The most common strategic mistakes we see in the first year of a startup’s life center around go-to-market. While brute-force sales execution can’t fix product-market issues, there is no substitute for a relentless founder focus on customers. In many ways—dollars-at-work being the most honest measure of customer needs—everything starts with founder-led sales.

The best teams—especially in vertical software—are maniacal about understanding their buyer. The rate-limiting factor to successful sales (founder-led or otherwise), customer discovery, is much more than an idea-stage exercise. It should be a core part of the company's DNA, yet constantly evolving. It’s a motion that starts before inception and should never stop. As became clear in our analysis of 100+ software winners, the ability to dynamically expand market opportunity over time is more critical than TAM at any moment in time. Identifying those opportunities, moreover, requires a deep understanding of why customers buy.

This insight is why Euclid focuses so intensely on founder-market fit: unpacking the flavors of potential buyers, connecting with them, and speaking their language are often prerequisites to effective customer discovery, sales, and product expansion. In vertical software, at least, the data bears out the fact that domain expertise correlates strongly with long-term success. It’s not a big leap to suggest that this may be because those who know their industry intimately excel at founder-led sales, setting the stage for outperformance.

The Central Challenge of Founder-Led Sales

Early-stage go-to-market missteps, founder-led by necessity, are particularly insidious. They often appear after some promising traction has already been achieved and may present as slow atrophy rather than an obvious red alert. A “product-market fit mirage”—wherein a few initial customers lean in but aren’t ultimately representative of broader demand—can tempt even the best operator into premature sales decisions that eat into already-thin margins for error:

Decelerating (free) customer discovery to serve early paying customers

Over-rotating sales positioning based on the needs of one or two large customers

Extrapolating assumptions from a successful beachhead ICP to another

Assuming “better” salespeople are the answer when initial traction slows

Bringing on an external leader before sales is ready to scale

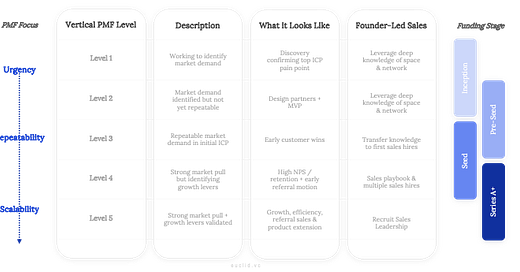

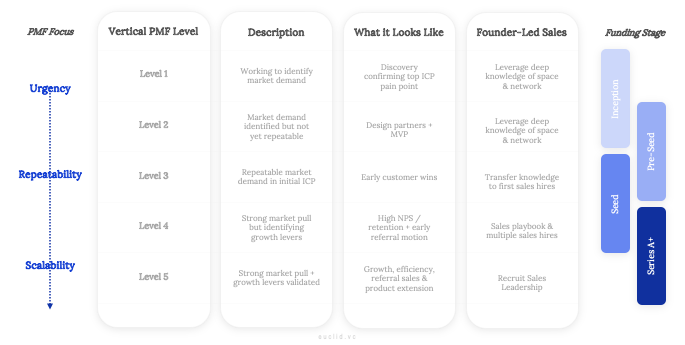

There is a common thread between these pitfalls: founders transitioning away from a sales mindset too early to focus on product, hiring, fundraising, etc. All startup success is derivative of solving a customer need—ongoing go-to-market cycles, therefore, are a prerequisite to product-market fit progress. We discussed this point in our previous essay on navigating to vertical PMF:

Our target is to identify prospective market demand, build a repeatable and efficient growth engine, and convert a certain percentage into customers. However, the degree of PMF will ultimately impact the ability to win a market and what separates good and great companies. It dictates the cost to acquire, onboard, and retain each additional customer. Scalability requires market pull in some capacity: customers want a solution that a startup can deliver. The degree of scalability will manifest in a company’s ability to find leads, convert a certain percentage into customers, and retain & grow those customers.

