (I post daily to TikTok). I publish these once a week (beta phase), as well as single stock pieces (1-3x a month) and macro deep-dives. I also publish on TikTok, Youtube, and Twitter!

Here is the YouTube version

What happened in the stock market this week?

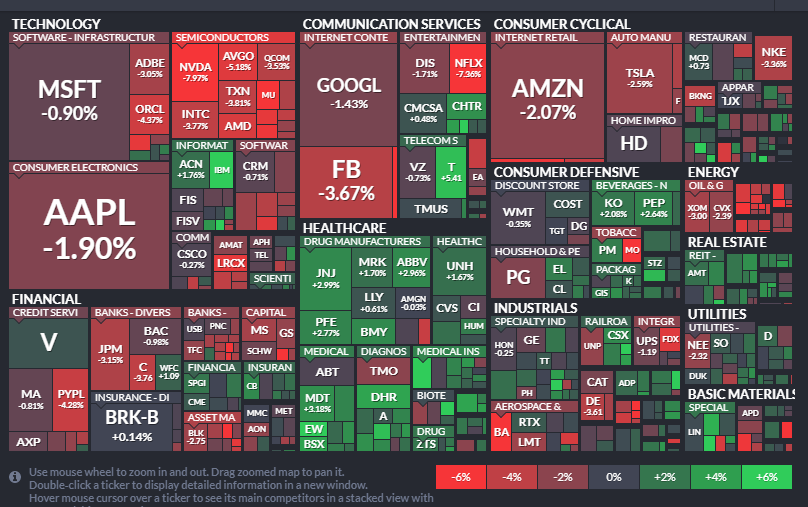

Market a little spooked by taxes resulting a weaker week. Economic data was broadly strong:

New home sales +21% and above 1mn units, beating expectations (and their highest since 2006 - nothing historical there)

Business activity on fastest pace on record.

Friday ended in the green (got some good ol photosynthesis) buoyed by relative strength in healthcare and consumer defensive.

QQQ bled out $6bn over the past week, partially driven by weakness in Netflix but also by the Big 5 delivering earnings next week.

Money is going back into financials, energy, and materials (partially a value rotation, partially because of a massive beat on earnings).

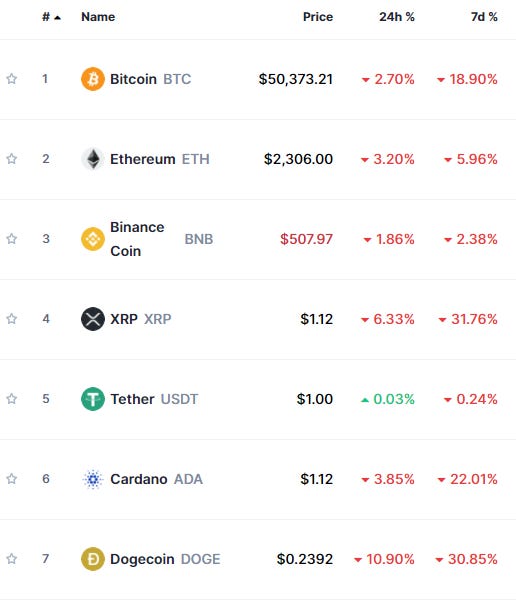

Crypto is showing a bit of a selloff . Bitcoin has been flirting with the 50k line (a ~10% drop on the week), also spooked by taxes. Dogecoin, after an incredible run this week, is down ~20%.

