Discover more from PrimeTrading

Hi!

Here is the latest article in the PrimeTrading education series about how to use MARKET STRUCTURE & PIVOTS like a swing & position pro trader.

Here’s what you’ll learn:

What is a market STRUCTURE

What is a PIVOT

Why using pivots is important to TIME your entry

How to FIND pivots

How to USE pivots to enter a trade

How to use pivots to MANAGE an early trade

Enjoy! ✌️

What is a market STRUCTURE

Before going into our main subject, it is important to understand what a market structure is. The price of any stock moves in bursts, up or down, from different lengths.

No stock will move in straight line (except maybe GME & AMC in 2020…but we’re not here to find MEME stocks ;)) so a stock in an uptrend will increase in price for a certain time, until it pulls back and/or consolidate for a certain time before continuing his ascension.

These new highs & new lows are making what we call a MARKET STRUCTURE. It is built of:

Higher Highs (HH)

Higher Lows (HL)

Lower Highs (LH)

Lower Lows (LL)

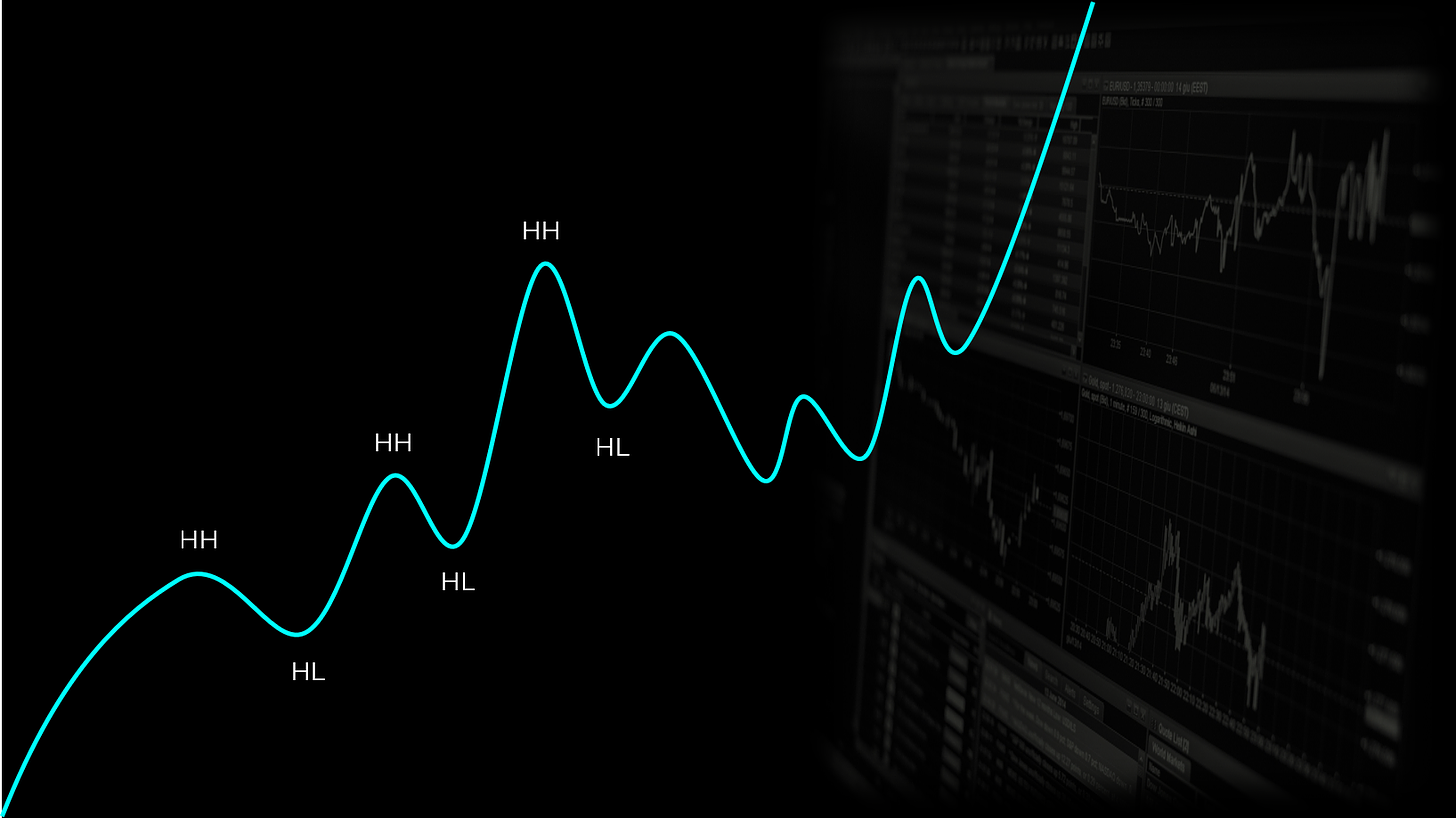

In an UPTREND, we want to see:

HH

HL

HH

HL

See the uptrend structure example below:

