Weekly Market Index

Last week’s crypto market price and volume indices were up +11.34% and +29.09%, respectively, while the volatility index fell by -28.38%.

The price index has been growing successively for seven weeks, demonstrating strong momentum in the market. Last week’s bull run was likely driven by a combination of news regarding higher-than-expected US unemployment data and the Bitcoin halving event.

Chart of the Week

Bitcoin reached an all-time high of US$70,000 on 8 March. This surge came after the release of US unemployment data. The unemployment rate of 3.9% exceeded expectations of 3.7%. Higher-than-expected readings are typically seen as negative or bearish for the USD, indicating a decrease in value. This led to speculation that inflationary pressures were diminishing because of the implementation of restrictive economic policies. Moreover, BTC crossed $71,000 and reached a new all-time high on 11 March. The rise in Bitcoin’s price also coincides with the upcoming block subsidy halving. Additionally, ETH price rallied and hit $4,000 for the first time since 2021.

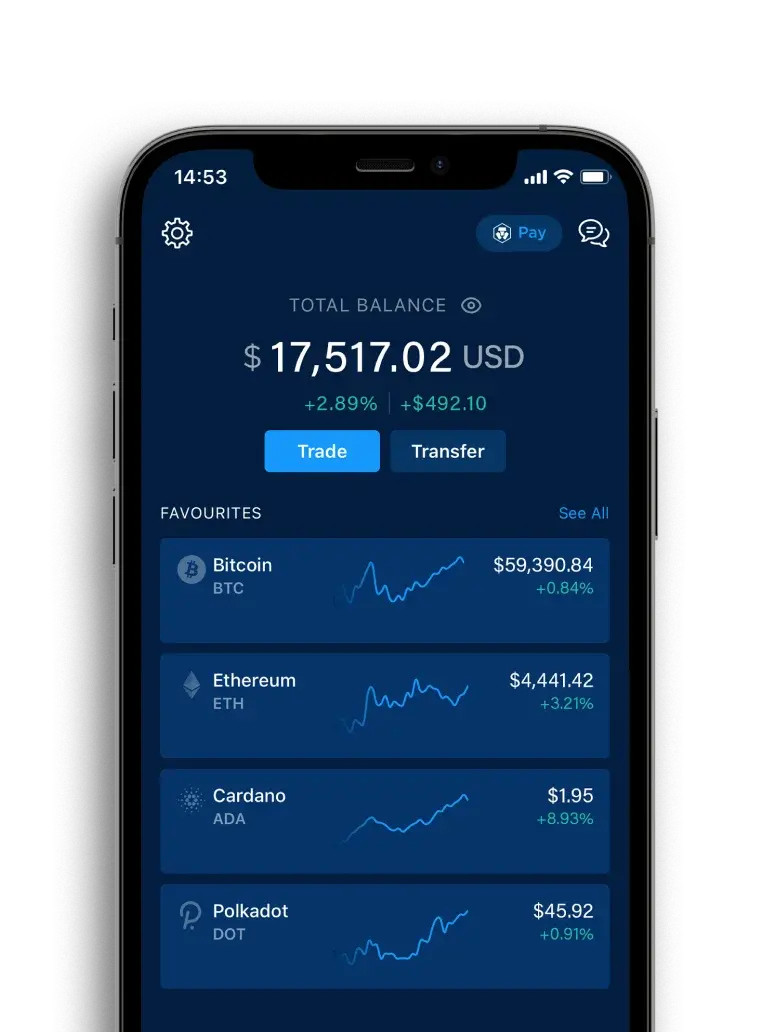

Weekly Performance

Bitcoin (BTC) and Ether (ETH) rose by +8.2% and +11.3%, respectively, in the past seven days. Price action for other selected top-cap tokens was mostly positive. The meme coins SHIB and PEPE outperformed.

Selected key categories were all up in terms of market capitalisation change in the past seven days, led by AI.