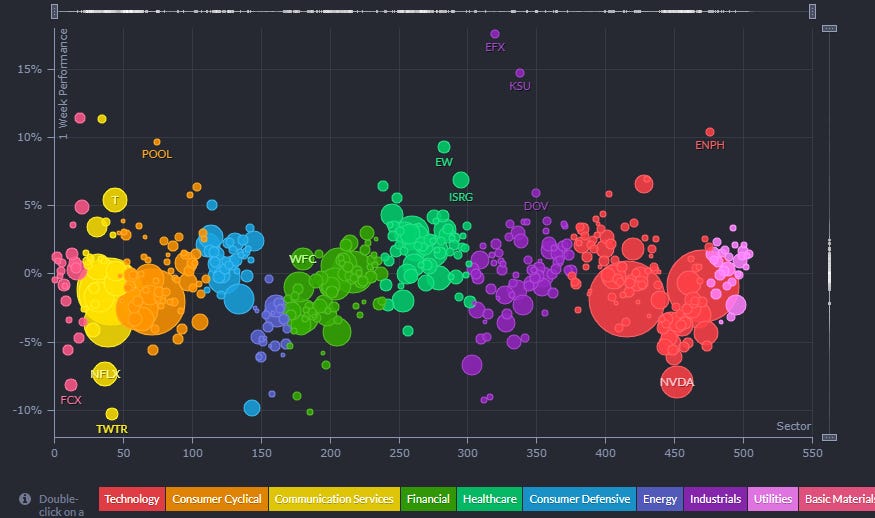

What stocks were the big movers?

Big Winner: Equifax showed up this week on a strong earnings report with their best quarter ever. (There is also a crypto called $EFX, so I wonder if there is potentially some confusion there.)

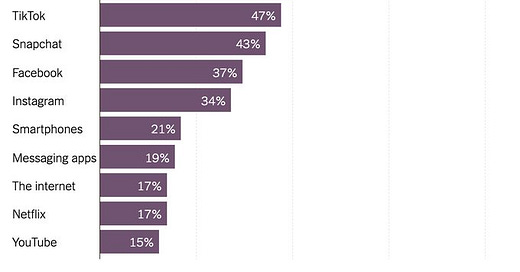

Big Loser: Netflix was pretty beat up this week after missing on subscriber estimates by ~2mn. The pandemic pulled forward a lot of their growth, and they are operating in an increasingly saturated space (Disney +, Amazon Video, Hulu, HBO, etc)

The Themes

2021 Performance so far:

The Crypto Selloff

Crypto had a weird week. The selloff began on April 18th, Sunday night for a myriad of reasons - a blackout in China, a weird report of a U.S Treasury crackdown that turned out to be “unsubstantiated”, Turkey ban, movement in Doge and the other alts, and the Coinbase IPO were all potential reasons for the downturn.