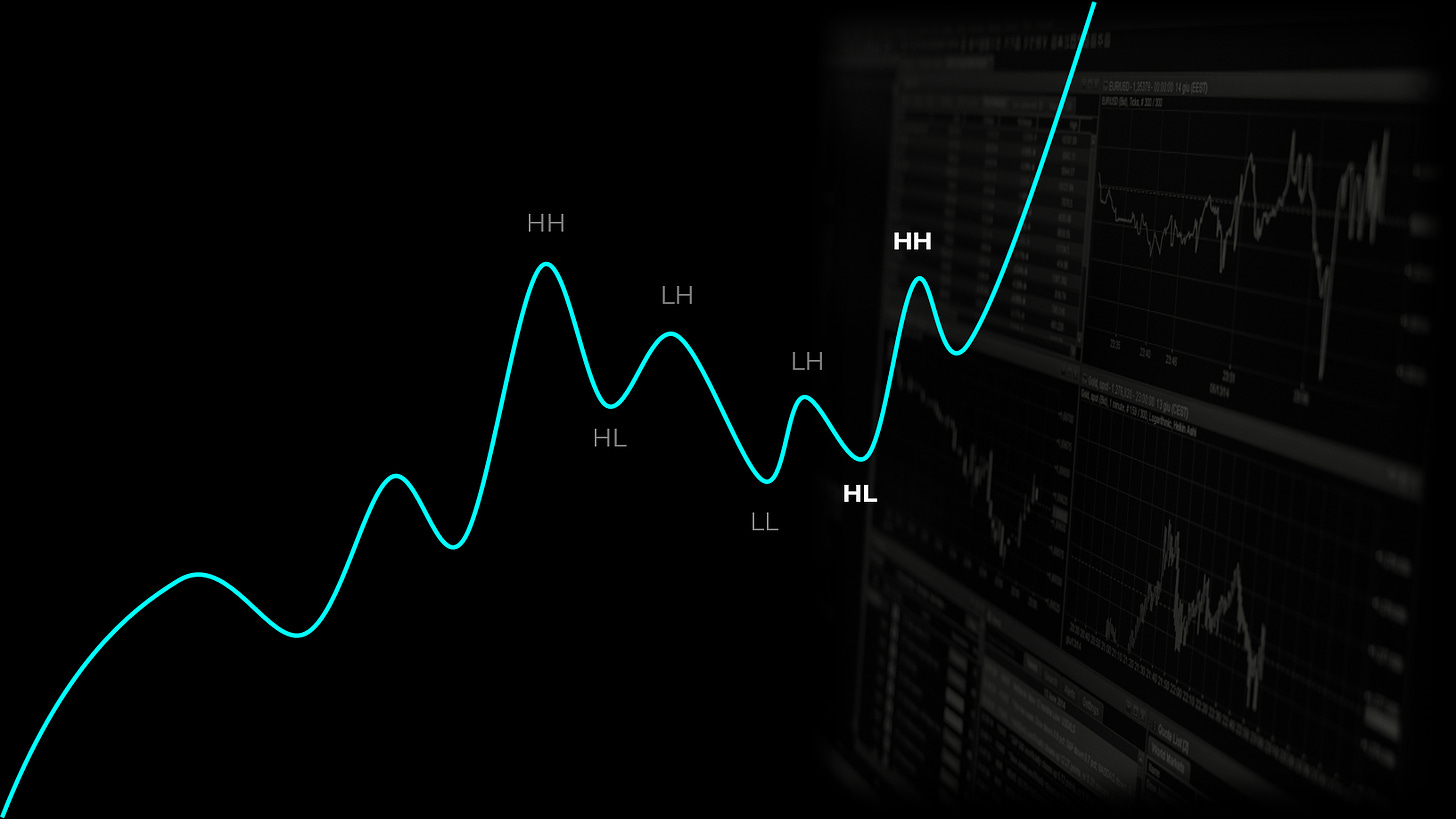

During a DOWNTREND/PULLBACK we want to see:

LH

LL

LH

LL

See the downtrend/pullback structure example below:

