Discover more from Nongaap Investing

[Premium Unlocked] Most Egregious Equity Grant of 2020?

A grant so bad it arguably warrants an independent investigation

Welcome to the Nongaap Newsletter! I’m Mike, an ex-activist investor, who writes about tech, corporate governance, the power & friction of incentives, strategy, board dynamics, and the occasional activist fight.

If you’re reading this but haven’t subscribed, I hope you consider joining me on this journey.

Premium Unlocked

December 29, 2020: As we exit 2020 and enter 2021, I wanted to unlock and share one of my favorite premium write-ups of the year.

I wrote this piece back in June about LivePerson (ticker: LPSN) and one of the (in my opinion) most egregious stock option grants of 2020.

Long story short, LPSN granted executive stock options in May 2020 with an exercise price of $27.39 materially below the grant date stock of $37.96.

I walk through how this below market price grant is possible (they implemented a 30-day average price formula) and why I think shareholders should be demanding changes.

Since the original write-up, the stock has run to $63.50 and in hindsight there was no reason to get this aggressive. You’re having a great year!

It’s disappointing to see LPSN’s Board erode their governance for this grant:

This grant raises serious flags over trading on material non-public information.

It breaks the spirit of the “open trading window” grant policy the company explicitly committed to in the 2020 Proxy.

Sets a very bad precedent on governance and compensation practices, and opens the door for year-to-year exercise price manipulation.

I can only share how I feel, but hopefully shareholders recognize these are issues that need addressing and will drive the appropriate changes in 2021. Happy holidays!

Original Write-up:

LivePerson’s (ticker: LPSN) May 15, 2020 deep in-the-money options grant is the most egregious equity grant I’ve come across in 2020.

Granting options with a $27.39 exercise price when the grant date stock price is $37.96 arguably warrants an independent investigation. That is not a typo. The stock price was 39% above the exercise price when the options were granted.

Historically, this is the kind of decision-making that causes shareholders to demand the resignation of directors and management involved.

The “Formula” for Deep In-the-Money Options

On May 15, 2020, LivePerson granted equity (options and RSUs) to management with a peculiar disclosure in the Form 4 regarding the option’s exercise price:

The exercise price for this stock option, the formula for which was set in advance by the issuer's compensation committee, represents the average daily closing price of the issuer's common stock, as reported on the Bloomberg Market Data Feed, over the trading days during the thirty calendar day period ending on May 15, 2020.

Alarm bells were immediately going off when I saw this footnote. Let’s break down what this disclosure is saying (between-the-lines):

The Compensation Committee (presumably) met on or around April 15, 2020 and decided to grant equity on May 15, 2020 after Q1 earnings on May 5, 2020.

The Compensation Committee explicitly forgoes the widely accepted (and standard) practice of using the grant date stock price to set the option exercise price. Instead, they explicitly choose to determine the exercise price “fair market value” by calculating LivePerson’s average daily closing price over 30 calendar days (from April 16, 2020 to May 15, 2020).

We can only speculate on the reasons why the “formula” was implemented in lieu of grant date price, but the results are clear. Management received deep in-the-money options with a $27.39 exercise price when the grant date price was $37.96. This was a material financial windfall for the management team.

I can’t emphasize enough how extraordinary this disclosure is to me. For highly liquid public companies, the exercise price should be the grant date stock price. To diverge from this highly established practice (in my opinion) signals weak corporate governance.

While 409A does allow alternative ways to calculate “fair market value” (i.e. 30 day average price “formula”), I believe it exposes shareholders to egregious behavior and abuse. Insiders can easily toggle between the 30 day fair value “formula” and grant date stock price to maximize year-to-year grant value.

Implementing a 30 day average price formula raises serious concerns over trading on material non-public information.

The “Formula” Exposes “Fair Market Value” Definition

The May 15, 2020 stock options were “granted under the terms of the LivePerson, Inc. 2019 Stock Incentive Plan”.

Under the terms of the 2019 Stock Incentive Plan, granting options with $27.39 exercise price when the grant date stock price is $37.96 is still considered granting options at 100% “Fair Market Value”:

Exercise Price. The Board shall establish the exercise price of each Option and specify the exercise price in the applicable option agreement. The exercise price shall be not less than 100% of the Fair Market Value (as defined below) on the date the Option is granted; provided that if the Board approves the grant of an Option with an exercise price to be determined on a future date, the exercise price shall be not less than 100% of the Fair Market Value on such future date.

Most people presume “Fair Market Value” means grant date stock price, but in actuality “Fair Market Value”, as defined in the 2019 Stock Incentive Plan, is pretty broad:

…fair market value as determined by (or in a manner approved by) the Board (“Fair Market Value”)

“Fair Market Value” is essentially determined by the Board. This gives the Compensation Committee a lot of discretion on how to set “fair market value” when granting options.