The reality is that there is no holistic “playbook” for early-stage sales—especially in vertical software, where distribution is reliant on an idiosyncratic ecosystem of stakeholders. There are best practices, of course, and no shortage of “systems” that can work: the “whale scale” approach, focusing on high-value customers; land-and-expand or “exponential” systems emphasizing post-sale engagement for ACV growth; referral-based strategies leveraging highly interconnected buyer network. As always, ideas and tactics are a dime-a-dozen… the hard work of a day-zero founder is to figure out what works before scaling it. This is why founder-led sales is so challenging: to draw on cliche, if you don’t take off while building the plane, you never will.

In today’s essay, we share our perspective on founder-led sales from a strategic rather than tactical perspective. We will walk through our product-market fit framework (updated below), unpacking the role of founder-led sales at each stage of maturity and the nuances particular to vertical software.

Level 1: Pre-Revenue

At this stage, the founding team is working to validate a hypothesis in a vertical, often leveraging prior experience and connectivity. Founder-led selling should be the core activity at this stage—a motion that can be materially accelerated when the founder(s) can leverage their network and relevant industry experience. Teams with high founder-market fit are sometimes able to make significant progress here, even before inception—getting verbal or LOI-tier buy-in well in advance of MVP.

We highly recommend that founders start selling immediately; don’t wait until you build product and hope demand exists. In our experience, the best founders sell well in advance of product. Remember you have no influence on latent demand—at least not until you’ve achieved significant, post-PMF scale—so there is no substitute for direct customer engagement early and often.

[Founder-led sales is] (1) going to help you with your product development… (2) You’re going to… figure out how to talk about it in an effective way. (3) It’s going to make it such that you can package that up [for other sellers].

Pete Kazanjy @ Atrium (via Lenny's Podcast)Level 2: First Customers

Founder-led selling, at this point, has demonstrated an urgent demand and willingness to pay for the product. A portion of that commercial motion will be focused on delivering a superior customer experience and generating enthusiasm amongst these early adopters. Often, customer success becomes a distribution strategy well before a CS team exists—because early adopters are referrers by nature. As Geoffrey Moore said in Crossing the Chasm, “[early adopters are] willing to take risks, have the highest social status, have financial liquidity, are social and have closest contact to… other innovators."1 At this stage, therefore, founders cannot be dissuaded by no’s. Instead, they should value them as important indicators of where not to spend time now and what it will take to sell to these targets later. Founders must continually sell, in other words, to refine initial ICP and understand the nature of additional demand beyond the beachhead.

Doubling down on early adopters with similar profiles and needs—assuming they are representative of much of the larger market—are far more valuable signals for PMF than identifying disparate use cases. The target milestone for founder-led selling at this stage is building a repeatable ability to identify, acquire, and onboard additional customers.

Level 3: Signs of Traction

A stable of satisfied customers within a vertical that grows each month or quarter as the team demonstrates an ability to attract repeatable demand. There is repeatability but not predictability. At this stage, go-to-market is still founder-led and crude—but once a repeatable motion is identified, the company can (and often should) bring on additional go-to-market resources.

The most common mistake at this stage is bringing on a sales leader rather than sales resources who can execute and refine a nascent sales motion. Simply jamming in fresh SDRs can also be a failure path, however, as they will do little to improve the bottom half of the sales funnel. The more promising hire at this stage is a go-to-market athlete with full-cycle experience (prospecting, closing, etc.) who can learn from your existing crude processes and contribute to improving them. Hiring two vs. one is often superior, fostering a level of competition and accounting for the (very common) possibility of a poor fit. As a rule, we find startup backgrounds (especially experience selling at the messy early stages) should be prioritized over industry exposure. In vertical software, however, sometimes “talking the talk” is not easily learnable. Threading this needle can be a significant challenge in the early days, and it may warrant testing both profiles.