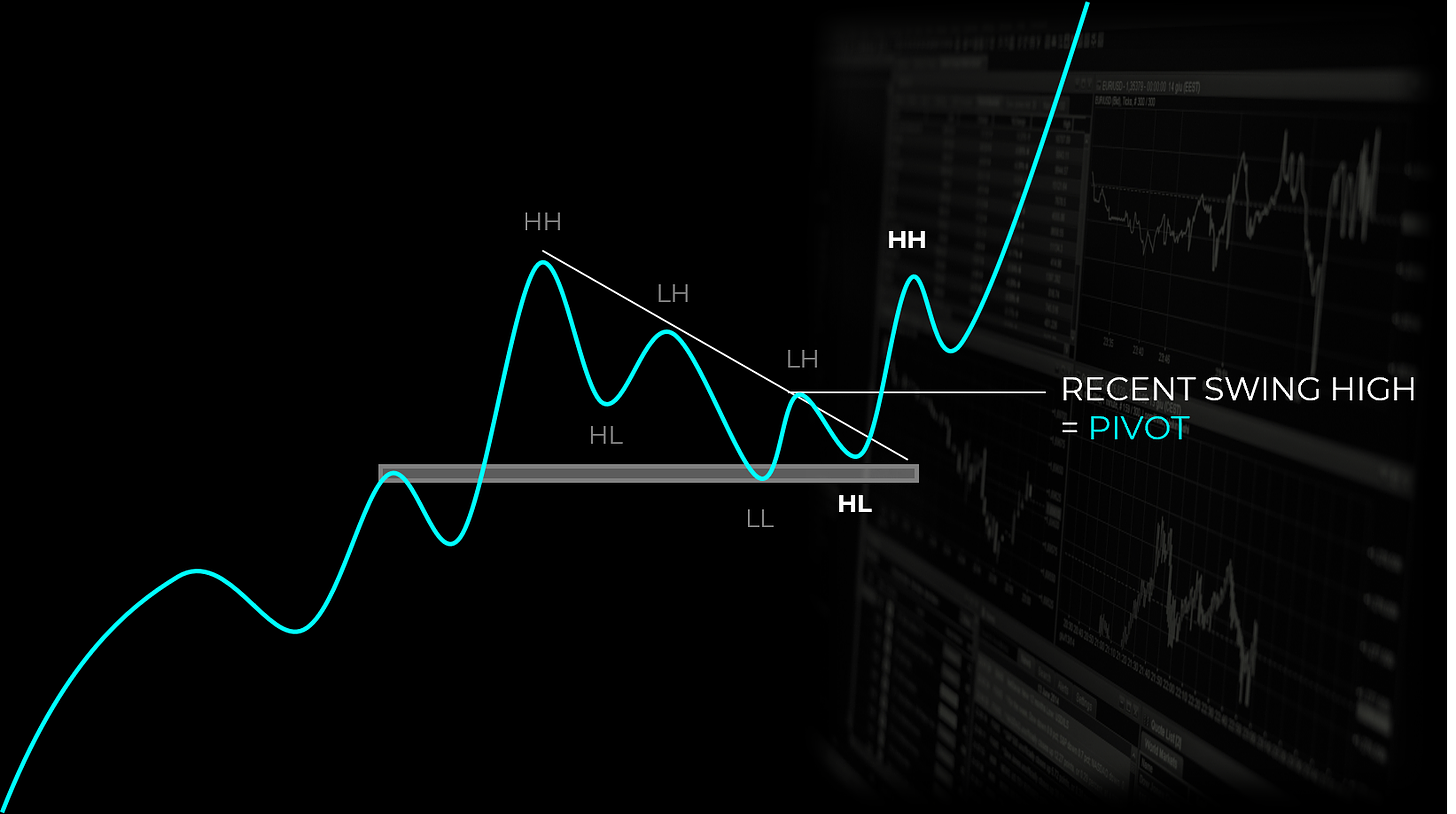

As a trader, we want to find the moment where the odds are shifting in our favor and the trend is ready to resume upward. To be able to confirm this change of character, we’ll need to see the structure shift from a short term downtrend/pullback, to an uptrend.

To confirm this structure shift, we want to see:

A Higher low (HL)

Followed by a Higher High (HH)

See the structure SHIFT example below:

Now you’ll tell me…yes but Alex, by the time the HH is confirmed, I missed all the initial move. You’re right!

That’s where our little PIVOT friend come into play…

What is a PIVOT

A pivot is essentially the level where we’ll be able to take the educated guess that if we breakout from here, price will likely make a HIGHER HIGH (HH).

If price breakout above our most recent swing high, which was the last LOWER HIGH (LH) in our pullback structure, then our next swing will create a new HIGHER HIGH (HH).

This recent swing high (LH) is our PIVOT.

See the PIVOT example below:

Why using pivots is important to TIME your entry

There is two main reasons why using the PIVOT is very important.

Increasing your trade probability by waiting for a price structure shift

Being early in a trade by entering lower in the base and increasing your potential trade return

For example, another entry tactic I use, entering on the Down Trend Line (DTL) breakout (which I call the Wedge Break (WB)), offers an even earlier entry… BUT the probability of the trade working is less as we did not confirm a price structure shift yet.

How to FIND pivots

In order to find those pivots, it’s essential that you train your eyes to see the market swings & price structure.

I know it can be quite challenging at first to see those highs, lows, etc. That’s why I suggest a tool that can help you learning that.

There’s an indicator called “ZIG ZAG” available on almost every good charting software that will highlight on your chart the market structure. Use it the first few weeks if you need help spotting market structure quickly.

LINK: ZIG ZAG indicator in TradingView (I adjust the “depth” parameter at 2)

See the ZIG ZAG indicator example below:

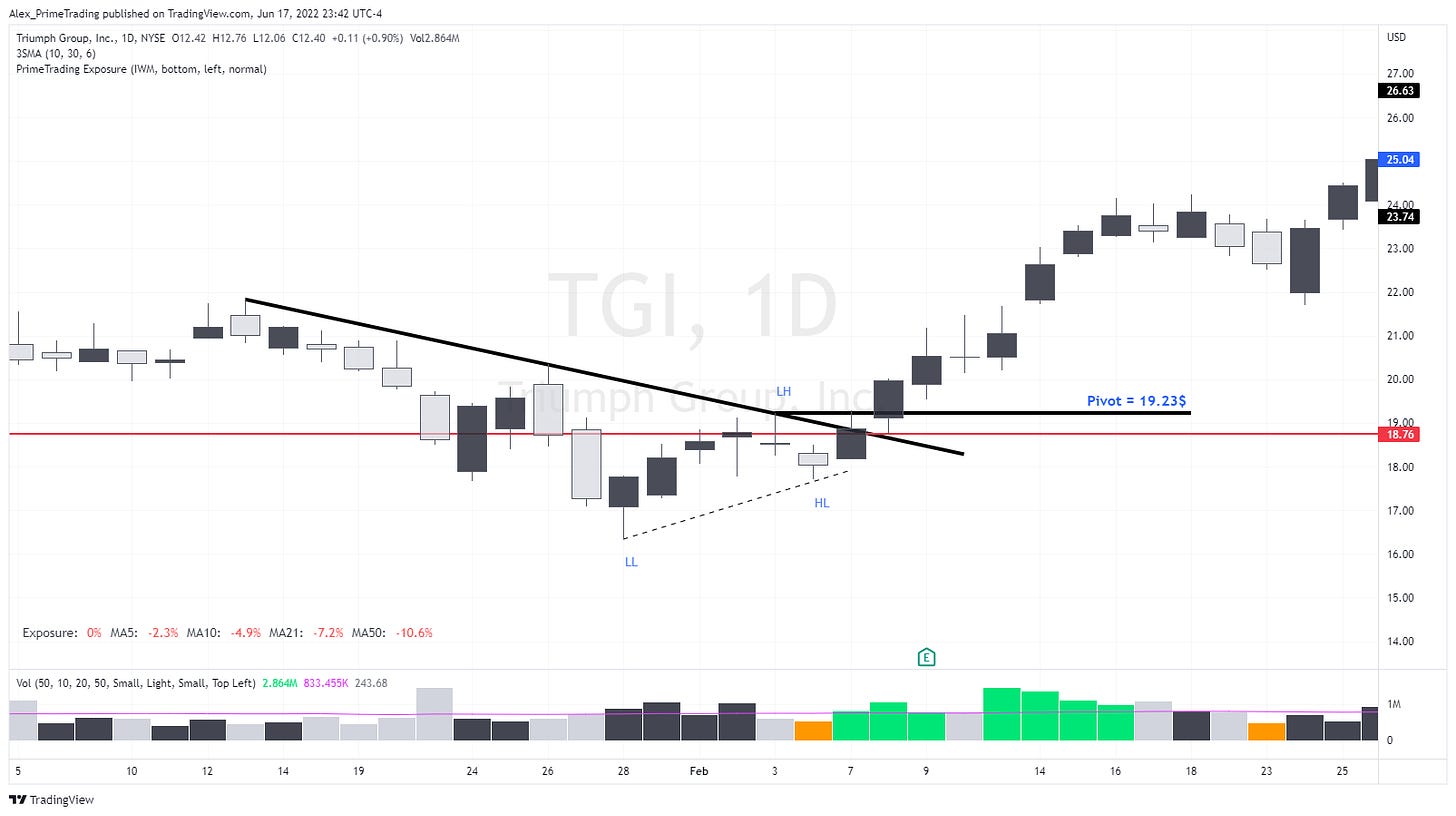

Important pullback characteristics to look for

Once you spotted your market structure within a stock, you want to make sure it has these characteristics.

Prior uptrend (I want to have an uptrend on the chart left side of at least 20-30%)

Pullback structure (LH-LL)

Ideally a HL before the DTL breakout

Price tightness before the breakout, you don’t want the last swing (LH-HL) be more than 10%. The smaller the better

Then, you are ready to simply attach a straight line to the most recent swing high within the pullback. In the case of our TGI example below, the PIVOT is at 19.23 (recent LH).

See a PULLBACK & PIVOT example below:

How to USE pivots to enter a trade

Once I find a good setup and mark my pivot with a line, I then want to place an alert at this price.

