I'm nervous, too! 🤮

Unfortunately, this big sell-off is what stock market investing is all about 📉

Earlier today, I checked the balances on my rollover IRA and self-employed 401(K) plans.

I wish I hadn’t done that!

Sure, I follow the swings in the stock market literally every day. And I know history (and TKer Stock Market Truth No. 2) tells us big sell-offs are normal.

But what’s also normal is your stomach dropping after you see the dollar-denominated short-term paper losses in your portfolio, which you’ve been funding regularly for two decades.

Fortunately (thanks to TKer’s paid subscribers), I spend all day looking at the data. And even if I don’t have the precise stats off the top of my head, I know that:

Extended pullbacks of 5% or greater happen multiple times an average year.

AND IMPORTANTLY, timing the market is incredibly difficult to do in a way that beats holding through the volatility.

Yes, this sell-off can get worse. Also yes, it’s possible the market inflects upward from here.

But in the context of a thoughtful investment strategy that aims to capitalize on the long-term return opportunity offered by the stock market, trading in and out of short-term volatility risks doing irreversible damage to your upside. Or as Howard Marks once eloquently wrote:

Reducing market exposure through ill-conceived selling — and thus failing to participate fully in the markets’ positive long-term trend — is a cardinal sin in investing. That’s even more true of selling without reason things that have fallen, turning negative fluctuations into permanent losses and missing out on the miracle of long-term compounding.

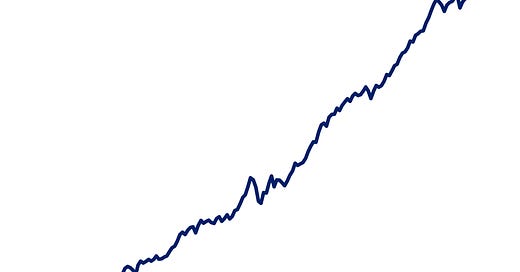

As all the historical data teaches us, this big sell-off is what stock market investing is all about. The path to long-term riches in the stock market is riddled with stomach-churning volatility.

It’s why smart people agree that time in the market beats timing the market.

That said, it’s OK to have emotions. Just don’t let them near your stock portfolio.

-

More from TKer:

Sam, we are all watching the chaos that is seemingly deliberately spewed out from trump’s mouth on a daily basis. The stock market is one of many facets of mindless expression of power for the simple reason that he has the power.

It remains to be seen where all of these executive decisions takes us — the potential for a cascade in adverse effects is real. However, the probability of reversals of decisions on tariffs, the remaining inertia within our institutions, and the economic macro data suggest that sentiment is overly pessimistic and that a bit of good news may have a disproportionate upside effect in coming weeks.

In the meantime the wall of worry must take a pause in its bull market advancement at least for a few weeks.