The founder’s key role is to manage these new hires and oversee knowledge transfer, ensuring that iteration contributes to an (eventually repeatable) “sales playbook.” This requires continued focus on the core vertical and ICP, constantly evaluating new prospective go-to-market motions. At this stage, the playbook should be highly customized to each ICP—not just by sub-vertical, but by size, buyer type, need, etc. Depending on performance, founders can also start working on how best to reach other market segments and to what extent these extensions will present marketing or product challenges.

Two common mistakes are prematurely passing the baton to a new salesperson without proper infrastructure in place, and founders hesitating to hand over responsibilities, hindering the growth of the sales team. Founders should find the right time to hire and ensure a smooth transition.

Jordan Wan @ CoFound Ventures (via Reimagined with Robin)Level 4: Early Growth

We now have a growing base of successful customers with high retention. If we are leaning into market pull appropriately, we should see improving conversion/win rates, high NPS, and customer referrals. Go-to-market beyond founder-led sales is formalizing, with the establishment of quotas and performance metrics for the sales team. The goal at this stage is to build a repeatable go-to-market motion that can scale efficiently beyond your first few hires. Each sales hire from here on out should be increasingly predictable regarding ramp and ROI.

While the founder is still selling—at least high-level or new-ICP accounts—startups with significant traction and repeatability should consider bringing on a sales leader. It’s worth noting that with higher revenue, growth rates, and predictability, attracting top-tier sales leadership becomes easier.

As they approach bringing on new sales management, founders don’t transition away from sales—instead, their commercial mindset gravitates relatively more to looking around the corner. This means allocating more time and resources to growth opportunities, including new acquisition channels, additional products, and/or wholly new customer segments.

Level 5: Scaling

The easiest way to describe this level is “you know when you see it.” The market pull is obvious. The go-to-market engine is humming and ready to scale. If a sales leader has not been hired yet, this is the right stage to do so.

It’s worth remembering that sales leaders should be hired for the company as it is today, not the job tomorrow. Hiring a senior leader used to managing hundreds of reps with multiple management layers is unlikely to be the right fit. Hire the right person for the next 18 months, and if they outperform and scale with the organization, that’s a win. But if you over-hire early in the company’s life, that can be a very costly mistake. While you hope you nail the hire out of the gate, founders who have managed sales closely up to this point can more easily track performance and be ready to step in if things go south.

Neglect of the commercial side of the ledger is a recipe for pain down the road. Put simply, this isn’t “Field of Dreams,” and the “build it and they’ll come” strategy usually doesn’t pan out in the long run.

Meka Asonye @ First Round Capital (via First Round Review)The Truth About Founder-Led Sales

The tl;dr is that founders need to own sales and revenue throughout the company’s early growth cycles. Understanding the customer needs, defining the ICP, and refining the GTM motion is far too critical to be handed off, at least until the business is genuinely ready for scale. Even then, there should never be a “transition” away from a sales mindset for founders; it’s the organization's lifeblood and must permeate a culture top-down. No salesperson—perhaps ever in the life of the best companies—will replicate a founder’s unique understanding of the customer, the market, and how to articulate the vision.

The truth about founder-led sales is this: it’s the single most important element of a vertical software startup at its early stages, as a driver of revenue, product-market fit, and company culture. As countless case studies demonstrate, founder-led sales is nothing short of a superpower. Not only because it’s the surest path to early compounding revenue, but also because an organization dedicated relentlessly to finding and solving high-value customer problems requires its leaders to set the tone.

Thanks for reading Euclid Insights! Links to quotes here.2 If you know a vertical software founder thinking through their early-stage sales strategy, we would love to be helpful. Please reach out via LinkedIn, email, or here on Substack—we look forward to hearing from you.

Moore (1991). Crossing the Chasm. Harper.

Asonye. (2025). $0 to $5M: How to Nail Founder-Led Sales. First Round Review.

Kazanjy. (2022). Founder-Led Sales — Pete Kazanjy (Founding Sales). Lenny’s Newsletter.

Wan, Li. (2023). Founder-Led Sales: Lessons from Scaling to $100M+. Reimagined with Robin, Notable Capital, YouTube.