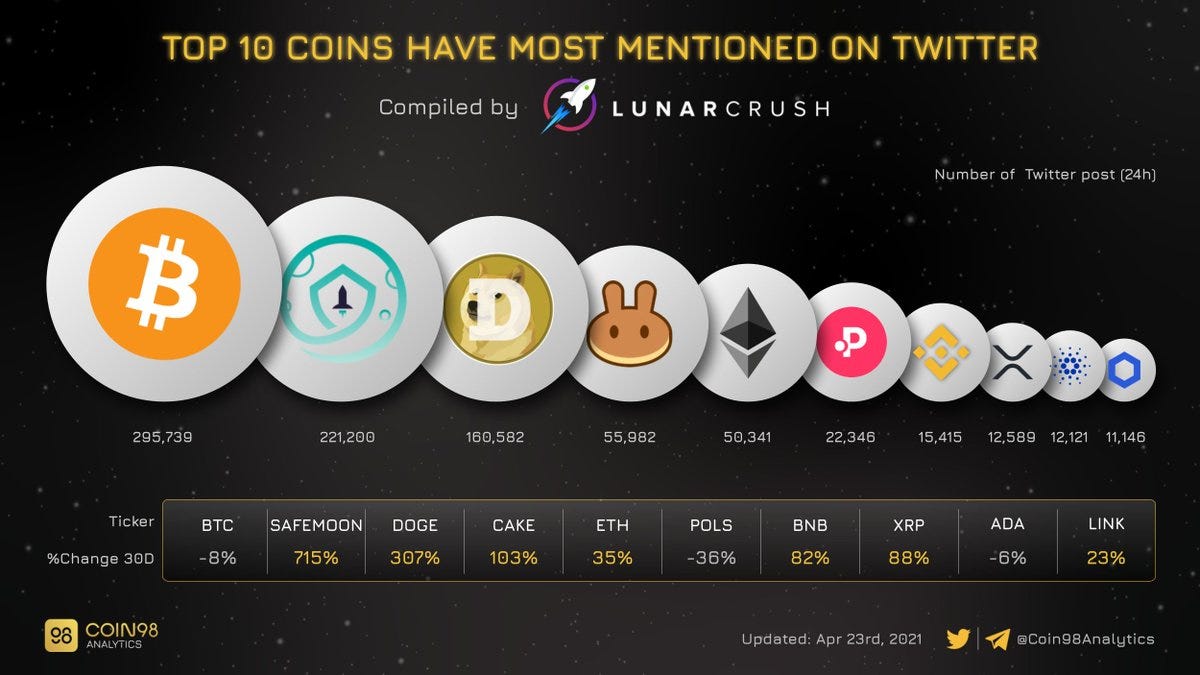

Ah yes, the Dogecoin Boom

Doge had a pretty big week. It’s down 30% now. But it had quite the run there for a while. At its peak, it was a better investment than Bitcoin, across its entire 7-year existence.

Safemoon and other altcoins are making waves into the market. A lot of money is being fueled into these underground coins - diverting dollars away from the main cryptos as people chase quick gains.

Markets are driven by emotion at this point. We are seeing people band together (#SAFEMOONGANG) and other collectives. Humans are social creatures, after all.

There is a crypto called SCAM that has reached a market cap of ~$1.5bn. And a crypto called Cumrocket that surged > 600% in a single day to a market cap of ~$140mn.

Big takeaway? Anything can be financialized. And it doesn’t have to make perfect sense. Supply and demand are literally the only things that matter.

Taxes

Capital Gains Change: Biden proposed doubling the capital gains tax rate from 20% to 39.6% for people earning > $1mn a year which would mean that federal tax rates could be as high as 43.4%.

The announcement floated around on Thursday. Market didn’t like it at all, and had quite the selloff.

Corporate tax rates: Biden has also talked about raising the corporate tax rate from 21% to 28%. The theory is that corporations would just pass off the tax hike to consumers - but with the supply chain squeeze, how much can they pass off?