Interestingly, LivePerson has an exquisitely clear and unambiguous definition of “Fair Market Value” in their 2019 Employee Stock Purchase Plan:

(n) “Fair Market Value” shall mean the market price of a Share as determined in good faith by the Administrator. Such determination shall be conclusive and binding on all persons. The Fair Market Value shall be determined by the following:

(i) If the Shares are admitted to trading on any established national stock exchange or market system, including without limitation NASDAQ, on the date in question, then the Fair Market Value shall be equal to the closing sales price for such Shares as quoted on such national exchange or system on such date; or

(ii) if the Shares are admitted to quotation on NASDAQ or are regularly quoted by a recognized securities dealer but selling prices are not reported on the date in question, then the Fair Market Value shall be equal to the mean between the bid and asked prices of the Shares reported for such date. In each case, the applicable price shall be the price reported in The Wall Street Journal or such other source as the Administrator deems reliable; provided, however, that if there is no such reported price for the Shares for the date in question, then the Fair Market Value shall be equal to the price reported on the last preceding date for which such price exists.

If neither (i) or (ii) are applicable, then the Fair Market Value shall be determined by the Administrator in good faith on such basis as it deems appropriate.

I believe this contrast in “Fair Market Value” definitions is not an oversight. It tells me the Stock Incentive Plan’s definition was purposely kept broad to give the Board more discretion over setting “Fair Market Value”.

If the 2019 Employee Stock Purchase Plan’s definition of “Fair Market Value” was applied to the May 2020 option grants, the exercise price would have been the grant date stock price.

But by giving more discretion on “Fair Market Value”, the Compensation Committee now has the procedural cover to egregiously time option grants to the benefit of insiders.

Synthetic “Spring Load” Option Grant?

When you examine the events leading up to the May 2020 options grant, this grant has all the characteristics of a synthetic “spring load” option grant.

As a reminder, “spring loading” is when a company grants equity and then releases news that positively impacts the stock price:

While the May 2020 options are granted after the “good news” positively impacts the stock price, using a 30 day exercise price “formula” captures the benefits of a “spring load” (hence synthetic “spring load”).

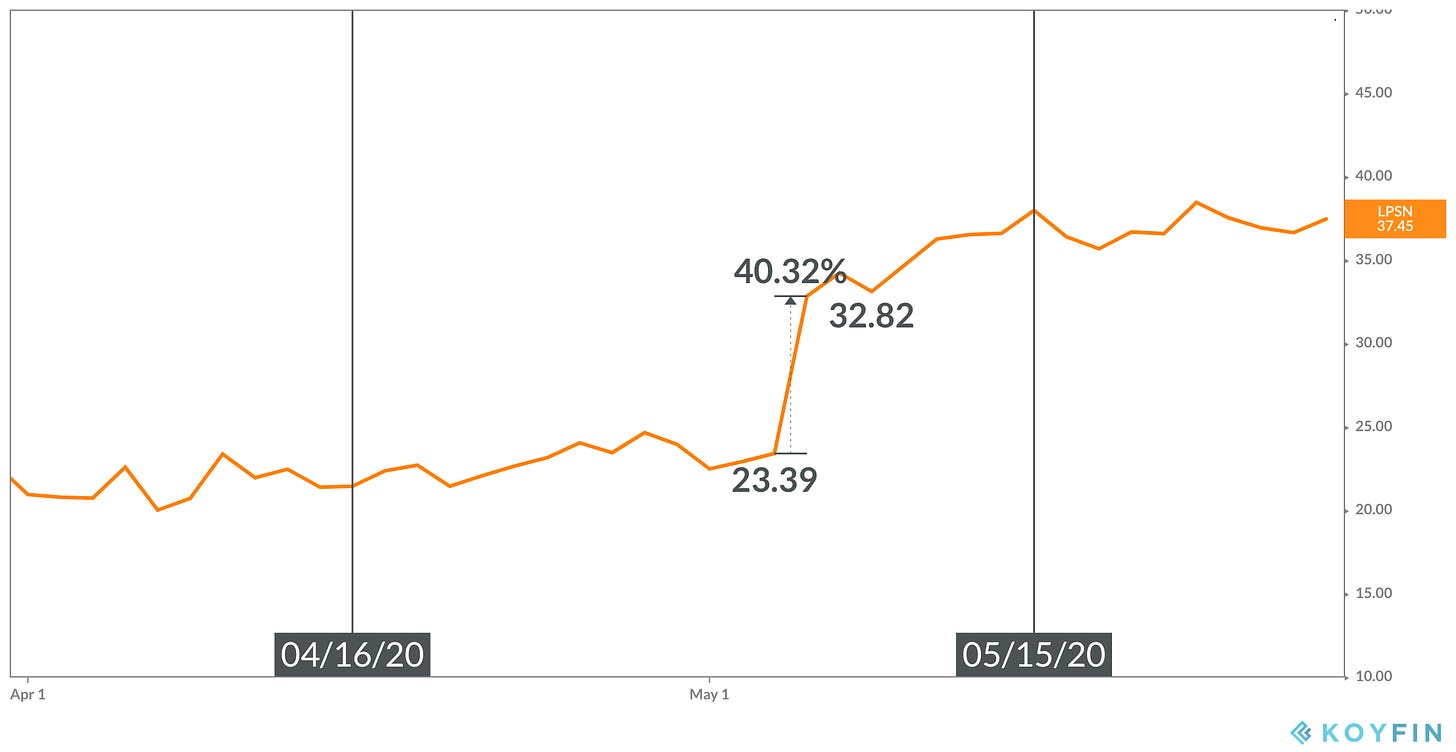

To get a better handle on how the exercise price “formula” creates a synthetic “spring load”, let’s visualize the 30 calendar day price window (April 16, 2020 to May 15, 2020) the Compensation Committee uses to calculate the exercise price:

Wow, that’s quite the price move within the window. Why did the stock pop 40% from $23.39 to $32.82?

