Our live coverage of banking fears in global markets has moved here.

March 15, 2023 Global stocks and banking news

By Alicia Wallace, Nicole Goodkind and Krystal Hur, CNN

Small business owner felt she faced “existential threat” with SVB’s collapse

From CNN's Jeanne Sahadi

Vanessa Pham, co-founder and CEO of Asian food company Omsom, felt like her business was facing an existential threat last Friday when she learned her bank, SVB, had gone under.

“We had to run payroll, manufacture product, operate the business, and fundamentally those funds were the lifeline of the business. So it was very challenging,” Pham told CNN’s Poppy Harlow.

What she didn’t do was tell her nine employees that the company might not make payroll.

“I was very committed to ensuring that we were going to take care of our team. Of course with the $250,000 that was insured by the FDIC, that was going to be the first order of business. I communicated that to my team on Friday,” Pham said.

Beyond that, though, she had to battle her fears and plan for worst-case scenarios. But they never came to pass because thanks to the US government’s efforts to step in and backstop all deposits at SVB she had access to all her funds by Monday.

What's the fate of US mortgage rates amid this chaos?

From CNN's Michelle Toh

With all the panic in the market, could it get tougher to purchase a home?

A CNN viewer from Philadelphia says he and his wife are looking to purchase their first home.

He asked the panel of guest experts tonight during the CNN primetime special on the banking crisis whether they foresee mortgage rates going up or down as a result of the fallout from the collapse of SVB.

Vivian Tu, a former JPMorgan trader, said she could understand his concern in the current climate.

"I think realistically, from what we've heard from the Fed, interest rates likely will continue to rise," she said.

"On top of that, I think a lot of folks are feeling very concerned about, 'Hey, if I'm saving up for a down payment, is a bank a safe place to put that money?'"

Why did SVB get special treatment?

From CNN's Danielle Wiener-Bronner

After Silicon Valley Bank failed on Friday, its customers were filled with fears. But by Monday, they could breathe a sigh of relief — the Treasury Department, the Federal Reserve and the Federal Deposit Insurance Corporation had said over the weekend that it would make each customer whole, even beyond the $250,000 insured by the FDIC.

While it was welcome news for account holders, the extraordinary move raised questions for some, who wondered why the FDIC bent its rules for SVB and its customers.

Eric Krahn, a computer systems engineer from Iowa, asked this question during a CNN primetime event on Wednesday.

"Why does this bank and account holders get special treatment to be made fully whole?" he asked. "How does this inspire confidence in our system?"

Lynnette Khalfani-Cox, CEO of AskTheMoneyCoach.com, wondered the same thing, she said during the program.

"I do think there's a little bit of moral hazard here," she said, referring to the idea that banks may take on more risk if they think they'll get bailed out (more from my colleague Allison Morrow on that concept is below).

As to why the FDIC made the decision it did? The Federal government didn't want SVB's failure to "have a domino effect," Khalfani-Cox said. "Federal regulators deemed them to be in the category of systemic risk, so they granted an exemption."

What is this "moral hazard" thing?

From CNN's Allison Morrow

You may hear economists and market analysts reference "moral hazard" when discussing the past weekend's rescue of two US banks, Silicon Valley Bank and Signature.

"Moral hazard" is somewhat academic shorthand for the idea that banks (or other entities) will take on more risk if they believe that they will ultimately be bailed out.

For example, some argue that SVB should have been allowed to fail — that the pain of the fallout would outweigh the downsides of customers losing their money and startups going out of business. Of course, others note that the risk of letting the 16th-largest US bank collapse, and potentially letting its tech industry customers also fail, could have far-reaching and potentially devastating consequences.

Credit Suisse borrows more than $50 billion from Swiss National Bank

From CNN's David Goldman

Credit Suisse on Wednesday said it would borrow 50 billion Swiss Francs ($53.7 billion) from the Swiss National Bank, hours after the central bank said it was ready to provide financial support after shares in the country's second biggest lender crashed as much as 30%.

"Credit Suisse is taking decisive action to pre-emptively strengthen its liquidity," the bank said in a statement.