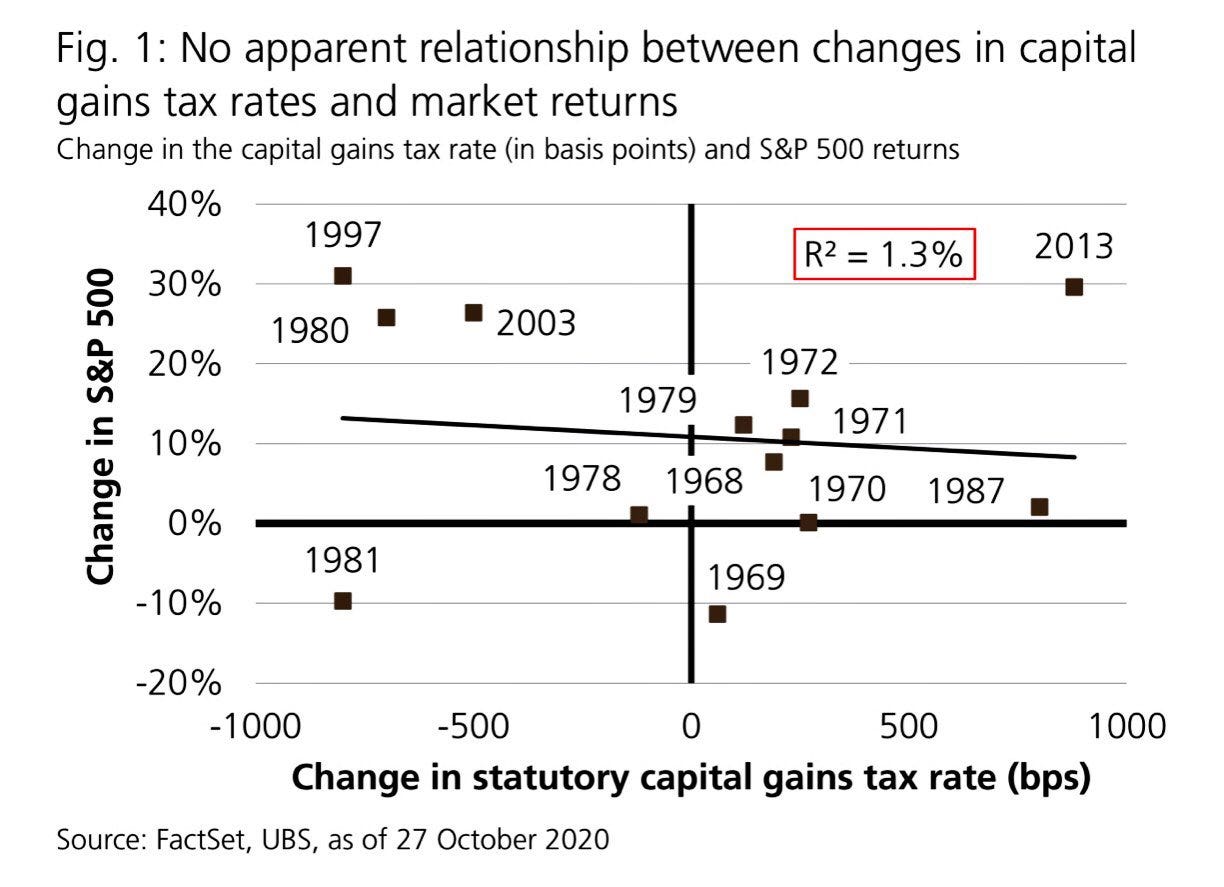

What will happen? This chart has been floating around to show that the market is mostly fine with a cap gains change.

Stocks are a place to park money at this point. They show frustration through a selloff, but there aren’t many other viable options for returns (however, if it does pass, people will likely rotate into real estate and other tax-advantaged holdings)

Watch politicians trades to see if it will actually get passed (and at what level)

Inflation

Is it actually transient?

Cost pressures are #1 topic on earnings calls

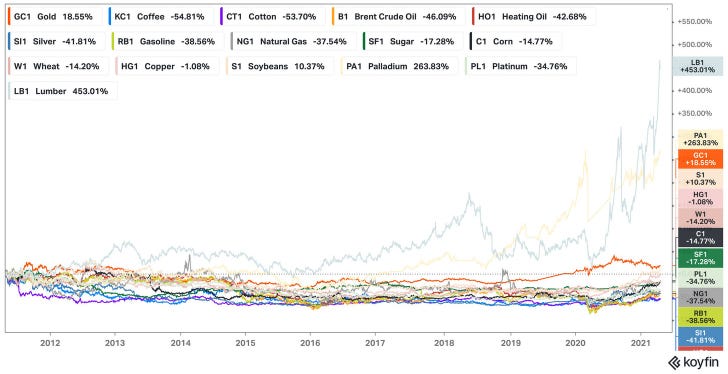

Semiconductor shortage: This will create problems. It’s showing up in used car sales prices. Factories are idling. Palladium (as you can see below) is on the move. So is lumber (unrelated to semis). Weak supply chains.

Where is inflation coming from? Used car prices, rents, price hikes (from supply chain bottlenecks and labor shortages) are all on the rise. That will put upward pressure on inflation, and make it harder for things to be “transient”.

The labor market will be one to watch. It’s a chicken and egg problem with labor - over time, we can automate some jobs, but I don’t think we have a plan in place for what automation truly means for the economy.

For now, there simply aren’t enough workers (or the pay simply isn’t high enough to entice). A tight labor market will also create cost pressures.

Supply chain disruptions and input prices are a big worry here. The flash print in the PMI was above consensus, so it will be interesting to see how the Fed interprets all the data needed to begin their tapering journey (assuming employment recovers too).