News Highlights

- Crypto.com announced a partnership with Altava Group, a digital fashion tech company, to expand the Web3 ecosystem. The collaboration aims to enhance digital fashion services offered by Altava Group, which works with luxury brands like LVMH, Balmain, and Bulgari. The partnership will explore the integration of Crypto.com’s NFT marketplace and payment solution and will involve joint promotions through online and offline events.

- BlackRock is planning to acquire spot Bitcoin exchange-traded products (ETPs) for its Global Allocation Fund. The company has filed with the Securities and Exchange Commission (SEC) to incorporate these ETPs into its funds. BlackRock’s filing states that it may acquire its own iShares Bitcoin Trust (IBIT) product as well as other Bitcoin ETPs listed and traded on national exchanges.

- It was revealed that Elon Musk-owned companies Tesla and SpaceX hold a combined total of approximately $1.3 billion worth of bitcoin in their respective wallets according to Arkham Intelligence. Tesla was reported to hold 11,500 BTC (~$780M), and SpaceX held 8,290 BTC (~$560M).

- The revenue from Ethereum’s network fees reached nearly a two-year high, totalling $193 million in a week according to IntoTheBlock. This surge in activity coincides with the heightened speculation surrounding meme tokens such as PEPE, SHIB, and FLOKI. Ethereum-based decentralised exchanges also experienced a significant increase in trading volumes. The average transaction fees on Ethereum rose to as high as $28, making it expensive for users.

- Asset management firm VanEck, known for its Bitcoin exchange-traded fund (ETF), launched its own NFT platform called “SegMint”, highlighting the traditional finance industry’s growing interest in Web3 tokenisation. SegMint allows users to vault and fractionalise digital assets by issuing tradable keys on its in-house exchange. The platform focuses on shared ownership and self-custody of assets, addressing some of the limitations of existing NFT platforms.

- Hong Kong’s central bank, the Hong Kong Monetary Authority (HKMA), announced the launch of Project Ensemble, a wholesale central bank digital currency (CBDC) project aimed at supporting the tokenization market.

- The United States Securities and Exchange Commission (SEC) decided to delay its decision on whether to approve options trading for spot Bitcoin exchange-traded funds (ETFs). The SEC granted itself an additional 45 days to review proposals from the Cboe Exchange, the Miami International Securities Exchange, and the Nasdaq regarding options on Bitcoin ETFs.

Recent Research Reports

|  |  |

|---|---|---|

| Research Roundup Newsletter [January 2024] | DePIN: Crypto’s Rising Narrative | Alpha Navigator: Quest for Alpha [January 2024] |

| Research Roundup Newsletter [January 2024] |

|---|---|

| DePIN: Crypto’s Rising Narrative |

| Alpha Navigator: Quest for Alpha [January 2024] |

- Research Roundup Newsletter [January 2024]: We present to you our latest issue of Research Roundup, featuring trending market insights in January, charts of the month, and our deep dive into the world of crypto ETFs.

- DePIN: Crypto’s Rising Narrative: DePIN is currently one of crypto’s hottest narratives. We introduce what DePIN is, how it works, and the current market landscape.

- Alpha Navigator [January 2024]: Fed signals rate cut in March unlikely. Asset class performance was mixed in January, with crypto and equities up slightly.

Recent University Articles

|  |  |

|---|---|---|

| What Is Celestia? All about TIA Token | What Is Restaking? How to Use EigenLayer | Introduction to Crypto Derivatives, Options, and Futures |

| What Is Celestia? All about TIA Token |

|---|---|

| What Is Restaking? How to Use EigenLayer |

| Introduction to Crypto Derivatives, Options, and Futures |

- What Is Celestia? All about TIA Token: Learn about Celestia, the first modular blockchain network with a pluggable consensus and data availability services for Layer-2 rollups.

- What Is Restaking? How to Use EigenLayer: Learn how to restake your tokens on Ethereum and how popular projects like EigenLayer and liquid staking work.

- Introduction to Crypto Derivatives, Options, and Futures: What are crypto derivatives? Learn about the main types, including options and futures, and whether to trade them.

Catalyst Calendar

We’re all ears.

Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you!

Author

Research and Insights Team

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.