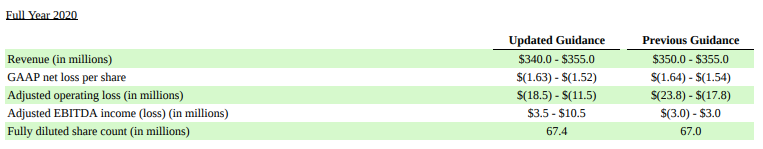

That 40% price pop is the result of Q1 2020 earnings (May 5, 2020) when LivePerson announced strong quarterly results and updated 2020 guidance, which included a materially positive revision to 2020 adjusted EBITDA:

I’ve seen a lot of corporate governance “dark arts” over the years, but this left me a bit speechless.

The Compensation Committee decided to implement a 30 calendar day price “formula” when they (presumably) knew:

Q1 2020 earnings and updated 2020 guidance would be very strong relative to consensus expectations.

The stock price would have a strong, positive reaction to earnings and updated 2020 guidance.

Applying an average price calculation, instead of volume weighted price or grant date price, would lead to a materially favorable exercise price given ~2/3 of trading days are pre-earnings and not pricing in the “good news”.

For reference, 30% of the 30 calendar day volume was on May 6, 2020 and the post-earnings trading days represented 70% of the 30 calendar day trading volume despite being ~1/3 of the trading days. Earnings had a massive impact on the stock’s volume and price which isn’t properly captured in the 30 day average price formula.

That is a significant amount of material, nonpublic information the Board was likely in possession of when they approved an exercise price “formula” in lieu of using grant date stock price.

Also, if the implementation of the “formula” wasn’t suspicious enough, this is the first time LivePerson has applied a fair market value “formula” to determine exercise price. In the past, the exercise price was simply the grant date price:

Why did the Compensation Committee implement an exercise price “formula” for the May 2020 grants?

In the 2020 proxy, we learn the Company adopted an “open trading window” equity granting policy in 2019 (i.e. grant equity after earnings):

In recognition of best-practice considerations around grant-making procedures, in 2019, the Company adopted internal grant-making guidelines which contemplate, in part, that grants of stock options, would be made in a manner such that the option’s exercise price would be determined in an “open trading window,’’ as set in accordance with the Company’s Insider Trading Policy.

Under this new policy, 2020 equity was granted on May 15, 2020 after earnings. Prior to the May 2020 grants, LivePerson typically granted equity before earnings. Interestingly, many of those pre-earnings equity grants exhibit characteristics of a “spring load”.

When you connect the dots, an argument could actually be made that the May 2020 exercise price “formula” is a continuation of LivePerson’s history of (alleged) “spring load” grants.

History Of (Alleged) “Spring Load” Grants?

LivePerson has a strong (recent) history of well-timed equity grants:

May 2017: Options granted a week before earnings. Stock pops 23% on earnings.

Dec 2017: Sizable RSU grant when 2017 results are more-or-less known. Stock would pop 10% on Q4 2017 earnings release (Feb 2018).

Feb 2018: Sizable options grant less than a week before Q4 2017 earnings announcement. Stock pops 10% on earnings.

Feb 2019: Equity granted the same day earnings is announced. Stock pops ~6% the next day on earnings.

2020 was supposed to be the first year the Company couldn’t “spring load” equity grants, but they managed to create a synthetic “spring load” by implementing an exercise price “formula” in lieu of grant date stock price.

Shame. Shame. Shame.

Historically, the May 2020 deep in-the-money options grant is the kind of decision that causes shareholders to demand the resignation of directors and management involved.

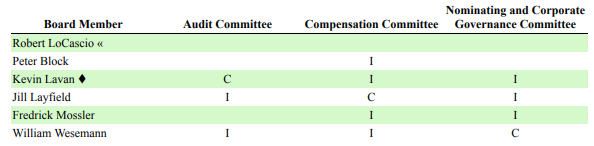

At the very least, shareholders should demand a thorough independent investigation. Unfortunately, the entire Board (excluding the CEO) is on the Compensation Committee so there aren’t unaffiliated Directors to run an independent investigation.

If there was a FICO score that assessed Independent Directors on their capacity to govern on behalf of outside shareholders, Peter Block, Kevin Lavan, Jill Layfield, Fredrick Mossler, and William Wesemann would all be getting very poor scores right now. This grant was the equivalent of declaring governance bankruptcy.

It’s a real shame.

Subscribe to Nongaap Investing

An ex-activist investor who writes about corporate governance, the power & friction of incentives, strategy, interpersonal board dynamics, activist fights, and other random topics.