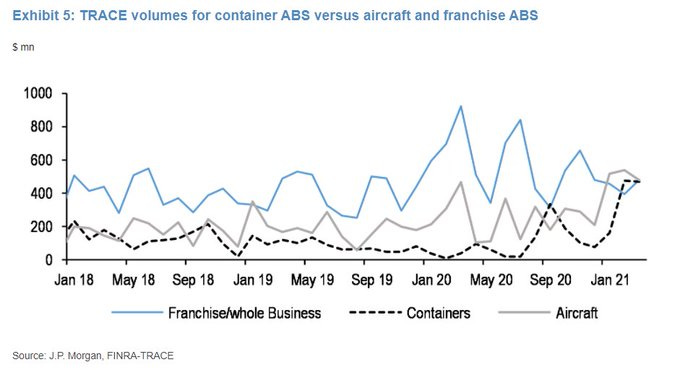

Fun: Gridlock in global shipping = strong market for container ABS

Lumber

Lumber is on the rise due to supply chain bottlenecks, Canada-US tensions, limiting capacity, and people wanting to have a home and subsequently wanting to renovate that home - and probably tied into the fact that mortgage rates are at an all-time low.

It’s not the lack of trees, it’s the lack of lumber: “The stumpage fee, or what lumber companies pay to land owners for trees, for Louisiana pine sawtimber on March 31 was $22.75 per short ton. That’s the lowest since 2011. Meanwhile, lumber futures are up 85% in 2021”

Got plenty of stumps, just don’t have the sawmill capacity to process the stumps for lumber.

The Balance Sheet Economy

This is a debt-fueled economy, driven by liquidity and low rates. As long as you can access debt, companies will remain alive (even if a zombie). The U.S. High Yield bond index is now a record ~$1.5T.

Triple-C companies can borrow at 8% (from a high of 20.2% in March 2020) as investors chase yield to the absolute bottom. People are desperate for yield, and they are pushing into the riskiest balance sheets to get exposure.

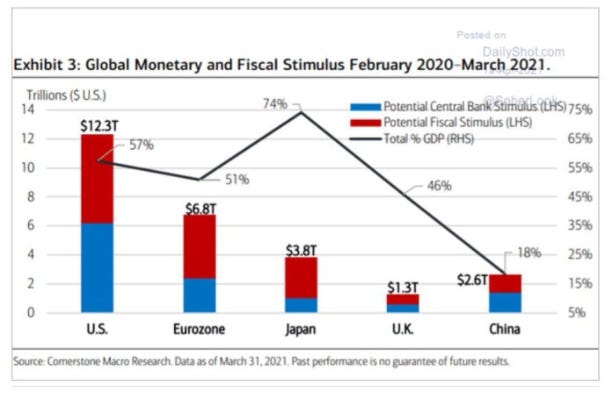

Lots of fiscal and central bank stimulus: On top of that, there has been more than ~$12.3T in stimulus, which is a lot of money that needs to find a home. This is relative to our ~$21T GDP.

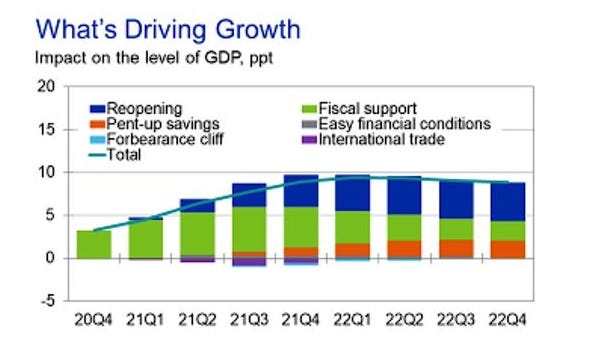

GDP Drivers: Speaking of GDP, most of the things driving GDP are fiscal support and reopening demand. Once all that shakes out, it will be interesting to see how things progress.