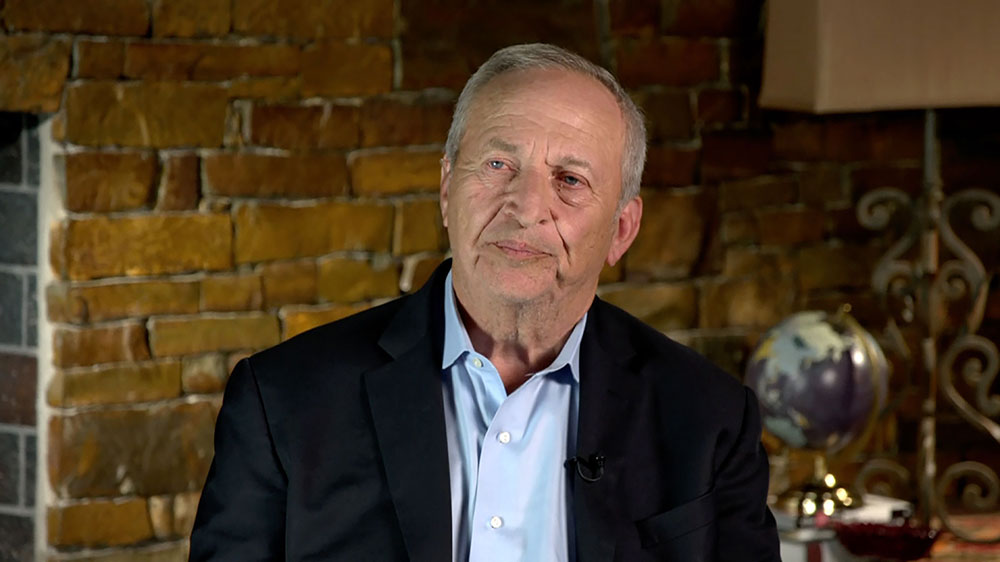

Summers: "Americans' money is safe"

From CNN's Allison Morrow

Former Treasury Secretary Larry Summers told CNN that despite scary headlines, now is not the time for consumers to panic.

"I don't think this is a time for panic or alarm," Summers said. "This is not 2008, where people needed to be worried about where they could get their money...It absolutely is not that."

"Americans' money is safe," he said.

Are banks in a similar position to the situation in 2008?

From CNN's Michelle Toh

Is the banking sector in the same situation as the one that triggered the 2008 financial crisis?

That's what a viewer from Fenton, Missouri, asked the CNN panel of business experts tonight during a CNN primetime special on the banking crisis.

CNN's chief business correspondent Christine Romans said no.

"They're not allowed to anymore," she explained.

"They don't have all that garbage, that junk on their balance sheets anymore because they're not allowed to. They have to have better capital set aside, and the big banks have to undergo stress tests."

However, Romans noted that "the verdict is out on the controversy about whether some of these smaller banks were allowed to not partake in all of the Dodd-Frank regulations, and maybe that left them more exposed."

Some context: Those regulations laid out stricter rules for the banking industry, though small and mid-sized banks — those with assets below $250 billion, like SVB — were exempted from some of the rigorous capital requirements applied to larger institutions, and from the obligation to undergo tests of their ability to withstand financial stress by the Federal Reserve each year.

CNN's Anna Cooban contributed to this report.

Switzerland's central bank says it will backstop Credit Suisse if necessary

From CNN's Mark Thompson

Switzerland's central bank said Wednesday it was ready to provide financial support to Credit Suisse after shares in the country's second biggest lender crashed as much as 30%.

In a joint statement with the Swiss financial market regulator FINMA, the Swiss National Bank (SNB) said Credit Suisse (CS) met the "strict capital and liquidity requirements" imposed on banks of importance to the wider financial system.

"If necessary, the SNB will provide CS with liquidity," they said.

Already on edge after the failure of Silicon Valley Bank in the United States last week, investors dumped shares in the embattled Swiss bank earlier in the day, sending them plummeting to a new record low after its biggest backer appeared to rule out providing any more funding.

In their statement, the Swiss authorities said that the problems of "certain banks in the USA do not pose a direct risk of contagion for the Swiss financial markets."

"There are no indications of a direct risk of contagion for Swiss institutions due to the current turmoil in the US banking market," the statement continued.