When the market opens and you hear all these alerts ringing, what do you do?

I like to enter using these tactics:

Enter directly on the pivot breakout (you can use automatic stop orders).

Better entry price if stock is running away, but higher chances of a squat/failed breakout.

Enter on the hourly (H1) pivot breakout high.

Higher entry price, but you increase your probability of the trade working.

Pivot breakout entry

The first method I use to enter in trades at pivots is to simply enter a market order when the price crosses it up. In that case, you get an entry that is very close to the pivot, but the risk is higher that the stock fail is breakout and your at a loss.

If you work full time, you can also use automatic stop orders at these levels on your broker platform.

Stop Order @ 19.23$

With a SL placed at the most recent HL

If this level is broken, then the whole setup is not still valid based on market structure.

This way you can automate your trading, but you’ll also have to take smaller position because your SL will be larger than the breakout candle Low Of Day (LOD) I like to use. (A full article on this subject soon)

See a PIVOT breakout example below:

H1 pivot breakout entry

To increase your win rate using these entries, you can ask for a little more confirmation at the pivot. In that case, you can wait the pivot breakout, and then go on the lower H1 timeframe and mark the HIGH of that H1 candle. In our example below, this H1 high is @ 19.42.

You can then put an automatic stop order at this price or a simple price alert to enter the trade once we get a breakout of this H1 high.

Stop Order @ 19.42$

With a very tight SL placed at the H1 confirmation candle. In that case, @ 18.98$

See a PIVOT H1 breakout example below:

How to use pivots to MANAGE an early trade

As I said, not every entry will work. You’ll notice that sometimes they try to breakout a stock only to sell into that strength. In that case, the price will come right back to your entry or below. You have to anticipate that scenario that happens quite often, specially in the last year or so during bad market environment.

When you enter the stock you have to look for these early cues:

1- Price breakout powerfully, then pullback slowly to the pivot level

In that case, watch for a simple retest of the level, and continuation upward. Could simply be an intraday BORS setup.

2- Price breakout and they are selling it hard BUT without taking out LOD

In that case, I want to give the stock some time below the entry level to see if it was only a shakeout. I keep the position intraday (if SL not hit), but if price did not come back above pivot at the end of the day, I close the position.

3- Price breakout and they are selling it hard even below LOD

In that case I sell the position right away without asking question.

With scenarios 2 & 3, you want to always reset your pivot alert in case in was a false breakout due to a bad general market day and they try to breakout the stock again the day after. I missed too much opportunities by removing the stock from FL only to see it rocket higher the following day.

See a FAILED pivot breakout example below:

Takeaway

In this article, I showed you my own system for using MARKET STRUCTURE & PIVOTS ENTRY, however these rules might not fit your style or personality. You MUST have a system in place with specific rules that fits your personality, and that, you’ll have to experiment to find what fits you best.

I really hope that you enjoyed that PrimeTrading Education series article. If you did, please share it so that more folks can be reached and this Newsletter can grow. :)

Feedback!

I would highly appreciate if you could DM me with constructive feedback or new idea for that newsletter.

Also, if you have questions, don’t hesitate!

Cheers! ✌️

Alex

Subscribe to PrimeTrading

Tactical swing trading daily newsletter with an educational twist. $NQ & $ES market analysis with daily levels, high potential setups focuslist w/ precise entry levels, Breadth/Internals, Sectors analysis & much more!

Thanks for all the insightful educational articles Alex. Eagerly waiting for your detailed article on Swing Low SL and breakout candle Low Of Day (LOD) SL.

Hi, Alex, sorry, newbie here. I found your articles very good and easy to follow. But in this one, I simply do not understand why $8.18 is a pivot in your last chart, the one with the failed pivot. It means that candle should be the last LH and then be followed by a HL, if I understood the concept correctly. I do Could you please explain it a bit to me? What point is considered the HL? Thanks.