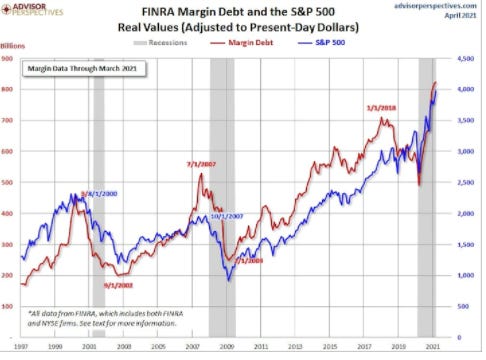

Consumers are benefiting from the easy money economy too. Margin debt is at all time-highs due to a combination of low interest rates + liquidity

This moves in-line with the S&P 500

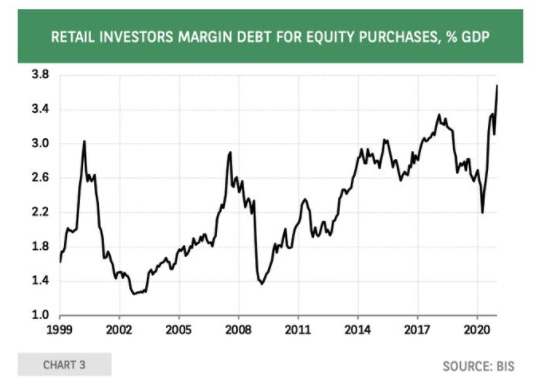

But is pretty high relative to GDP

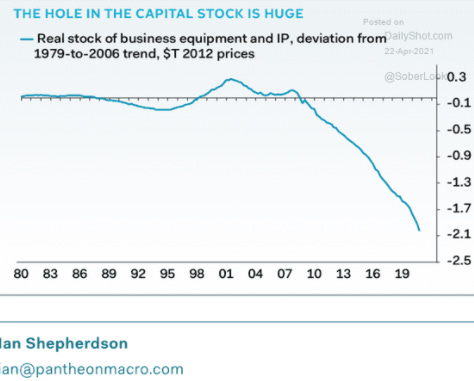

Businesses aren’t investing in capex either. Capex is one way to build a better business - and it’s interesting that businesses don’t feel the need to do this.

Concluding Thoughts: The Market is Reactive

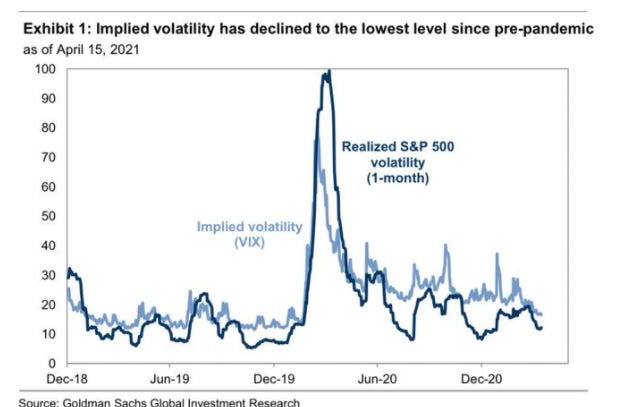

This week was a flurry of altcoins and tax worries, against the backdrop of a strong economic data. Even though implied volatility is at lowest level since pandemic, it still can feel like market whiplash amongst all the emotion and noise.

What to look for? I am keeping an eye out for companies with pricing power and operate in moat industries. Have been pretty fascinated by waste management and will be watching the credit bureau space after the $EFX beat.

Next Week

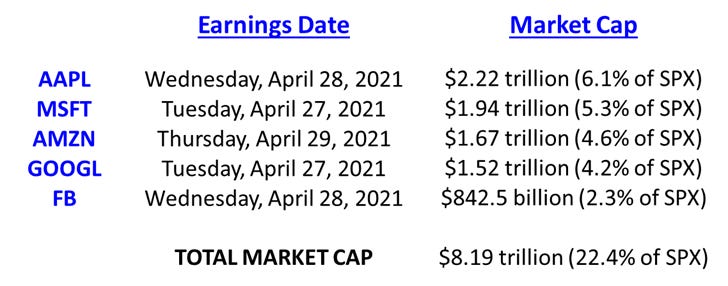

Big earnings week. The 5 largest stocks are reporting at the same time!

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Subscribe to Kyla’s Newsletter

human-centric economic analysis to help all of us understand the world better